- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:VUZI

Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As November 2025 draws to a close, the U.S. stock market has seen a robust week, with major indexes logging their best performance since June, despite the Nasdaq's seven-month winning streak coming to an end. For investors seeking opportunities in smaller or newer companies, penny stocks—though an outdated term—remain relevant and intriguing due to their potential for growth at lower price points. These stocks often represent underappreciated chances for investment when paired with strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.72 | $368.6M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.795 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.847 | $144.85M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.285 | $553.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.25 | $1.36B | ✅ 5 ⚠️ 1 View Analysis > |

| FinVolution Group (FINV) | $4.99 | $1.26B | ✅ 3 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.50 | $584.17M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.837 | $6.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.81 | $86.32M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 345 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Microvast Holdings (MVST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. develops battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $1.15 billion.

Operations: The company generates revenue primarily from its Batteries / Battery Systems segment, which amounted to $444.50 million.

Market Cap: $1.15B

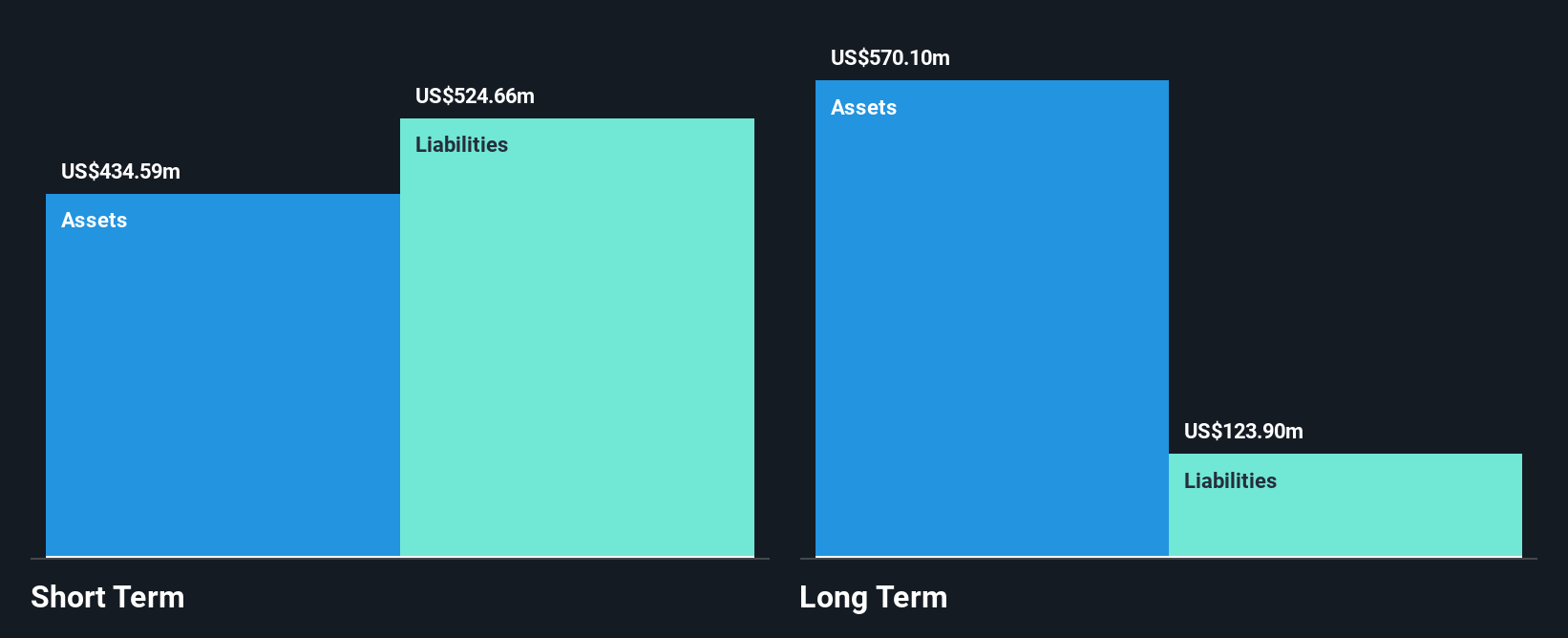

Microvast Holdings, Inc. has demonstrated growth potential in the battery technology sector, with revenue from its Batteries/Battery Systems segment reaching US$444.50 million. Despite being unprofitable, it has reduced losses over five years and maintains a sufficient cash runway exceeding three years. The company's recent earnings report highlighted a net loss of US$1.49 million for Q3 2025, contrasting with a net income in the previous year, yet sales increased to US$123.29 million from US$101.39 million year-on-year for the quarter. Microvast's market cap is approximately $1.15 billion, and it recently filed a follow-on equity offering worth $137.6 million to bolster its financial position further.

- Navigate through the intricacies of Microvast Holdings with our comprehensive balance sheet health report here.

- Examine Microvast Holdings' earnings growth report to understand how analysts expect it to perform.

Vuzix (VUZI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vuzix Corporation designs, manufactures, and markets AI-powered smart glasses, waveguides, and AR technologies globally with a market cap of $215.54 million.

Operations: The company's revenue is primarily derived from its Video Eyewear Products segment, which generated $5.31 million.

Market Cap: $215.54M

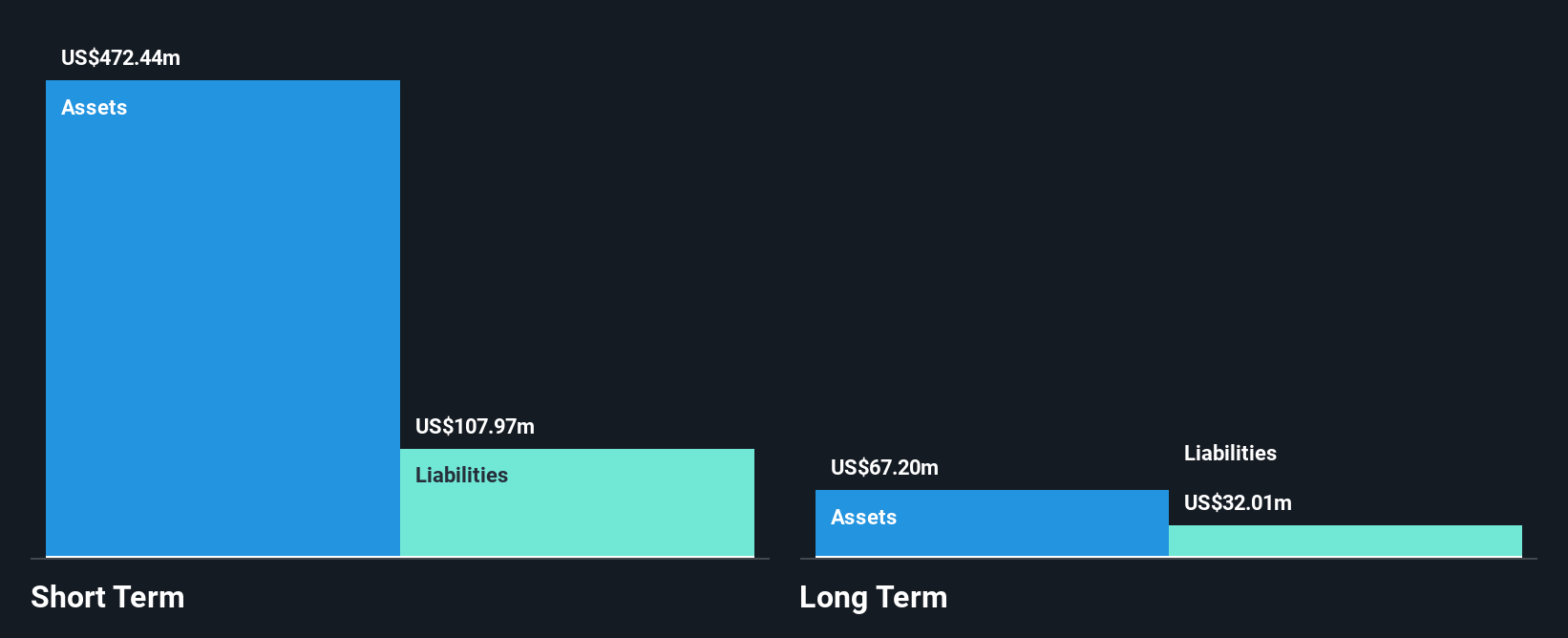

Vuzix Corporation, with a market cap of US$215.54 million, is actively advancing its smart glasses technology through strategic partnerships and client engagements. Recent orders totaling nearly US$1 million for its M400 smart glasses from an online retailer signify growing adoption in logistics operations across North America and Europe. Despite being unprofitable with a net loss of US$7.35 million for Q3 2025, Vuzix's debt-free status and sufficient short-term assets to cover liabilities provide some financial stability. The company's inclusion in the AR Alliance reflects its commitment to innovation within the augmented reality ecosystem, though it faces challenges like high share price volatility and limited cash runway under current free cash flow conditions.

- Unlock comprehensive insights into our analysis of Vuzix stock in this financial health report.

- Gain insights into Vuzix's future direction by reviewing our growth report.

Standard BioTools (LAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Standard BioTools Inc. develops, manufactures, and sells instrumentation, consumables, and services to scientists and biomedical researchers globally with a market cap of $576.85 million.

Operations: The company generates revenue from its Europe, Middle East, and Africa (EMEA) segment, which amounts to $51.38 million.

Market Cap: $576.85M

Standard BioTools Inc., with a market cap of US$576.85 million, is navigating the penny stock landscape by leveraging strategic collaborations, such as its recent partnership with Molecular Instruments to enhance Imaging Mass Cytometry workflows. Despite reporting a net loss of US$34.69 million for Q3 2025 and experiencing declining revenue from US$22.09 million to US$19.55 million year-over-year, the company maintains more cash than total debt and has sufficient short-term assets to cover liabilities. However, challenges persist with unprofitability and an inexperienced management team while aiming for future profitability through innovative technological advancements and strategic guidance affirmations for fiscal 2025 revenue expectations between US$165 million to US$175 million.

- Click here to discover the nuances of Standard BioTools with our detailed analytical financial health report.

- Gain insights into Standard BioTools' outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Unlock more gems! Our US Penny Stocks screener has unearthed 342 more companies for you to explore.Click here to unveil our expertly curated list of 345 US Penny Stocks.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VUZI

Vuzix

Designs, manufactures, and markets artificial intelligence (AI)-powered smart glasses, waveguides, and augmented reality (AR) technologies in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026