- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

A Fresh Look at Intuitive Machines (LUNR) Valuation Following Key NASA-Grade Certification Milestone

Reviewed by Kshitija Bhandaru

Intuitive Machines (LUNR) recently achieved CMMI Maturity Level 3 for software development. This milestone demonstrates that their engineering processes meet NASA’s demanding standards for human spaceflight projects. This could influence how investors view the company’s future growth.

See our latest analysis for Intuitive Machines.

Intuitive Machines has captured renewed attention thanks to milestones like the recent CMMI achievement, but momentum has been building for some time. The shares are up nearly 39% over the past month. While the year-to-date share price return remains down, total shareholder return over the past year is up an impressive 60%. This mix of strong recent gains with solid long-term performance suggests investor optimism is returning, fueled by signs of operational progress and future growth potential.

If news about space engineering milestones piqued your interest, the next logical step is to check out See the full list for free.

With shares up sharply this month and upbeat analyst targets suggesting further upside, investors may wonder if Intuitive Machines is currently undervalued by the market or if its recent progress has already been fully priced in, leaving little room for a buying opportunity.

Most Popular Narrative: 18% Undervalued

With Intuitive Machines closing at $11.79, the narrative consensus sets a fair value at $14.38. This indicates a meaningful gap that has stirred strong debate about the company’s outlook. This pricing dynamic puts fresh focus on how the growth story justifies the higher target.

"Strategic vertical integration of satellite and lander manufacturing, along with proprietary advancements from the KinetX acquisition, enhances cost efficiencies, IP control, and technological differentiation. This supports higher net margins and competitive pricing power as the company scales recurrent service contracts across civil, defense, and commercial markets."

Why do analysts predict such a dramatic transformation in profitability and valuation over the next few years? The blueprint behind this price target relies on projections for rapidly expanding revenues and a leap from deep losses to meaningful earnings. Curious which ambitious forecasts anchor this bullish stance? Explore the full narrative to see the financial leaps that could justify the premium implied by the fair value.

Result: Fair Value of $14.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in government contracts and ongoing operating losses could quickly undermine the bullish outlook. This could make future growth far less certain.

Find out about the key risks to this Intuitive Machines narrative.

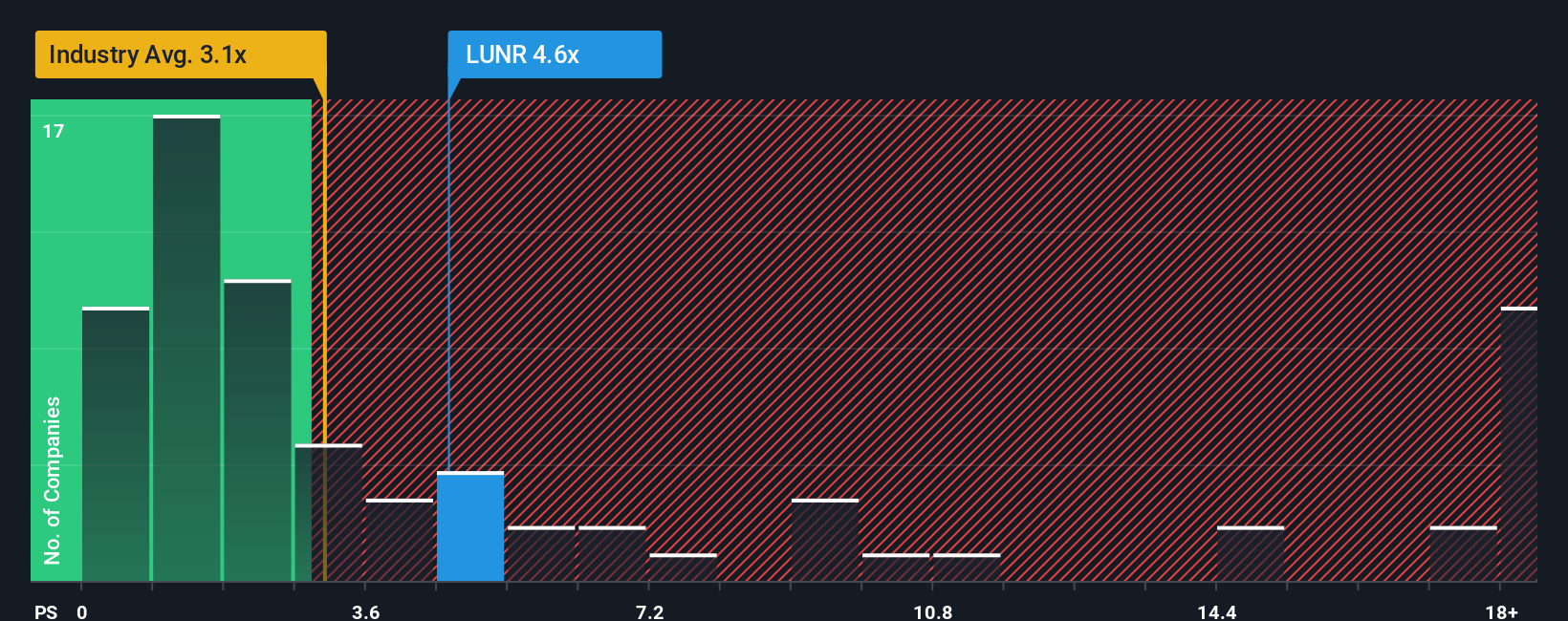

Another View: Multiples Send a Caution Signal

While long-term growth forecasts suggest upside, Intuitive Machines is currently trading at a sales ratio of 6.1, well above both its industry (3.4) and peer (2.5) averages, and over four times its fair ratio of 1.4. This sizable gap highlights valuation risk and raises the question of whether momentum could shift if expectations falter.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Machines Narrative

If you have a different perspective or want to dive deeper into the numbers, why not assemble your own view of the Intuitive Machines story and see what you discover? You can do it in just a few minutes. Do it your way

A great starting point for your Intuitive Machines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Shake up your watchlist and don’t risk missing out on tomorrow’s big winners. Put Simply Wall Street’s powerful screeners to work and spot real opportunities, fast.

- Tap into rapid growth potential by finding these 25 AI penny stocks that are capitalizing on breakthroughs in artificial intelligence and machine learning.

- Catch undervalued gems before the crowd with these 897 undervalued stocks based on cash flows based on discounted cash flows and strong fundamentals.

- Secure steady returns by seeing these 19 dividend stocks with yields > 3% offering yields over 3% for your income portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives