- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Why Intuitive Machines (LUNR) Is Up 17.6% After Achieving NASA-Grade Software Certification And What's Next

Reviewed by Sasha Jovanovic

- Intuitive Machines announced it has been appraised at Capability Maturity Model Integration (CMMI) Maturity Level 3 for software development, confirming its processes meet NASA’s Class A human spaceflight requirements as of October 7, 2025.

- This recognition highlights the company's disciplined engineering approach and signifies increased confidence in its ability to deliver reliable lunar exploration solutions to major clients.

- We'll examine how meeting NASA's rigorous software standards could reshape the investment narrative for Intuitive Machines going forward.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Intuitive Machines Investment Narrative Recap

Belief in Intuitive Machines centers on the company's ability to secure and deliver high-profile lunar and space contracts as government and commercial demand for space access grows. The recent CMMI Maturity Level 3 appraisal enhances confidence in its technical execution and may improve its appeal for future contracts, but it does not materially reduce the immediate risk of revenue lumpiness tied to large, milestone-based projects or setbacks on lunar missions, arguably still the most significant near-term catalyst and risk.

Of the recent announcements, the $116.9 million NASA contract to deliver payloads to the Moon’s South Pole stands out as most relevant. Achieving NASA’s Class A software standard could directly support this mission and similar contracts, reinforcing Intuitive Machines’ credentials and its ability to win and fulfill technically demanding, high-value awards that move the needle for both revenue growth and investor sentiment.

Yet, despite this important technical step, investors should be aware that financial results remain concentrated around a few binary events and...

Read the full narrative on Intuitive Machines (it's free!)

Intuitive Machines' narrative projects $502.2 million revenue and $41.2 million earnings by 2028. This requires 30.5% yearly revenue growth and a $283 million earnings increase from -$241.8 million today.

Uncover how Intuitive Machines' forecasts yield a $14.38 fair value, a 15% upside to its current price.

Exploring Other Perspectives

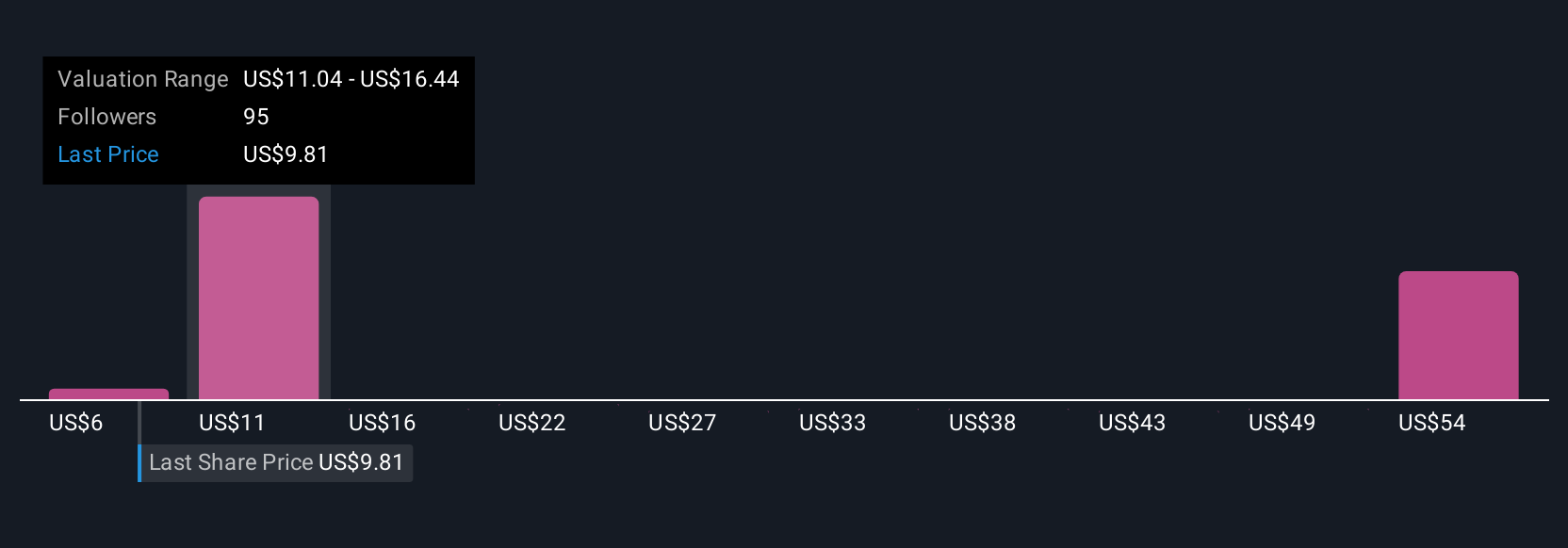

Simply Wall St Community members shared 27 fair value estimates for Intuitive Machines ranging from US$5.69 to US$59.07 per share. With performance hinging on a handful of major contracts, it is crucial to consider how differently investors may assess the risks and rewards facing the company.

Explore 27 other fair value estimates on Intuitive Machines - why the stock might be worth less than half the current price!

Build Your Own Intuitive Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intuitive Machines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intuitive Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intuitive Machines' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives