- United States

- /

- Electrical

- /

- NasdaqGS:NXT

Nextracker (NXT): Assessing Valuation as Analyst Upgrades and Growth Roadmap Spark Investor Interest

Reviewed by Kshitija Bhandaru

Nextracker (NXT) is in the spotlight after announcing an upcoming Capital Markets Day, which will unveil its long-term growth strategy and financial roadmap. Recent upbeat coverage from major banks has amplified the buzz.

See our latest analysis for Nextracker.

Riding waves of positive analyst attention and anticipation for its Capital Markets Day, Nextracker has seen remarkable momentum, posting a 30.3% share price return over the past month and an eye-catching 146.9% total shareholder return in the past year. The company’s latest string of upbeat news, from global R&D expansion to technology partnerships, is fueling sentiment that its growth story is far from over.

If Nextracker's surge has you rethinking where the next big story might emerge, now is the perfect chance to discover fast growing stocks with high insider ownership

Yet with Wall Street’s optimism driving up Nextracker’s valuation, the key question emerges: is the company’s rapid growth fully reflected in its share price, or is there still a window for new investors to buy in?

Most Popular Narrative: 14.7% Overvalued

With Nextracker's latest close at $83.85, the current consensus narrative suggests a fair value of $73.08, indicating the stock trades at a meaningful premium. This raises big questions about what factors are driving such optimism and what could spark the next move.

Nextracker's global expansion of R&D facilities in the U.S., Brazil, and India, along with the partnership with UC Berkeley for solar technology research, is expected to reinforce its commitment to innovation and position the company as a leader in solar technology, impacting long-term revenue and growth.

Ready for the full story? The real intrigue lies in bold revenue and profit projections, margin pressures, and growth rates that push this fair value higher than peers. Ever wonder what kind of aggressive assumptions drive an above-market price? See what makes this narrative so unexpectedly bullish.

Result: Fair Value of $73.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariff uncertainty and a heavy reliance on U.S. demand could quickly challenge the bullish outlook if market or policy conditions shift unexpectedly.

Find out about the key risks to this Nextracker narrative.

Another View: Multiples Reveal Relative Value

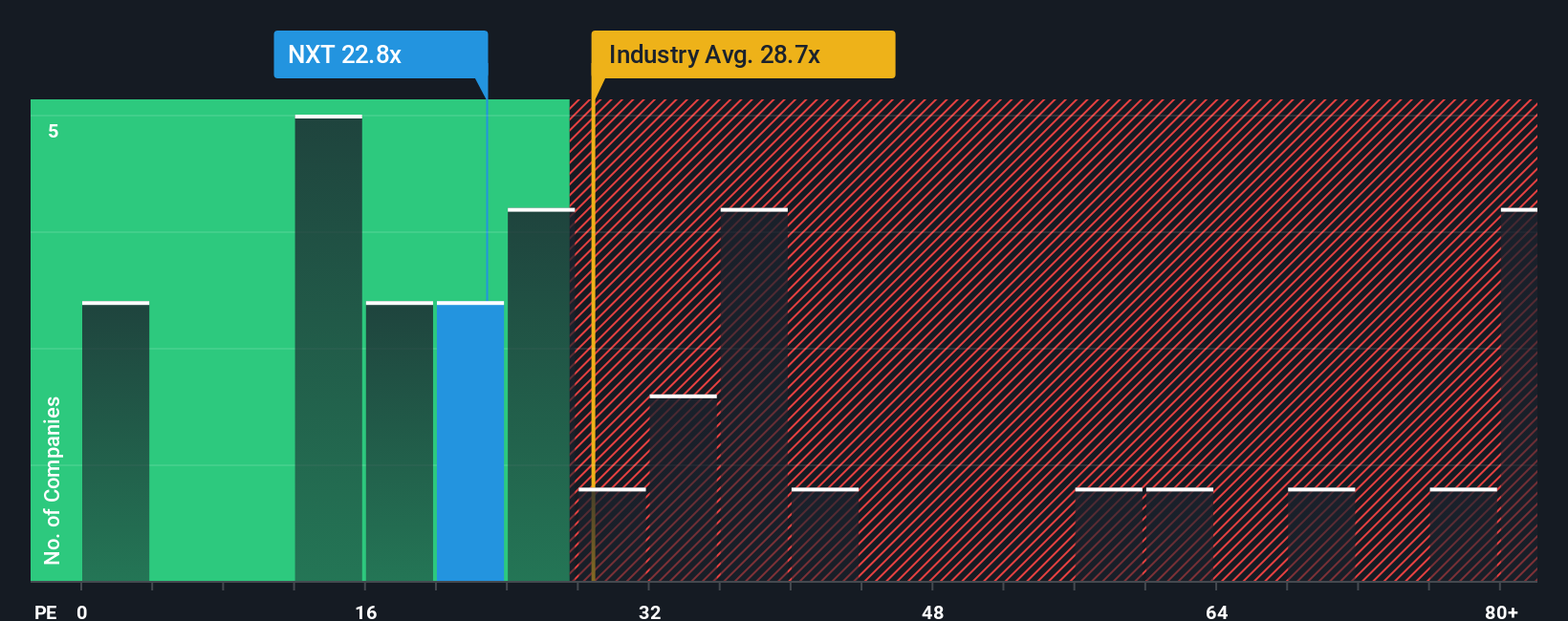

While the consensus fair value points to Nextracker being overvalued, our market comparison tells a slightly different story. The company’s price-to-earnings ratio stands at 22.8x, noticeably below both the industry average (28.7x) and its peer group (38.9x). In fact, the current multiple is also well under the fair ratio of 33.4x. This suggests that despite a premium share price, valuation risk may not be as high as headlines suggest. Could this gap hint at lingering upside the market has missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nextracker Narrative

Curious to see a different angle or want to shape your own take on Nextracker? You can explore the numbers and craft your own perspective in just a few minutes: Do it your way

A great starting point for your Nextracker research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one story. Uncover opportunities others might overlook by checking out unique stocks handpicked using powerful Simply Wall Street tools.

- Claim the potential of disruptive healthcare by reviewing these 32 healthcare AI stocks, which focuses on breakthroughs in artificial intelligence turning patient outcomes around.

- Spot high-yield income plays before the crowd by scanning these 18 dividend stocks with yields > 3%, as these stocks deliver consistent returns above 3% for your portfolio’s stability.

- Catalyze your portfolio growth by eyeing these 25 AI penny stocks, built for rapid expansion at the forefront of automation and machine learning innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nextracker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXT

Nextracker

Provides solar tracker technologies and solutions for utility-scale and distributed generation solar applications in the United States and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives