- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab USA (NasdaqCM:RKLB) Powers Varda And iQPS Missions With Successful Launches

Reviewed by Simply Wall St

Rocket Lab USA (NasdaqCM:RKLB) successfully launched its third Pioneer spacecraft for Varda Space Industries and its second mission for the Institute for Q-shu Pioneers of Space last week. Despite these operational achievements, the company's stock only saw a minor price move of 0.05% over the past week, which was set against a broader market decline of 2.2% amid ongoing global economic tensions and tariff concerns. Rocket Lab's announcements of new software suites for mission support and a $500 million follow-on equity offering also emerged during this period, yet their influence on stock performance appears limited given the substantial market headwinds. Although successful launches and technological advancements underscore Rocket Lab's growth potential, the overall market dynamics, including tech sector volatility and corrections, might have tempered investor enthusiasm for RKLB, resulting in only marginal stock price changes despite positive company-specific developments.

Explore the potential challenges for Rocket Lab USA in our thorough risk analysis report.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

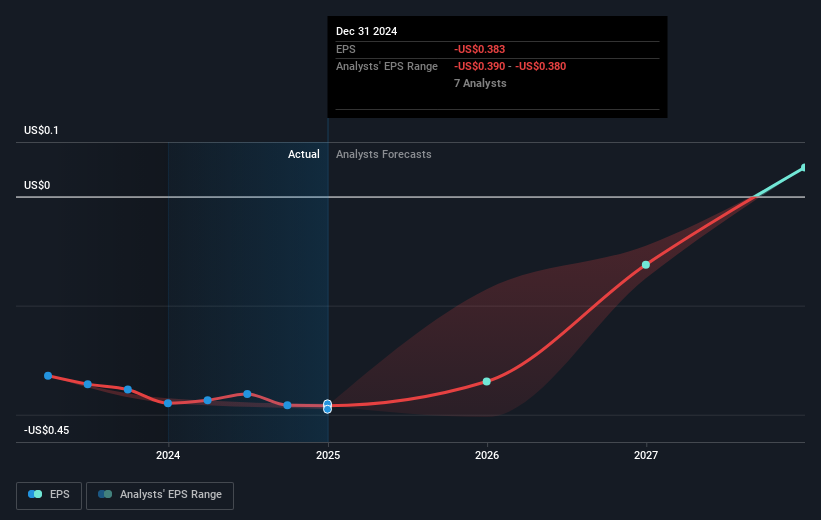

Over the past year, Rocket Lab USA's total shareholder return was a significant 356.55%, showcasing impressive performance. This surpassed both the US Aerospace & Defense industry, which returned 19.4%, and the broader US market, which gained 9.6%. Several developments likely contributed to this substantial return. Notably, Rocket Lab's revenue nearly doubled for the year 2024 to $436.21 million, even though the company remained unprofitable with a net loss of 190.18 million USD. The successful launch of the "60th Electron mission" in February, deploying a Gen-3 satellite, was another key achievement reflecting the company's operational prowess.

Additionally, the announcement of a 32 million USD contract with the U.S. Space Force in November 2024 for the VICTUS HAZE mission likely bolstered investor confidence in Rocket Lab's strategic capabilities. However, legal challenges like the February 2025 class-action lawsuit over the Neutron rocket's launch timeline might have introduced some uncertainties, tempering some of the optimism surrounding the company's future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab USA

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives