- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Analyst Forecasts Just Became More Bearish On Intuitive Machines, Inc. (NASDAQ:LUNR)

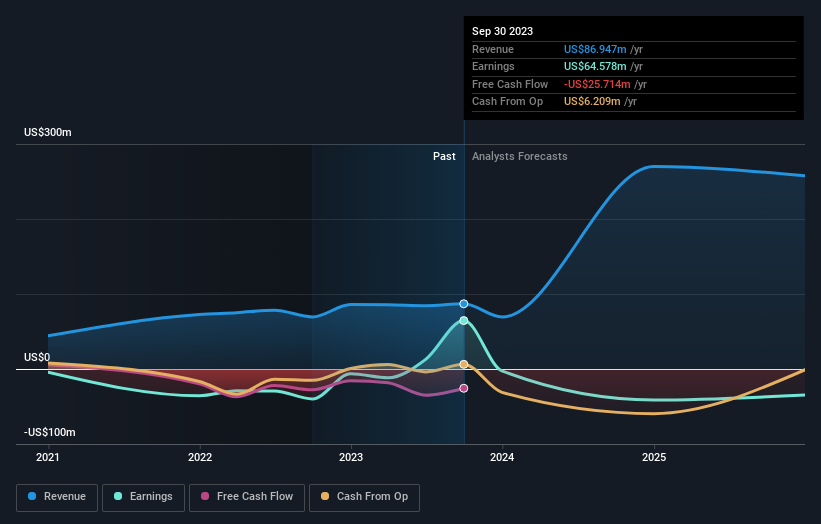

One thing we could say about the analysts on Intuitive Machines, Inc. (NASDAQ:LUNR) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well. Shares are up 4.9% to US$2.99 in the past week. Investors could be forgiven for changing their mind on the business following the downgrade; but it's not clear if the revised forecasts will lead to selling activity.

Following the downgrade, the current consensus from Intuitive Machines' four analysts is for revenues of US$270m in 2024 which - if met - would reflect a huge 210% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$459m in 2024. The consensus view seems to have become more pessimistic on Intuitive Machines, noting the sizeable cut to revenue estimates in this update.

See our latest analysis for Intuitive Machines

Notably, the analysts have cut their price target 50% to US$5.63, suggesting concerns around Intuitive Machines' valuation.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Intuitive Machines' growth to accelerate, with the forecast 148% annualised growth to the end of 2024 ranking favourably alongside historical growth of 19% per annum over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.2% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Intuitive Machines to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for next year. They're also forecasting more rapid revenue growth than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of Intuitive Machines' future valuation. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Intuitive Machines after today.

That said, the analysts might have good reason to be negative on Intuitive Machines, given a weak balance sheet. Learn more, and discover the 3 other concerns we've identified, for free on our platform here.

We also provide an overview of the Intuitive Machines Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives