- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

What Does Kratos’ 261% Rally Mean for Investors After Raytheon Contract Win in 2025?

Reviewed by Bailey Pemberton

If you have been tracking Kratos Defense & Security Solutions lately, you are likely feeling a little caught between excitement and caution. After all, how often do you see a stock rocket 261.3% higher year-to-date and 841.7% over three years? These numbers are enough to catch the attention of any investor, but such dizzying gains naturally spark questions about whether now is the right time to jump in, hold on, or take some profits off the table.

The last month alone has been a microcosm of this rollercoaster. Kratos saw a rapid 37.7% surge, followed by a sharp 8.1% dip just this past week. This reflects how quickly sentiment can shift and highlights the heightened volatility that often accompanies rapid growth. Much of this recent movement mirrors broader market enthusiasm for the defense sector, where geopolitical uncertainties and increased government spending have cast a bright spotlight on companies with proven capabilities.

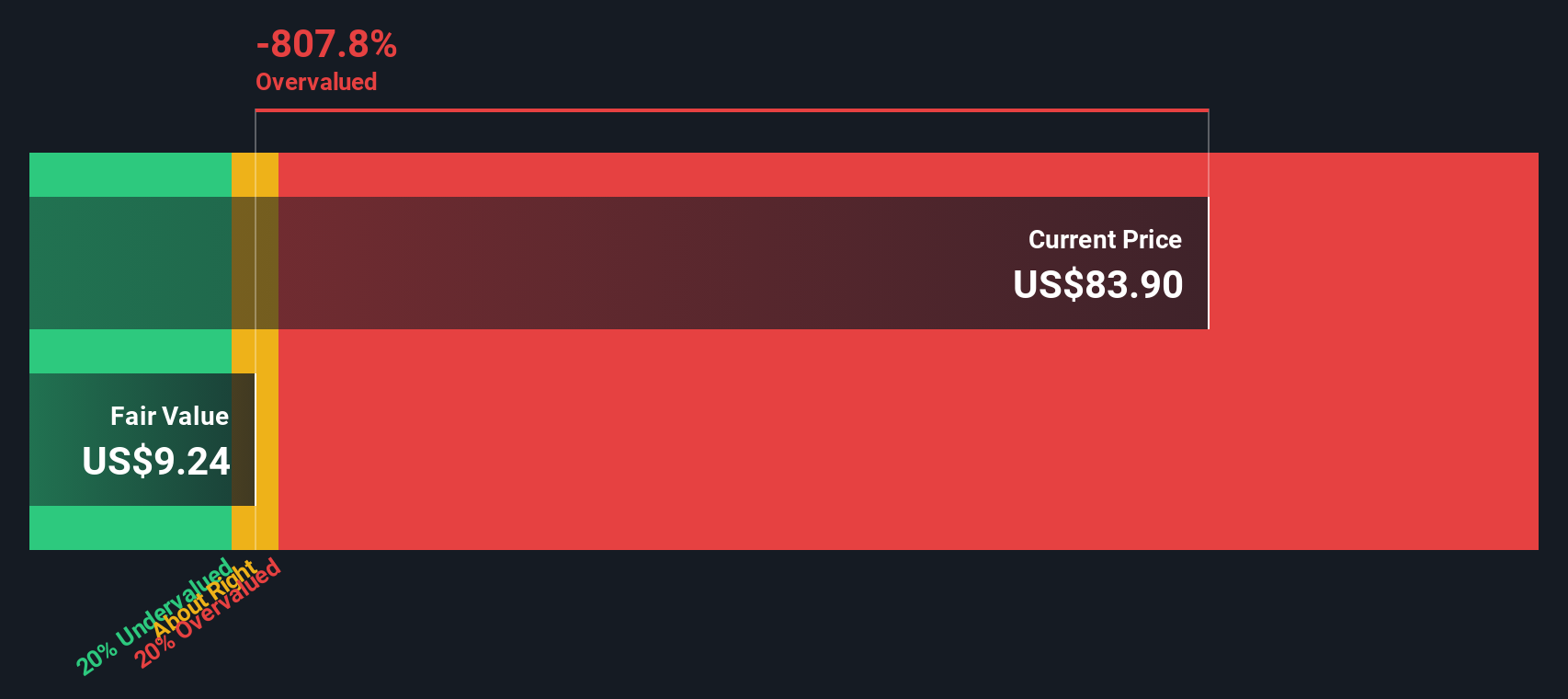

But with great performance comes higher expectations, and the big question on every investor’s mind is, “Is Kratos undervalued, overvalued, or just right?” When we ran Kratos through six different valuation checks, it scored a 0 out of 6 for being undervalued. That fact alone should grab your attention if you are weighing this stock, not because it means Kratos is a bad bet, but because it urges a closer look at how valuation really works in a high-growth context.

So let’s break down the main valuation approaches, and preview why a single score never tells the whole story. There is an even better way to understand if a stock is truly worth your investment, and we will get to that before we finish.

Kratos Defense & Security Solutions scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kratos Defense & Security Solutions Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's dollars. This approach seeks to answer what Kratos Defense & Security Solutions would be worth if you owned its future business income, measured in today’s money.

As of the latest reported period, Kratos posted a Free Cash Flow (FCF) of -$54.22 million. While negative now, analysts forecast a rapid turnaround, expecting FCF to swing to $27.01 million by 2027 and continue to climb steadily through 2035 according to extended projections. Over the next decade, annual FCF is estimated to reach $105.87 million, with much of this long-term growth inferred from analyst trajectories and Simply Wall St’s extrapolations. All projections are made in US dollars.

Using the 2 Stage Free Cash Flow to Equity model, the calculated intrinsic value per share is just $8.64. By comparison, the current share price indicates the stock is trading at a premium of 1003.6% to its DCF-derived value. This substantial gap signals that Kratos appears significantly overvalued based on its forecasted cash flows and current fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kratos Defense & Security Solutions may be overvalued by 1003.6%. Find undervalued stocks or create your own screener to find better value opportunities.

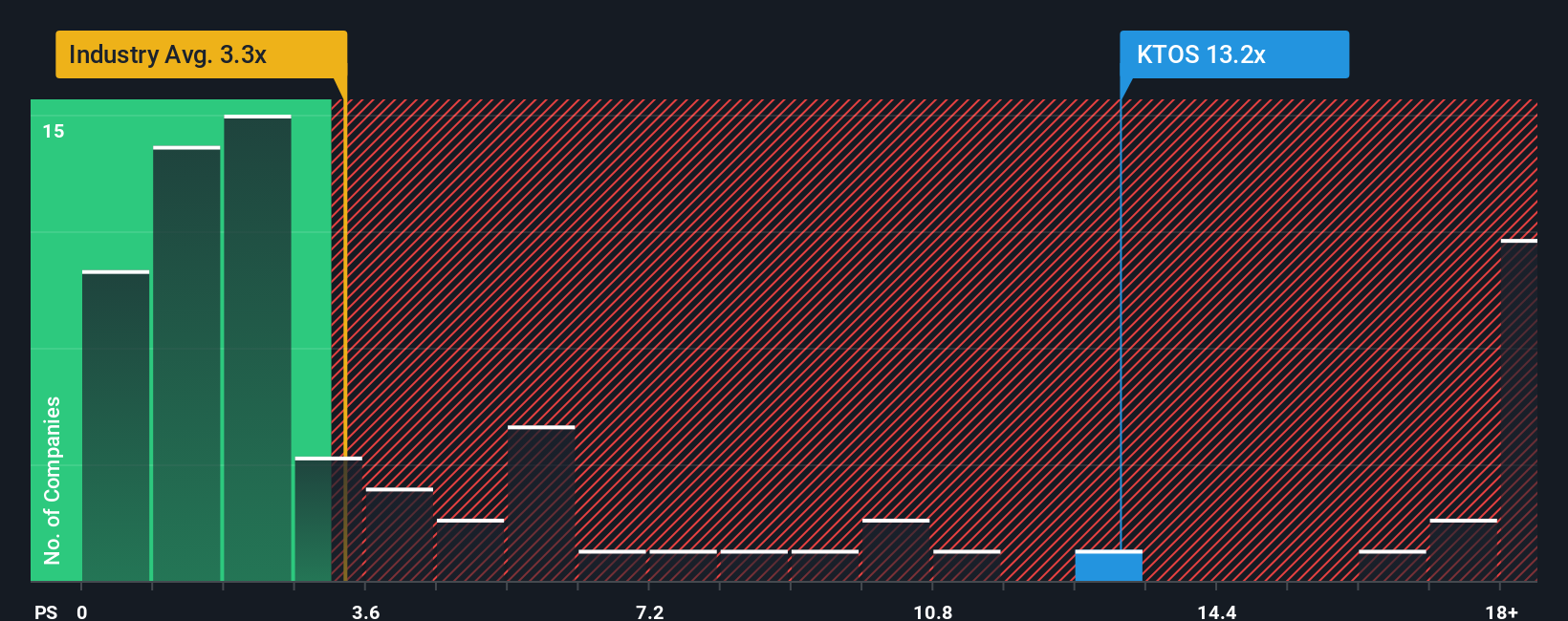

Approach 2: Kratos Defense & Security Solutions Price vs Sales

The Price-to-Sales (P/S) ratio is often a preferred metric for valuing companies like Kratos Defense & Security Solutions that are in high-growth phases or not yet consistently profitable. By focusing on revenue rather than earnings, the P/S ratio helps to provide a clearer comparison for companies where profit margins may still be developing. This makes it particularly useful for firms reinvesting heavily in expansion or innovation.

Growth and risk both play important roles in determining what counts as a “normal” or “fair” P/S multiple. Higher expected growth generally justifies a higher multiple, while greater risks suggest a lower one. Context is essential: industry trends and future outlook must be considered alongside the headline ratio.

Currently, Kratos trades at a P/S ratio of 13.26x, which stands well above the Aerospace & Defense industry average of 3.33x and its peer group average of 4.58x. Evaluating this further, Simply Wall St’s proprietary “Fair Ratio” model assigns a value of 2.64x for Kratos. Unlike a basic comparison to industry or peers, the Fair Ratio synthesizes the company’s growth prospects, risks, profit margins, market capitalization, and sector background to provide a more tailored benchmark for valuation.

When comparing Kratos’s actual multiple to its Fair Ratio, the premium becomes evident. With the P/S trading far above what is justified by the company’s profile and forecast, this measure indicates that the stock is substantially overvalued.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kratos Defense & Security Solutions Narrative

Earlier, we alluded to a better way to make investment decisions, and that solution is Narratives. A Narrative is simply your story about the company, connecting your view of Kratos Defense & Security Solutions, their business, opportunities, and risks, to concrete estimates of future revenue, profit margins, and earnings. These estimates then determine what you believe is a fair value for the stock.

Narratives are more than just numbers; they bridge the company’s story, your investment thesis, and a dynamic financial forecast. On Simply Wall St’s Community page, millions of investors use Narratives to record and share their expectations, making complex analysis accessible to anyone. By comparing the Fair Value from your Narrative to the current market Price, you gain a clear framework for deciding when it makes sense to buy, hold, or sell.

As new information emerges, such as big contract wins, updated revenue forecasts, or changes in margins, Narratives update automatically to help you stay current and confident in your thesis.

- Some investors see Kratos’s exposure to defense modernization and a strong contract pipeline as grounds for a fair value as high as $86.71 per share.

- Others, focused on stretched valuation multiples and risks to cash flow, consider $60.00 to be a more realistic fair value.

No matter your view, Narratives put you in control and help you make investment decisions backed by your own logic and assumptions, not just market hype.

Do you think there's more to the story for Kratos Defense & Security Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives