- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Investors Still Aren't Entirely Convinced By Intuitive Machines, Inc.'s (NASDAQ:LUNR) Revenues Despite 42% Price Jump

Intuitive Machines, Inc. (NASDAQ:LUNR) shares have continued their recent momentum with a 42% gain in the last month alone. But the last month did very little to improve the 58% share price decline over the last year.

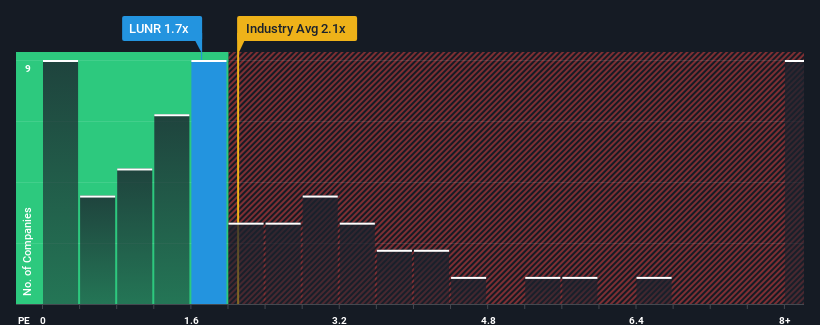

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Intuitive Machines' P/S ratio of 1.7x, since the median price-to-sales (or "P/S") ratio for the Aerospace & Defense industry in the United States is also close to 2.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Intuitive Machines

What Does Intuitive Machines' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Intuitive Machines has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Intuitive Machines' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Intuitive Machines' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. Pleasingly, revenue has also lifted 96% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 65% per year during the coming three years according to the four analysts following the company. With the industry only predicted to deliver 7.9% per year, the company is positioned for a stronger revenue result.

In light of this, it's curious that Intuitive Machines' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Intuitive Machines' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Intuitive Machines' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 7 warning signs we've spotted with Intuitive Machines (including 3 which make us uncomfortable).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives