- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense & Security Solutions (NasdaqGS:KTOS) Secures US$59M Contract for Additional BQM-177A Aircraft

Reviewed by Simply Wall St

Kratos Defense & Security Solutions (NasdaqGS:KTOS) recently announced a major contract award worth $59 million for 70 BQM-177A Subsonic Aerial Target aircraft, which is part of a larger contract potentially reaching $228 million. This development likely fueled the company's impressive 11% share price increase over the past week, despite broader market declines. The defense contractor's achievement underscores strong execution capabilities and highlights potential growth within the sector, as indicated by the reinforcing of its operational footprint in California and Florida. In contrast, the broader market, including the Dow Jones and Nasdaq, faced declines due to ongoing tariff concerns and disappointing tech sector news. This divergence suggests that Kratos's contract news provided a distinct positive catalyst amid market challenges. This case exemplifies how company-specific successes can mitigate broader economic pressures, with Kratos capitalizing on steady demand for defense technology in a volatile market landscape.

See the full analysis report here for a deeper understanding of Kratos Defense & Security Solutions.

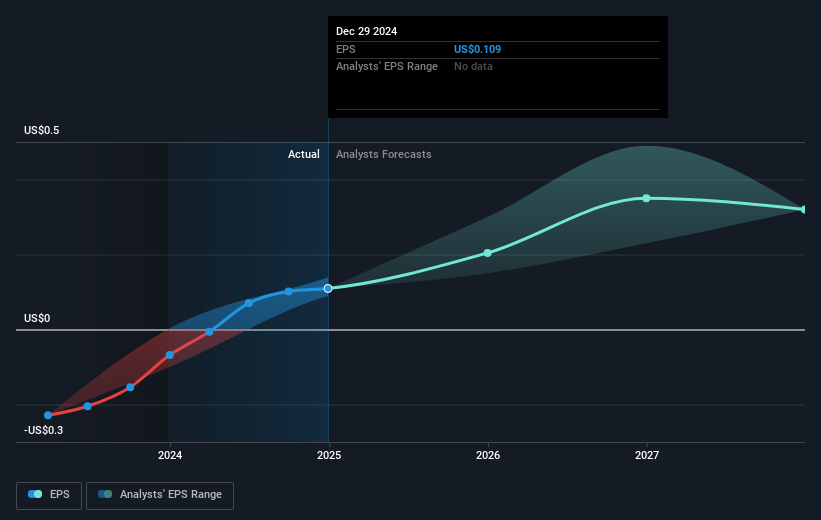

The past five years have seen Kratos Defense & Security Solutions capture a total shareholder return of 78.04%, underscoring its resilience and potential amidst broader market shifts. A pivotal moment was its recent leap into profitability, complemented by an impressive earnings growth forecast of 27.83% annually. This growth trajectory aligns with a robust year where Kratos outperformed both the US Aerospace & Defense industry and the broader market, returning beyond 20% in the past year against respective industry and market gains. Such performance highlights Kratos's capability to capitalize on its profitable growth momentum, primarily driven by sustained demand in defense sectors coupled with strategic contract wins.

Key milestones have included a marked improvement in net profit margins and earnings per share, reflecting technological advancements and successful project deliveries. Significant contract awards, like the US$1.45 billion MACH-TB 2.0, further strengthen Kratos's foothold in military technology innovation. The joint venture with RAFAEL Advanced for US$175 million signifies a focused commitment to expanding capabilities, alongside continuous innovation in unmanned aerial systems such as the XQ-58A Valkyrie. These factors collectively highlight a forward-looking approach that aligns with its robust market performance over the ongoing five-year period.

- Unlock the insights behind Kratos Defense & Security Solutions' valuation and discover its true investment potential

- Assess the downside scenarios for Kratos Defense & Security Solutions with our risk evaluation.

- Are you invested in Kratos Defense & Security Solutions already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kratos Defense & Security Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

Kratos Defense & Security Solutions, Inc.

Flawless balance sheet with reasonable growth potential.