- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab (RKLB) Valuation in Focus as U.S. Expansion and Tech Milestones Signal Next Phase of Growth

Reviewed by Simply Wall St

Most Popular Narrative: 39.9% Overvalued

According to the narrative by KiwiInvest, Rocket Lab shares are considered significantly overvalued compared to their calculated fair value, discounting future growth and profitability targets at a rate of 8%.

Rocket Lab has achieved revenue of $436 million through 16 annual launches of its Electron rocket, along with its rapidly expanding 'Space Systems' segment. Roughly one-third of revenue comes from its low-cost rocket launches, with the remaining two-thirds generated by selling the satellites used in those launches to its customers. To achieve $6 billion in revenue by 2035, Rocket Lab must get its newest rocket, Neutron, operating in a similar low-cost manner to fend off competition, while maintaining high reliability to capture more of the faster growing and higher margin Space Systems segment.

Curious how Rocket Lab’s ambitious journey to multi-billion dollar revenues shapes this bold valuation? The narrative relies on aggressive growth projections and targets margins that rival industry leaders. Wondering which numbers could justify such a leap? The full breakdown offers rare insight into Rocket Lab’s possible future position in the industry and what it could mean for current investors.

Result: Fair Value of $31.72 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, setbacks in Neutron's launch timeline or persistent challenges in achieving positive margins could quickly change investor sentiment regarding Rocket Lab's growth story.

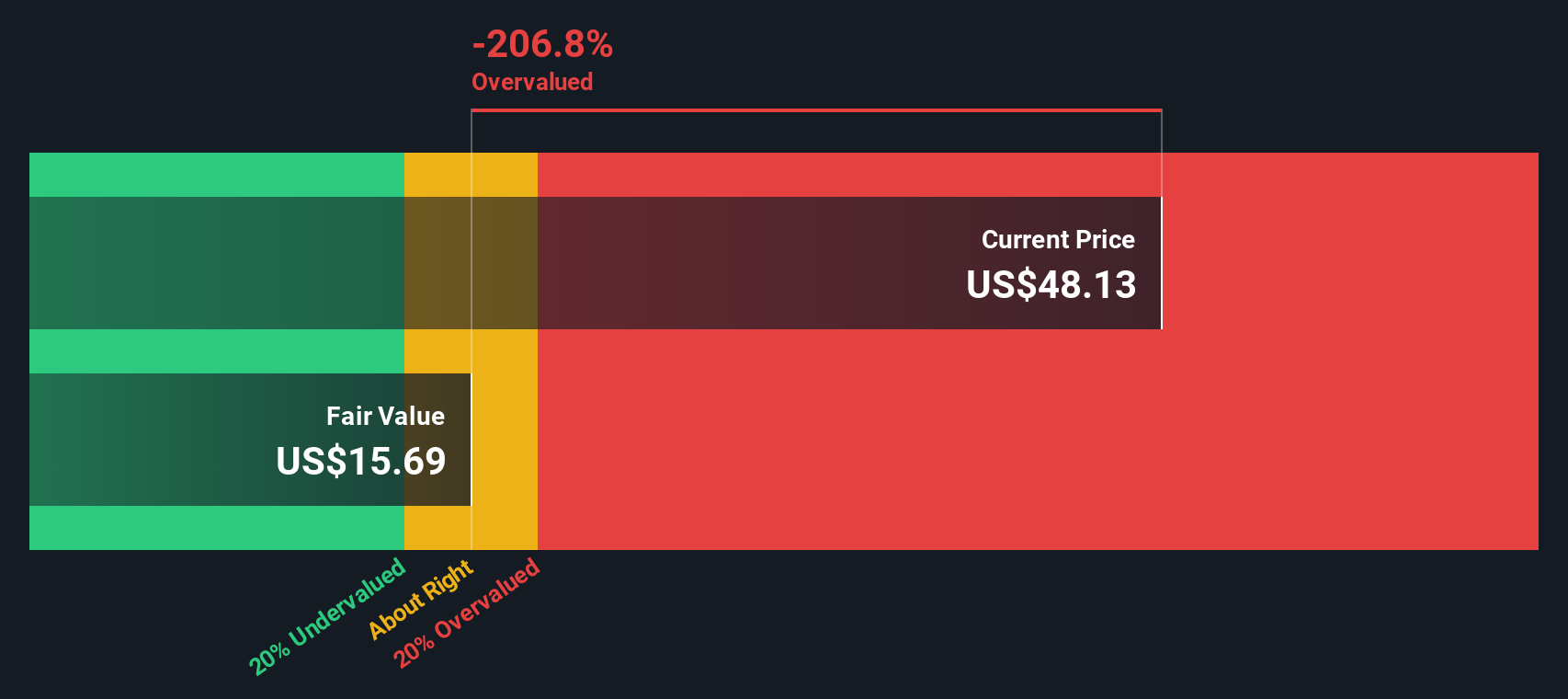

Find out about the key risks to this Rocket Lab narrative.Another View: SWS DCF Model

Taking a step back from multiples, our SWS DCF model paints a similar picture. The model indicates Rocket Lab’s shares are above fair value, even when using projected future cash flows. Could market optimism be running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rocket Lab Narrative

If you see things differently or want to dig into the numbers yourself, you can easily create your own perspective in just a few minutes, so why not do it your way?

A great starting point for your Rocket Lab research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why limit yourself to a single opportunity when you can diversify your portfolio with a range of timely trends? Simply Wall Street’s expert screeners can help you discover strategies and sectors that are relevant today, giving you more options in the current market.

- Increase your income potential by tracking companies offering dividend stocks with yields > 3%. This can help you capture growing dividends and maintain steady cash flow in various market conditions.

- Stay updated on the latest advancements in medicine and technology by following healthcare AI stocks, where artificial intelligence is shaping the future of healthcare.

- Identify tomorrow’s potential disruptors with our guide to AI penny stocks. Connect with emerging innovators who are transforming industries through smart automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026