- United States

- /

- Machinery

- /

- NasdaqCM:MVST

A Look at Microvast Holdings (MVST) Valuation Following Solid-State Battery Launch and Capacity Expansion

Reviewed by Kshitija Bhandaru

Microvast Holdings (MVST) has drawn fresh attention from investors after the launch of its True All-Solid-State Battery technology. This rollout is driving higher demand and improved profitability for the company.

See our latest analysis for Microvast Holdings.

Momentum in Microvast Holdings shares has gone into overdrive lately, with the stock boasting a 21% gain in just the last day and a remarkable 117.4% share price return year-to-date, fueled by buzz around its new solid-state battery technology, recent upward earnings revisions, and ongoing capacity expansion plans. Total shareholder return is even more dramatic, up over 2,300% for the trailing year, highlighting both the excitement around Microvast’s growth story and a change in how investors perceive its risk and reward profile.

If Microvast’s spectacular run has you scanning for the next breakout, this is a great moment to discover fast growing stocks with high insider ownership.

With Microvast’s shares surging on optimism about its breakthrough battery technology and strategic expansion, the key question is whether this powerful run still leaves room for upside, or if future growth is already priced in.

Most Popular Narrative: 4.7% Undervalued

With the fair value now pegged at $5.50, slightly above Microvast’s last close of $5.24, the market is inching closer to analyst expectations. This suggests optimism is driving shares toward their narrative fair value. Momentum is building, but the foundation behind this view lies in how the company’s key operational strengths are expected to play out over the next several years.

Execution of multi-region growth strategies, particularly in EMEA and APAC, with a ramp-up in U.S. presence, allows Microvast to capitalize on shifting government policies and major fleet decarbonization mandates, expanding total addressable markets and improving customer diversification, positively impacting revenue visibility and risk-adjusted earnings.

Curious what double-digit revenue growth, rapid margin expansion, and ambitious future profit multiples mean for this stock’s journey? The most popular narrative is built on bold, quantitative projections and global expansion moves. See the full view to discover the numbers driving this hotly debated fair value.

Result: Fair Value of $5.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing heavy China-based investments and volatile financials could quickly challenge the bullish outlook if geopolitical or accounting risks intensify.

Find out about the key risks to this Microvast Holdings narrative.

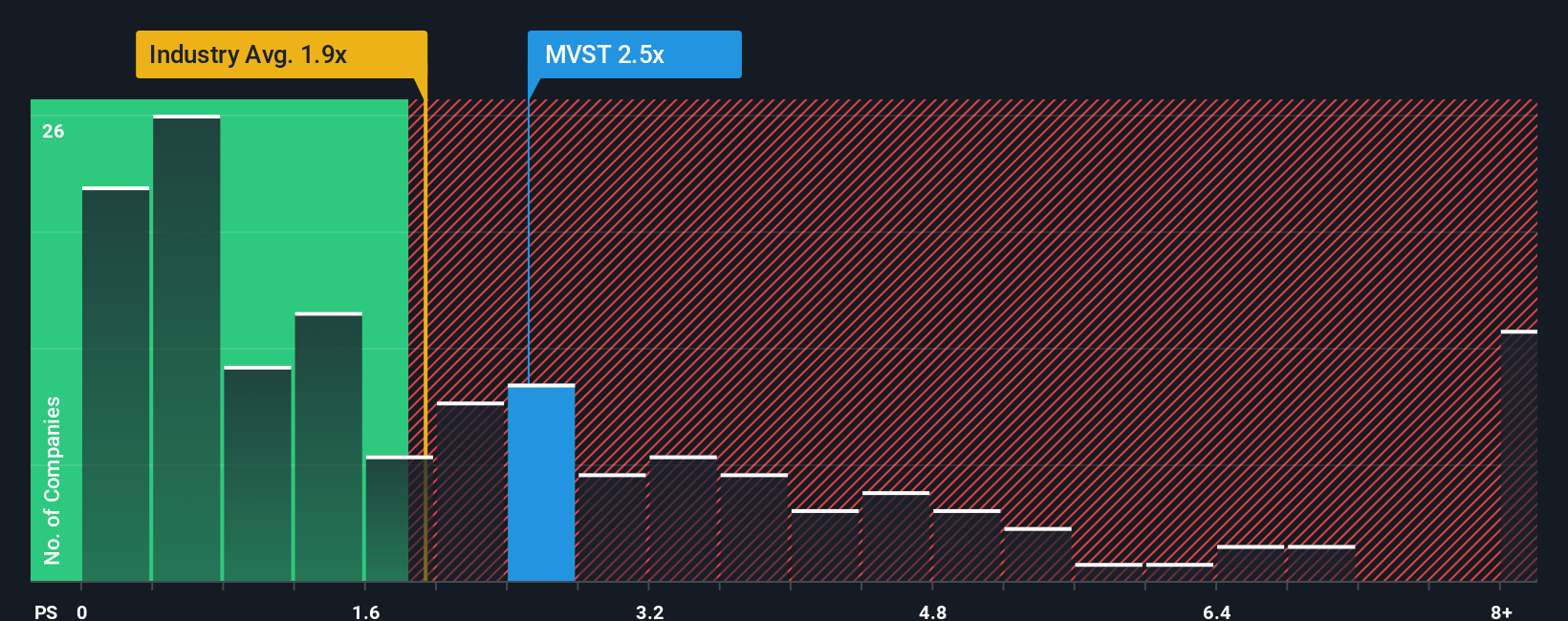

Another View: Price-to-Sales Comparison Raises Caution

Looking at value from a different lens, Microvast’s price-to-sales ratio stands at 4x, which is notably higher than the US Machinery industry average of 1.9x and the peer average of 0.7x. Even so, this is still below the fair ratio of 13.3x that the market could one day recognize. This gap highlights both risk and opportunity. Investors may ask whether optimism is already priced in or whether valuations could adjust even higher.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microvast Holdings Narrative

If you see the story differently or want to run your own analysis, you can easily shape your own take in just minutes. Do it your way.

A great starting point for your Microvast Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always one step ahead, so don’t just stop at Microvast Holdings when opportunities abound. The Simply Wall Street Screener offers fresh pathways to find your next standout investment.

- Uncover compelling income opportunities by tapping into these 18 dividend stocks with yields > 3%. This is where strong yields meet solid fundamentals for steady potential returns.

- Gain an edge in the future of healthcare by seeking out innovators through these 33 healthcare AI stocks. This tool spotlights pioneers in medical AI transforming patient outcomes and diagnostics.

- Position yourself ahead of the curve and assess fast-moving blockchain disruptors inside these 79 cryptocurrency and blockchain stocks. This screener opens doors to companies redefining the digital landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives