- United States

- /

- Construction

- /

- NasdaqGM:IESC

Market Participants Recognise IES Holdings, Inc.'s (NASDAQ:IESC) Earnings Pushing Shares 27% Higher

Despite an already strong run, IES Holdings, Inc. (NASDAQ:IESC) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 138% following the latest surge, making investors sit up and take notice.

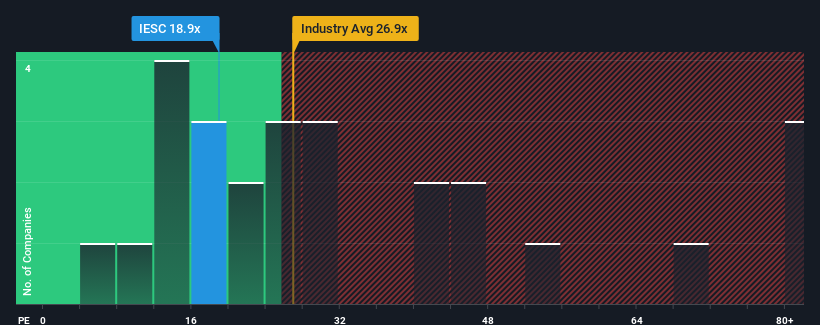

Following the firm bounce in price, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider IES Holdings as a stock to potentially avoid with its 18.9x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, IES Holdings has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for IES Holdings

How Is IES Holdings' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as IES Holdings' is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 180%. The strong recent performance means it was also able to grow EPS by 147% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that IES Holdings' P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From IES Holdings' P/E?

IES Holdings' P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that IES Holdings maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for IES Holdings you should know about.

If you're unsure about the strength of IES Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IESC

IES Holdings

Designs and installs integrated electrical and technology systems, and provides infrastructure products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives