- United States

- /

- Construction

- /

- NasdaqGS:ROAD

Construction Partners (ROAD): Assessing Valuation Following Options Market Surge and Upbeat Analyst Estimates

Reviewed by Simply Wall St

If you’re watching Construction Partners (ROAD) and wondering what’s behind today’s buzz, it’s all about the options market. The stock has seen a surge in implied volatility, particularly on contracts that don’t usually grab headlines. When this happens, it’s often a sign that traders are bracing for a substantial shift. Maybe they’re expecting an event soon, or are positioning for some fresh information that could tip the balance either way. There’s also been a modest upward tick in earnings estimates, which may have added some wind to the sails of investor sentiment.

But it’s not just the options activity that should catch your eye. Over the past year, Construction Partners shares have more than doubled, suggesting strong momentum that hasn’t exactly gone unnoticed. The company’s stock price has climbed steadily year to date and over the past three years, showing remarkable growth relative to many peers. Even the last month has delivered another bump higher. Recent upward revisions in quarterly outlooks hint that confidence might be building just as volatility returns to the spotlight.

After such a substantial run and with the market bracing for a possible move, the real question is whether Construction Partners is now trading at a bargain or if investors are paying up in anticipation of future growth.

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Construction Partners is considered fairly valued, with the consensus analyst price target just a touch above its current trading level.

Ongoing vertical integration, through investment in owned asphalt plants and material sourcing, combined with increasing scale, is already enhancing operational efficiencies and margin expansion, as shown by record adjusted EBITDA margins despite weather disruptions. This should drive higher net margins and improved earnings resilience going forward.

Curious about what could justify such a robust share price? Analysts are betting on bold growth assumptions, rising margins, and future profitability metrics that most companies can only dream of. Want to see which financial forecasts could change everything? Find out the key numbers that might rewrite this company's story.

Result: Fair Value of $120.17 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, even with the upbeat outlook, any slowdown in infrastructure funding or unexpected cost inflation could quickly change the situation for Construction Partners.

Find out about the key risks to this Construction Partners narrative.Another View: DCF Analysis Adds Perspective

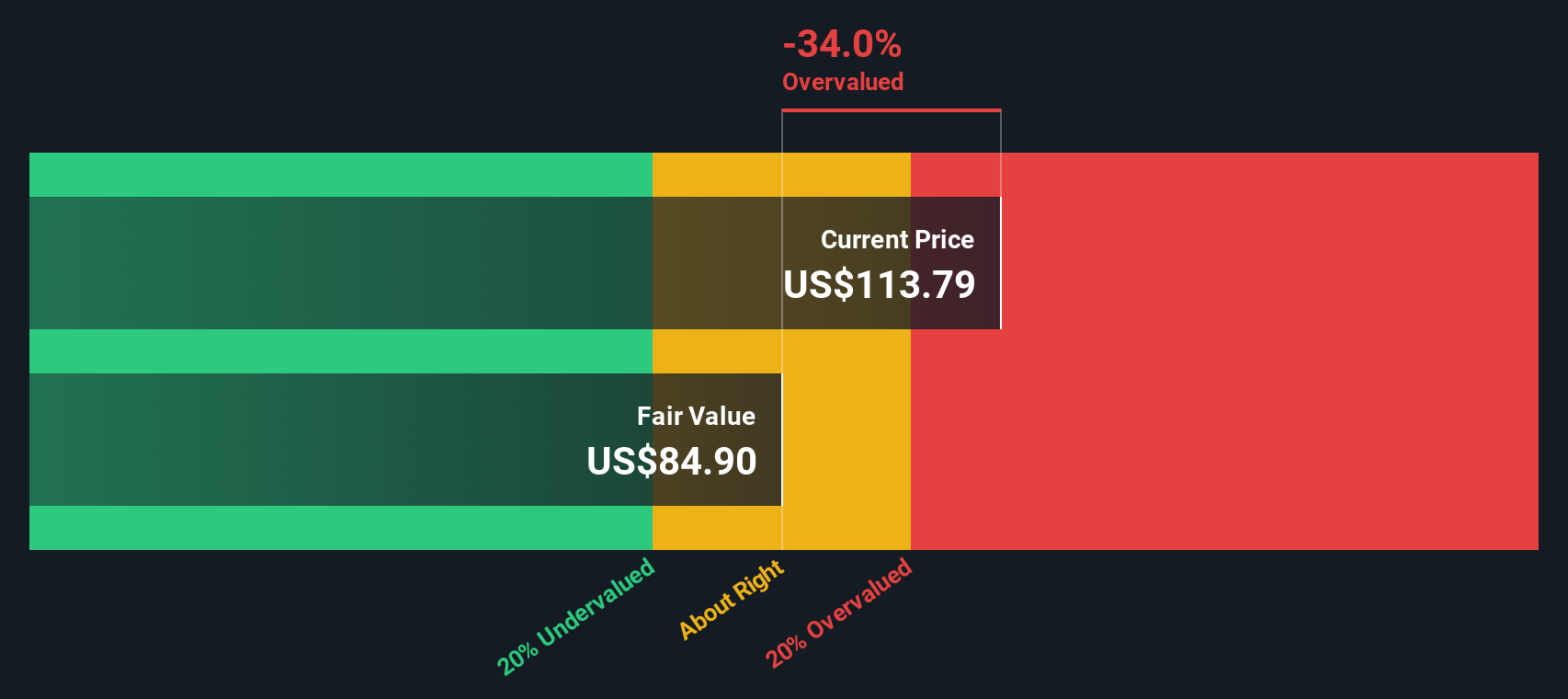

While analysts see the stock as fairly valued using their future growth assumptions, our SWS DCF model offers a more cautious picture and suggests the market price may be running hot. Could the long-term outlook be less certain than it seems?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Construction Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Construction Partners Narrative

If you see things differently or want to dive into the numbers yourself, it takes just a few minutes to craft your own take on the story. Do it your way.

A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Make sure you’re not missing some of the most compelling stock opportunities out there. The Simply Wall Street Screener makes it quick to find ideas matched to what matters to you.

- Supercharge your search for value by scanning the market for hidden gems with strong cash flow potential using undervalued stocks based on cash flows.

- Boost your portfolio’s passive income by finding stocks offering attractive yields through dividend stocks with yields > 3%.

- Uncover the next wave of artificial intelligence leaders who are positioned to shape tomorrow's technology landscape with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives