- United States

- /

- Electrical

- /

- NasdaqCM:OESX

Orion Energy Systems, Inc.'s (NASDAQ:OESX) Price Is Right But Growth Is Lacking After Shares Rocket 29%

Orion Energy Systems, Inc. (NASDAQ:OESX) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

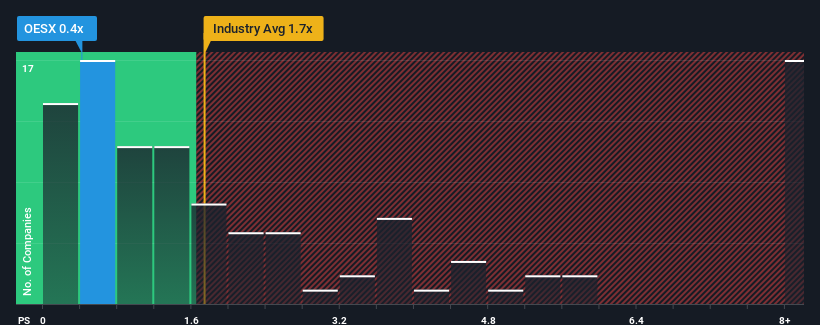

Even after such a large jump in price, Orion Energy Systems may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Orion Energy Systems

How Has Orion Energy Systems Performed Recently?

Recent times haven't been great for Orion Energy Systems as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Orion Energy Systems.Is There Any Revenue Growth Forecasted For Orion Energy Systems?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Orion Energy Systems' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. Still, lamentably revenue has fallen 20% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% per year during the coming three years according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 43% per year, which is noticeably more attractive.

In light of this, it's understandable that Orion Energy Systems' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

The latest share price surge wasn't enough to lift Orion Energy Systems' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Orion Energy Systems' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Orion Energy Systems that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OESX

Orion Energy Systems

Researches, designs, develops, manufactures, markets, sells, installs, and implements energy management systems for commercial office and retail, area lighting, industrial applications, and government in North America and Germany.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives