- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Intuitive Machines (NasdaqGM:LUNR) Posts Positive 2025 Revenue Guidance

Reviewed by Simply Wall St

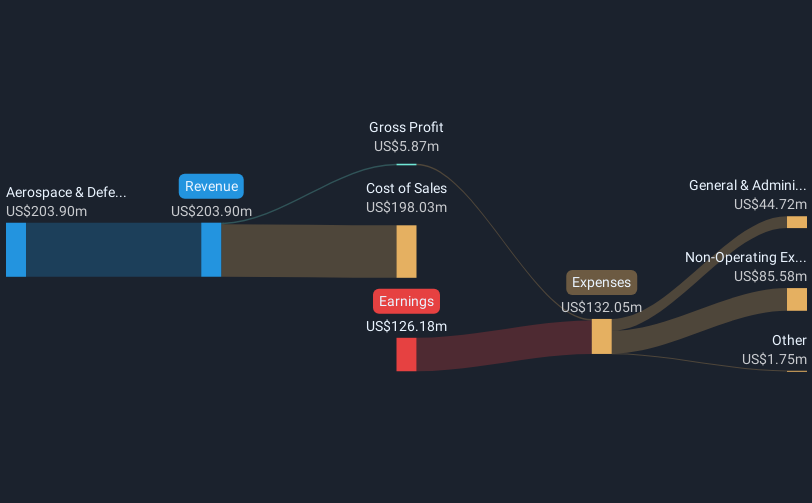

Intuitive Machines (NasdaqGM:LUNR) reported a 12% increase in its share price over the past week, likely influenced by several significant developments. The release of its Q4 2024 earnings showed sales growth but a net loss, which might have been somewhat counterbalanced by the positive revenue guidance for 2025. Additionally, the company's successful closure of a private placement could be perceived as a vote of confidence in its future prospects. These factors added weight to the broader market trend, which also saw a climb of 5% during the same period. The company's performance was thus aligned with the broader upward market movement.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past year, Intuitive Machines' total shareholder returns, including share price and dividends, amounted to a substantial 51.97% increase. This strong performance exceeded both the US market's return of 3.6% and the US Aerospace & Defense industry's 19.4% gain over the same period. Such a significant return indicates a robust investor confidence in the company's prospects despite its unprofitability.

The recent increase in share price, with a 12% gain in just one week, aligns with this overall positive trend and reflects investor optimism surrounding recent revenue guidance for 2025 and other strategic achievements. However, the company's financials indicate ongoing challenges, with increasing net losses even as sales grew substantially. Analysts expect revenue growth of 18.9% per year, which, though above the market average of 8.3%, is slower than the anticipated earnings growth of 95.69% annually. Despite these positive growth expectations, the current share price remains below the consensus analyst price target, representing a perceived undervaluation as the market awaits a potential turnaround in profitability.

Assess Intuitive Machines' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Intuitive Machines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives