- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab USA (NasdaqCM:RKLB) Wins The Right To Bid On Items In US$46 Billion U.S. Air Force Contract

Reviewed by Simply Wall St

Rocket Lab USA (NasdaqCM:RKLB) recently announced it won the right to bid on items within a $46 billion U.S. Air Force contract and the UK's $1.3 billion hypersonic technologies program. These developments highlight the company's growing position in the aerospace sector. Over the past month, Rocket Lab's stock price experienced a flat movement of 1.5 percent, which aligns with the broader market's trends. While these major announcements may have added a positive weight against the market's overall 4.4 percent decline, their major influence on stabilizing the stock's movement suggests an intrinsic strength within Rocket Lab's operational advancements.

Be aware that Rocket Lab USA is showing 2 weaknesses in our investment analysis.

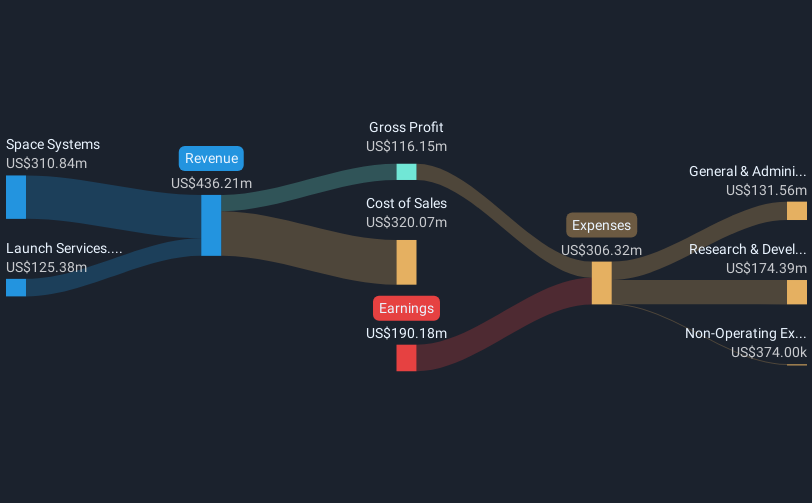

Rocket Lab USA's announcement regarding the right to bid on items in the US$46 billion U.S. Air Force contract and the UK's hypersonic technologies program could influence the company's projected growth outlined in the narrative. These possible contracts suggest a firm foothold in aerospace, potentially boosting future revenues and earnings by strengthening its position in national security sectors. This aligns with the company's increased focus on medium-class launches and cost-efficiency projects like the Neutron rocket and the Flatellite satellite, which are expected to cater to both commercial and defense markets.

Over the past year, Rocket Lab's total shareholder return, including share price and reinvested dividends, surged to a very large percentage, highlighting significant long-term capital appreciation. This performance stands out against the US Aerospace & Defense industry's 1-year return of 16.3% and the broader U.S. market's 2.5% return over the same period, underlining Rocket Lab's distinct outperformance relative to industry and market averages.

The recent news has potential implications for revenue and earnings forecasts, with analysts anticipating revenue growth attributed to increased launch frequencies and expanded product offerings. Earnings are, however, under pressure from factors like execution risks and competition, but the possible infusion of large government contracts could bolster long-term profitability. Despite a flat 1.5% share price movement, the price target of US$24.32 remains approximately 18.8% above the current share price of US$19.74, suggesting room for potential upward movement as Rocket Lab continues to execute its growth strategies.

*Correction - Original article stated that it won the contracts. Correction made to state it won the right to bid on items within the contract.

Explore Rocket Lab USA's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

Rocket Lab USA, Inc., a space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives