- United States

- /

- Construction

- /

- NasdaqGS:ROAD

Construction Partners (ROAD): Reassessing Valuation After Strong Earnings Beat and Upgraded Growth Guidance

Reviewed by Simply Wall St

Construction Partners (ROAD) just delivered a big step up in its story, with fourth quarter and full year results showing sharp gains in sales and profits, and management backing that momentum with higher 2026 guidance.

See our latest analysis for Construction Partners.

Despite a softer recent patch, with a 30 day share price return of negative 7.42 percent and a 90 day share price return of negative 13.26 percent, the stock still sits on a five year total shareholder return of 264.25 percent. This suggests that longer term momentum remains intact even as expectations cool after a strong run into these results.

If Construction Partners impressive growth has you thinking more broadly about infrastructure driven plays, it could be a good moment to explore fast growing stocks with high insider ownership.

With earnings surging, guidance climbing and the share price still sitting below consensus targets, investors now face a key question: is Construction Partners undervalued after the pullback, or are markets already pricing in its next leg of growth?

Most Popular Narrative: 14% Undervalued

With Construction Partners last closing at $105.34 against a narrative fair value of $122.50, the story leans toward upside potential grounded in long term growth assumptions.

Ongoing vertical integration through investment in owned asphalt plants and material sourcing, combined with increasing scale, is already enhancing operational efficiencies and margin expansion, as shown by record adjusted EBITDA margins despite weather disruptions. This is expected to support higher net margins and improved earnings resilience going forward.

Curious how this expansion story translates into that higher fair value? The narrative leans on assumptions about revenue momentum, margin rebuilding and future earnings strength. Want to see exactly how those moving parts stack up in the valuation model?

Result: Fair Value of $122.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this growth narrative could be knocked off course if government infrastructure budgets tighten, or if sustained labor and materials inflation erodes margins faster than expected.

Find out about the key risks to this Construction Partners narrative.

Another Angle on Valuation

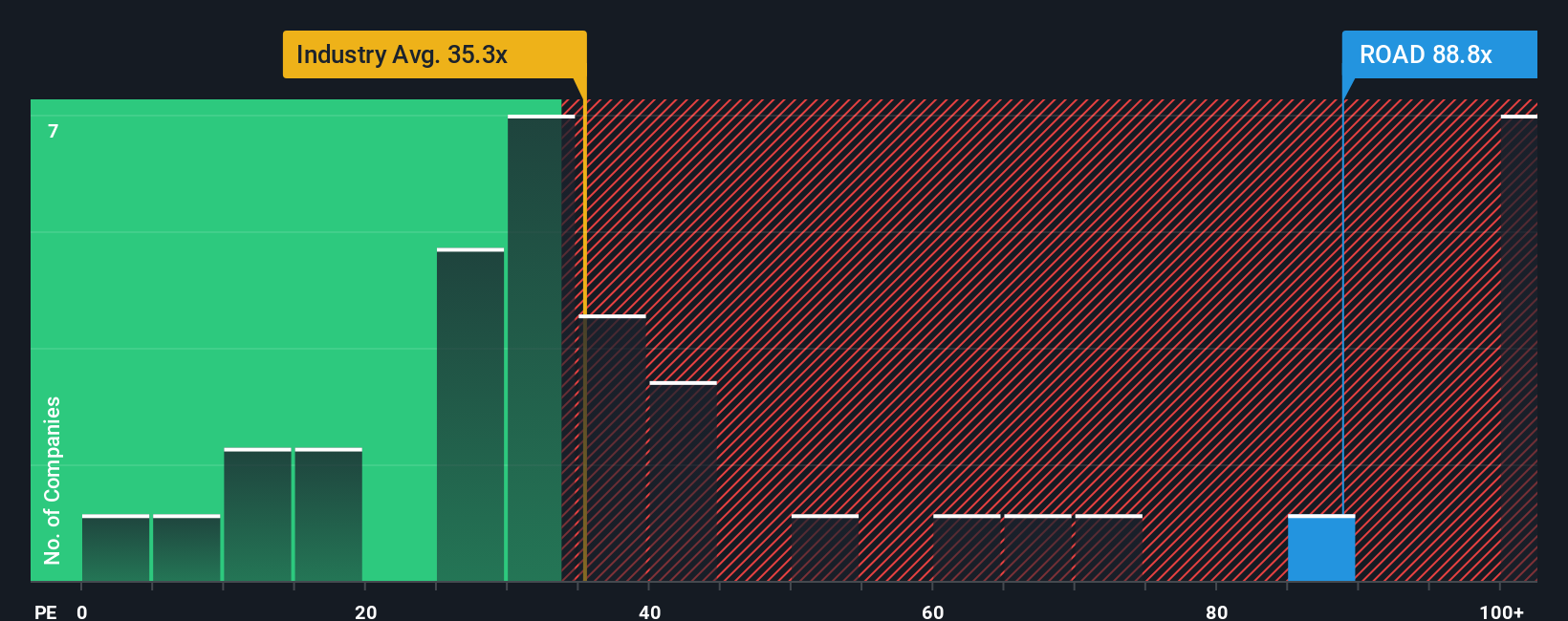

While the narrative fair value suggests upside, a simple earnings based lens points the other way. At a price to earnings ratio of 58.5 times versus an industry 33 times and a fair ratio of 32.5 times, the stock screens as richly priced and leaves less room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Construction Partners Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes, Do it your way.

A great starting point for your Construction Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall Street Screener to uncover high conviction ideas that match your style before other investors move first.

- Lock onto potential bargains by checking out these 933 undervalued stocks based on cash flows that future cash flows suggest the market has overlooked.

- Position yourself for breakthroughs in medicine as you review these 30 healthcare AI stocks reshaping diagnostics, treatments and hospital efficiency.

- Strengthen your income stream by assessing these 14 dividend stocks with yields > 3% that combine meaningful yields with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, Oklahoma, South Carolina, Tennessee, and Texas.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026