- United States

- /

- Industrials

- /

- NasdaqGS:IEP

What Icahn Enterprises (IEP)'s Quarterly Revenue Shortfall Versus Expectations Means For Shareholders

Reviewed by Sasha Jovanovic

- Icahn Enterprises recently reported quarterly revenues that grew by 5.3% year on year but missed analyst expectations for both revenue and earnings per share.

- While revenue growth was recorded, the shortfall relative to consensus estimates led to renewed questions about the company's ability to meet market performance expectations.

- We’ll examine how Icahn Enterprises’ revenue miss versus expectations shapes discussions around future execution and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Icahn Enterprises' Investment Narrative?

To be comfortable owning Icahn Enterprises right now, you have to believe in the company's ability to navigate an unprofitable business model while funding regular distributions and managing a complex capital structure with high interest costs. The latest quarterly results, a 5.3% revenue gain year on year paired with another miss on both revenue and earnings targets, don’t change the core story overnight, but they do sharpen focus on cash flow generation and the sustainability of the current dividend. While the revenue miss this quarter appears modest and has not led to major share price swings, it may increase scrutiny of management’s ability to execute on cost controls, given ongoing net losses and a reliance on debt financing. The risk profile continues to be anchored by high dividend payouts that are not covered by earnings, forecast revenue declines, a mostly new executive team, and persistent underperformance relative to peers and the broader US market. For now, the recent report underscores existing concerns rather than fundamentally shifting near-term catalysts or risks, but it leaves less room for error if future quarters see similar disappointments.

By contrast, continued debt reliance and cash flow strains are issues investors can't ignore.

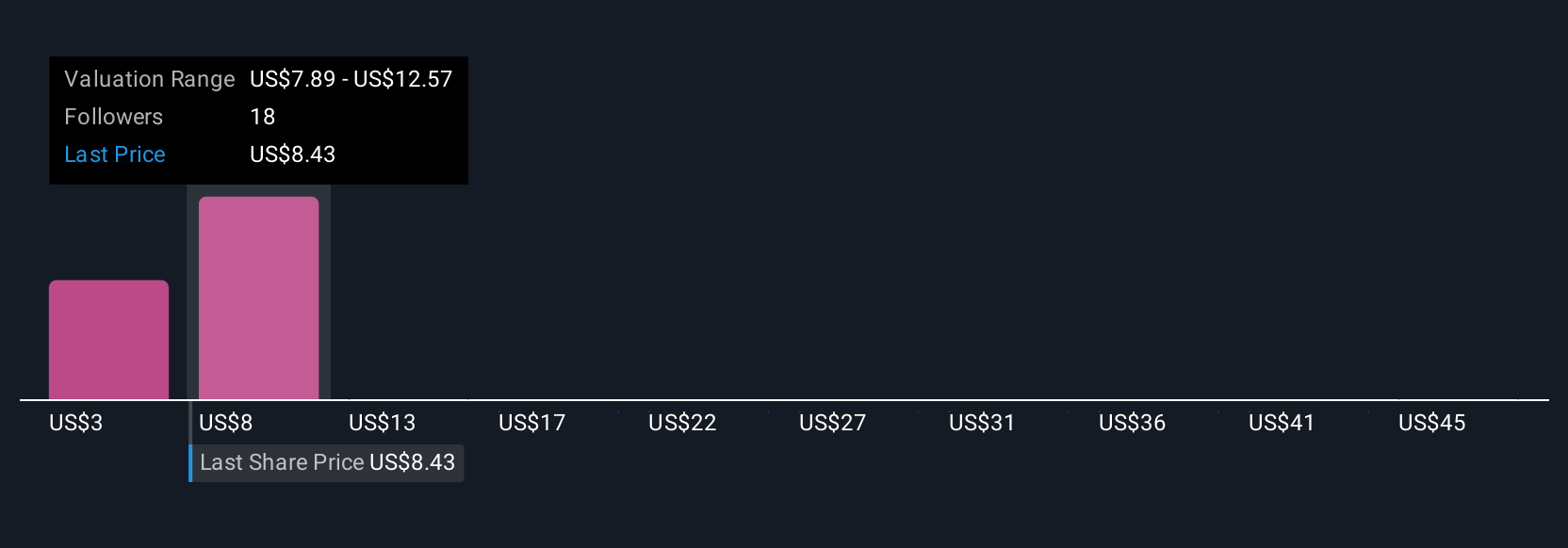

Icahn Enterprises' share price has been on the slide but might be up to 5% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 9 other fair value estimates on Icahn Enterprises - why the stock might be worth less than half the current price!

Build Your Own Icahn Enterprises Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Icahn Enterprises research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Icahn Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Icahn Enterprises' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IEP

Icahn Enterprises

Through its subsidiaries engages in the investment, energy, automotive, food packaging, real estate, home fashion and pharma in the United States and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives