- United States

- /

- Banks

- /

- NasdaqCM:BFC

Three Undiscovered Gems in the US Stock Market

Reviewed by Simply Wall St

Over the last 7 days, the United States stock market has experienced a 2.8% drop, yet it remains up by 24% over the past year with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying stocks that are not only resilient but also poised for growth can be key to uncovering potential opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Bank First (NasdaqCM:BFC)

Simply Wall St Value Rating: ★★★★★★

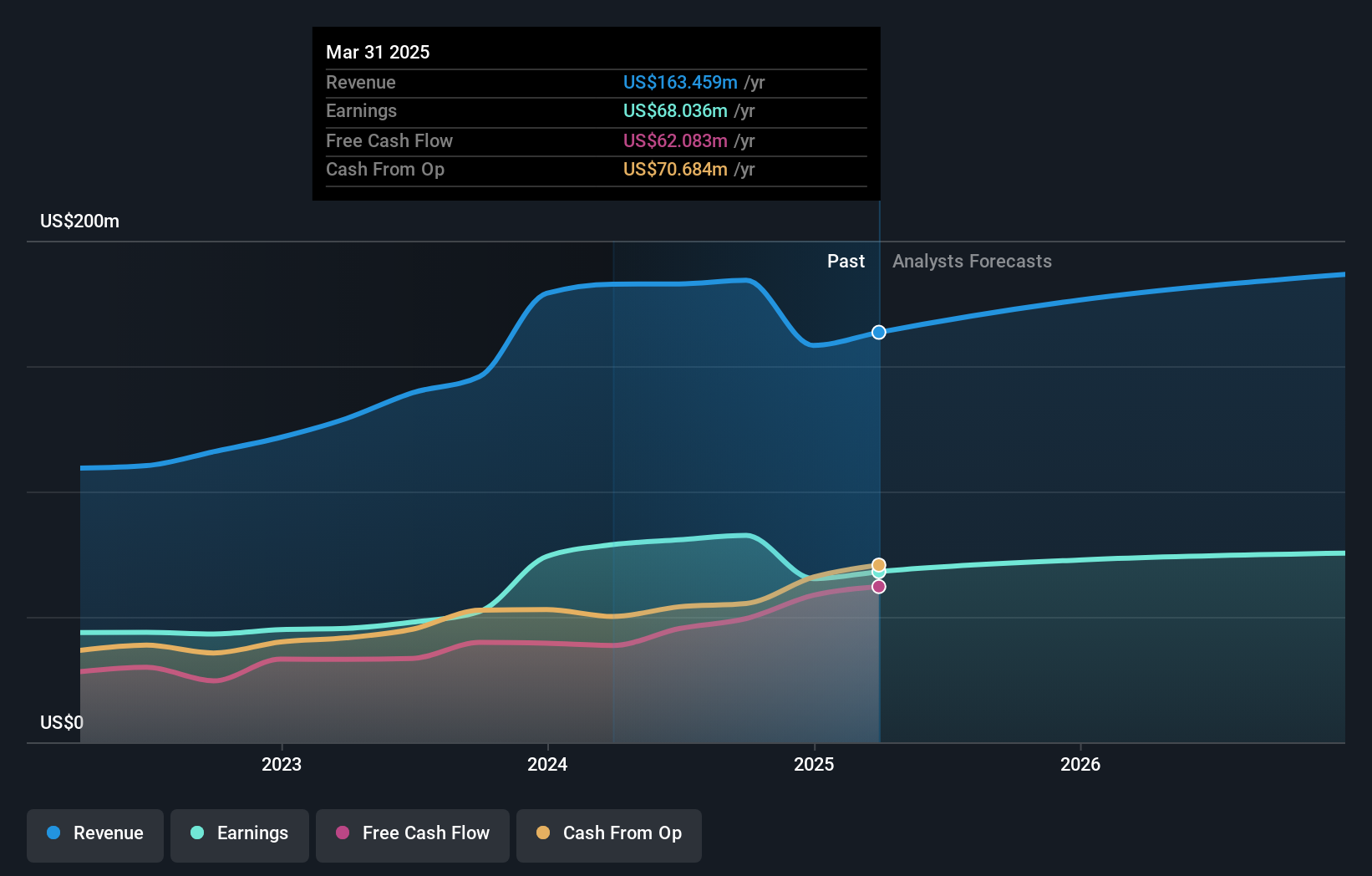

Overview: Bank First Corporation operates as a holding company for Bank First, N.A., with a market cap of $992.09 million.

Operations: Bank First Corporation's revenue is primarily derived from providing a full range of consumer and commercial financial institution services, amounting to $184.22 million.

Bank First, with assets totaling $4.3 billion and equity of $628.9 million, stands out for its robust financial health and growth potential. The bank's total deposits are $3.5 billion against loans of $3.4 billion, underscoring a solid deposit base that fuels its operations with minimal risk due to primarily low-risk funding sources. A net interest margin of 3.7% complements the impressive earnings growth of 58% over the past year, far surpassing industry averages by a significant margin. Additionally, it trades at nearly 18% below estimated fair value while maintaining an appropriate level of bad loans at just 0.3%.

Northwest Pipe (NasdaqGS:NWPX)

Simply Wall St Value Rating: ★★★★★☆

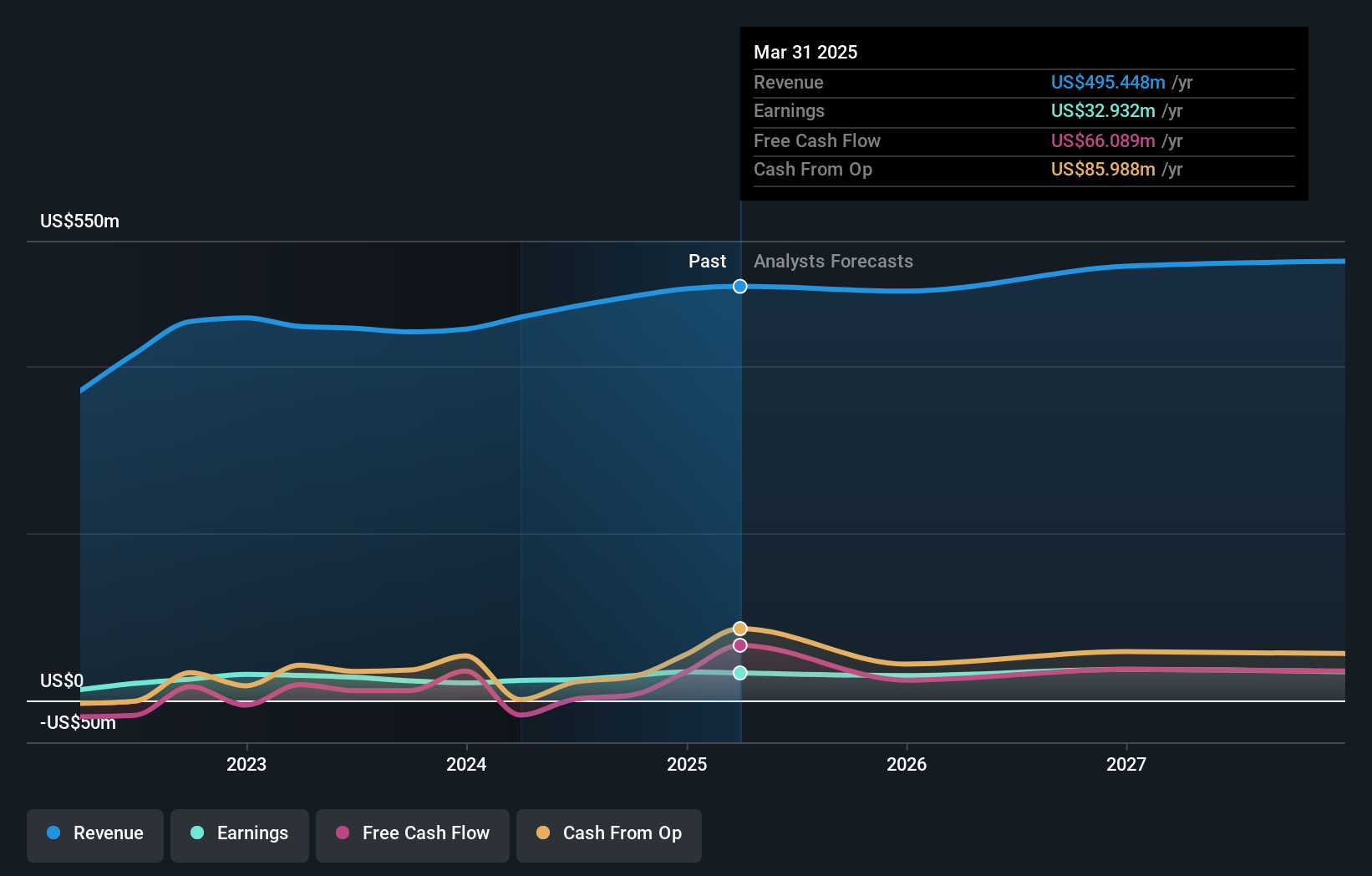

Overview: Northwest Pipe Company, along with its subsidiaries, manufactures and supplies water-related infrastructure products in North America, with a market cap of $478.68 million.

Operations: Northwest Pipe generates revenue primarily from its Engineered Steel Pressure Pipe segment, contributing $330.54 million, and the Precast Infrastructure and Engineered Systems segment, adding $152.54 million.

Northwest Pipe, a player in the water infrastructure sector, is trading at 49% below its estimated fair value. Over the past five years, earnings have grown by 4% annually. The company's interest payments are well covered by EBIT at 7.9 times coverage. Recent developments include plans to expand production capacity with a new mill in Salt Lake City and active evaluation of M&A opportunities to boost its Precast strategy. Despite challenges like price volatility and high interest rates affecting demand, Northwest Pipe reported third-quarter revenue of US$130 million and net income of US$10 million, reflecting solid financial performance compared to last year.

Gencor Industries (NYSEAM:GENC)

Simply Wall St Value Rating: ★★★★★★

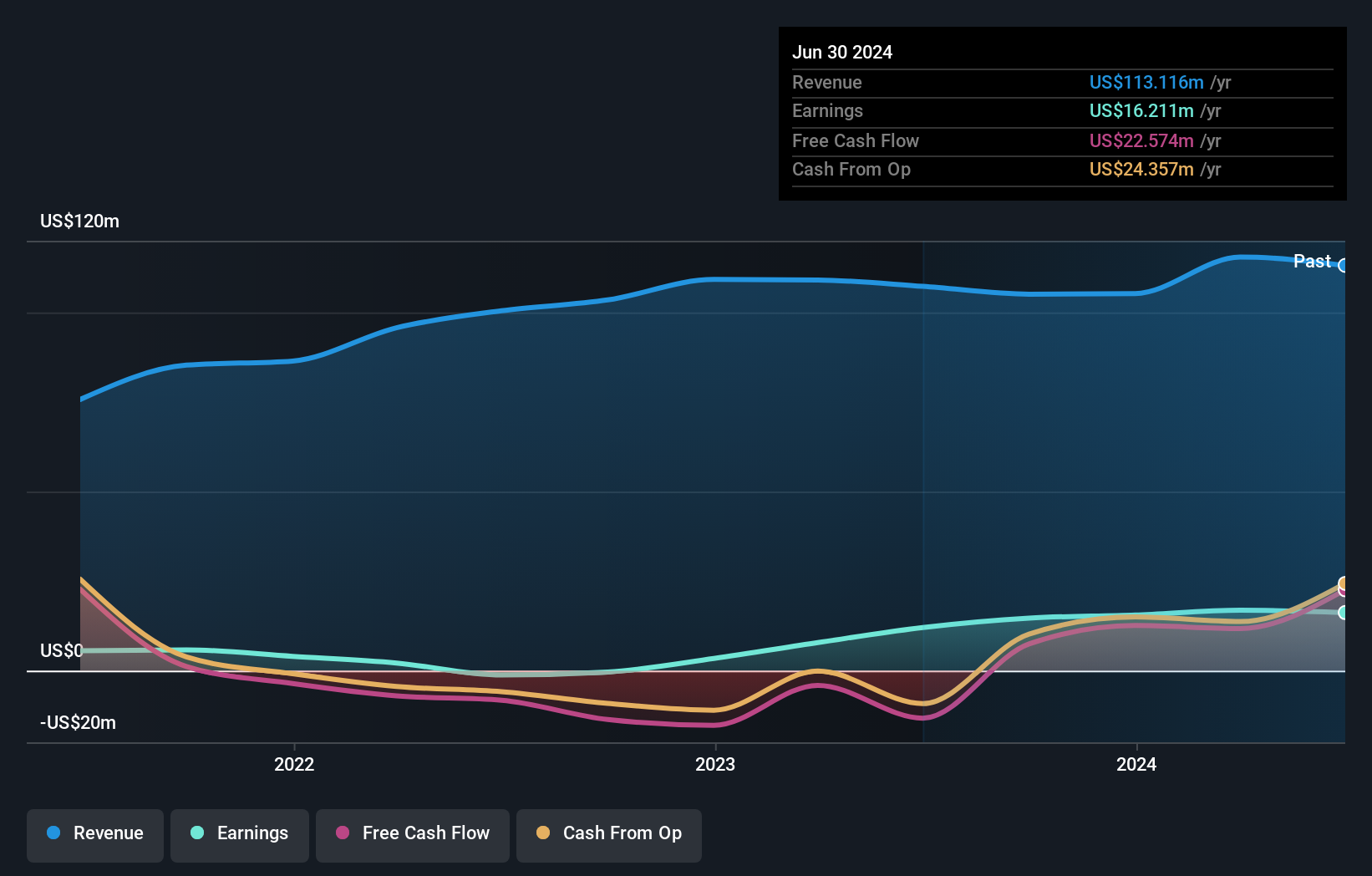

Overview: Gencor Industries, Inc., along with its subsidiaries, focuses on designing, manufacturing, and selling heavy machinery for highway construction materials and environmental control equipment, with a market cap of $258.71 million.

Operations: Gencor Industries generates revenue primarily from its equipment for the highway construction industry, amounting to $113.12 million.

Gencor Industries, a smaller player in the machinery sector, stands out with its debt-free balance sheet for the past five years. Its earnings surged by 35% last year, outpacing the industry average of 15%, indicating robust performance. The stock is currently trading at a significant discount, about 93% below estimated fair value. Despite recent challenges such as delayed SEC filings and auditor changes to Forvis Mazars, Gencor's high-quality earnings and positive free cash flow suggest resilience. These factors combined paint a picture of potential undervaluation amidst operational adjustments.

- Dive into the specifics of Gencor Industries here with our thorough health report.

Explore historical data to track Gencor Industries' performance over time in our Past section.

Key Takeaways

- Explore the 244 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank First might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BFC

Flawless balance sheet with solid track record and pays a dividend.