- United States

- /

- Machinery

- /

- NasdaqGM:PPIH

Perma-Pipe (PPIH) Q3 2026: Net Margin Compression Tests Bullish Profitability Narrative

Reviewed by Simply Wall St

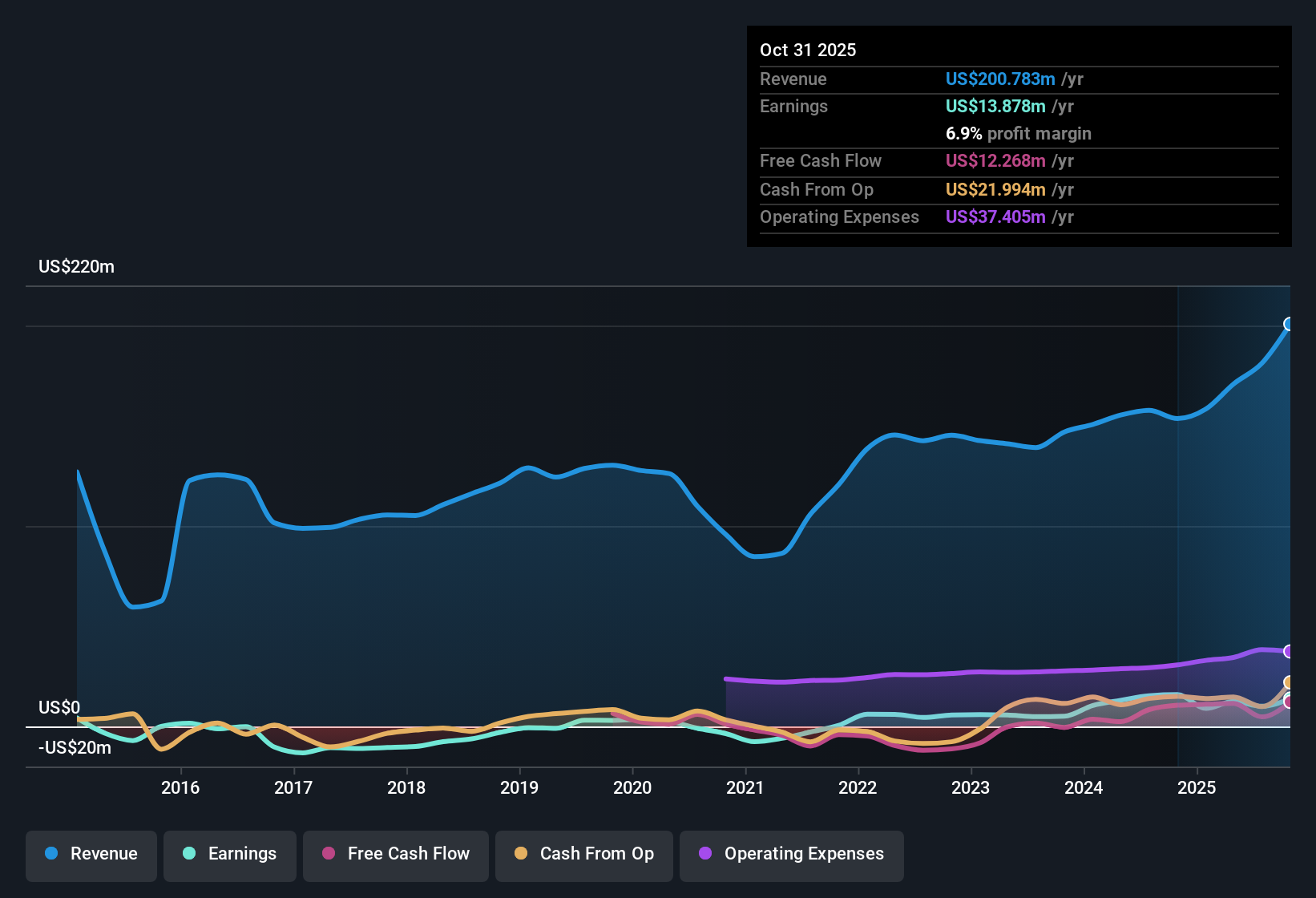

Perma-Pipe International Holdings (PPIH) has laid out a busy Q3 2026, reporting revenue of about $61.1 million and basic EPS of roughly $0.78 as investors parse how the latest quarter fits into its recent run of profitability. The company has seen revenue move from around $41.6 million in Q3 2025 to $61.1 million in Q3 2026, while quarterly EPS shifted from about $0.31 to $0.78 over the same period. This sets up a results season where the key question is how sustainable these margins really are.

See our full analysis for Perma-Pipe International Holdings.With the headline numbers on the table, the next step is to weigh them against the dominant narratives around Perma-Pipe, seeing which stories the latest margins support and which ones the fresh data starts to push back on.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Slips to 6.9 Percent

- Over the last 12 months, net profit margin was 6.9 percent compared with 10.3 percent a year earlier, even as trailing revenue reached about 200.8 million dollars.

- Bears focus on this margin compression, yet the company still earned roughly 13.9 million dollars over the same period, which means:

- The drop in margin does not erase the fact that PPIH remains profitable after several years of earnings growth averaging about 49.5 percent per year.

- At the same time, slower forecast earnings growth of around 9.1 percent a year limits the argument that margins will quickly rebound to prior levels.

Trailing P E of 19 Times vs Peers

- PPIH trades on a trailing P E of about 19 times, below both the 24.1 times peer average and the 26 times US Machinery industry average, with a DCF fair value of roughly 32.57 dollars close to the 32.59 dollar share price.

- Bulls point to this relative discount and the fair value alignment as support for a quality at a reasonable price story, and the numbers give them some backing because:

- The stock is not priced at a premium despite multi year profitability and high quality past earnings, which can appeal to value oriented investors.

- DCF fair value sitting almost exactly at the market price suggests expectations are balanced rather than stretched, so any future improvement in growth or margins could be rewarded.

Revenue Growing Around 6 Point 8 Percent

- On a trailing basis, revenue growth sits at about 6.8 percent per year, while earnings are projected to rise around 9.1 percent annually, both below the broader US market forecasts of roughly 10.7 percent and 16.3 percent.

- What stands out for a more cautious view is that this moderate growth profile has to work against thinner margins, because:

- Revenue has climbed from about 153.6 million dollars to roughly 200.8 million dollars over the trailing periods, yet net income over those same snapshots moved from about 15.9 million dollars to 13.9 million dollars.

- This combination of slower projected growth and lower recent profitability gives skeptics a concrete basis to question how much upside is left without a clear operational improvement.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Perma-Pipe International Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Perma-Pipe’s cooling margins, slower forecast earnings growth, and only moderate revenue expansion leave limited room for upside without a meaningful boost in operational performance.

If that mix feels too constrained for your goals, use our stable growth stocks screener (2103 results) to quickly focus on companies already delivering steadier revenue and earnings momentum across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PPIH

Perma-Pipe International Holdings

Designs, engineers, manufactures, and sells specialty piping and leak detection systems in the United States, Canada, the Middle East, North Africa, Europe, India, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)