- United States

- /

- Industrials

- /

- NasdaqGS:HON

Honeywell International (NasdaqGS:HON) Partners With Taiyo Oil For Sustainable Aviation Fuel Expansion In Japan

Reviewed by Simply Wall St

Honeywell International (NasdaqGS:HON) recently announced a partnership with Taiyo Oil Co. Ltd. for the production of sustainable aviation fuel (SAF) in Japan using its UOP Ethanol to Jet (ETJ) technology. This significant development aligns with global environmental goals and may have supported Honeywell's 4% share price increase over the past month. Additionally, the company declared a quarterly dividend of $1.13 per share and continued its share buyback program, which could also have positively impacted investor sentiment. Despite the broader market facing declines, with the Dow Jones and Nasdaq down 1% and 3%, respectively, Honeywell's strategic moves towards sustainability seem to have bolstered its share price. Furthermore, Honeywell's buyback strategy and the anticipated commencement of the Okinawa facility in 2029 reflect proactive steps in navigating current market uncertainties and future growth.

See the full analysis report here for a deeper understanding of Honeywell International.

Over the past five years, Honeywell International (NasdaqGS:HON) has achieved a total shareholder return of 75.86%. This performance occurred amid diverse market conditions and strategic endeavors. In 2021, Honeywell's focus on innovative technologies, like the 1-Megawatt generator for hybrid-electric aircraft, underpinned its growth initiatives, alongside a $476 million contract to supply T55 engines for the U.S. Army. Additionally, the February 2021 announcement of a $10 billion share buyback program highlighted commitments to shareholder value.

Further bolstering financial performance, Honeywell expanded into cybersecurity via a reseller agreement in early 2025, indicating a proactive approach toward enhanced technological integration. The announcement to separate its Automation and Aerospace Technologies businesses by 2026, supported by Elliott Investment Management, suggests a forward-looking approach to value creation. Despite facing challenges, such as underperforming against the US Industrials industry in the past year, Honeywell's strategic adaptations in diverse sectors have influenced its robust long-term return.

- Unlock the insights behind Honeywell International's valuation and discover its true investment potential

- Analyze the downside risks for Honeywell International and understand their potential impact—click to learn more.

- Already own Honeywell International? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Honeywell International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Honeywell International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HON

Honeywell International

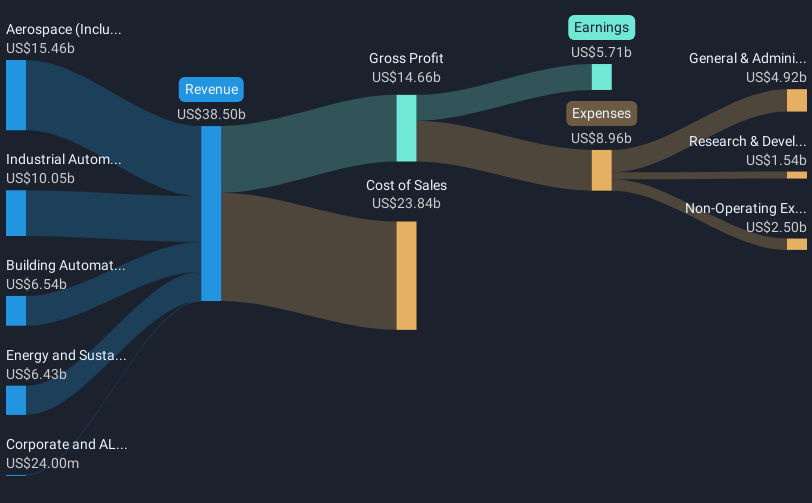

Engages in the aerospace technologies, industrial automation, building automation, and energy and sustainable solutions businesses in the United States, Europe, and internationally.

Established dividend payer with acceptable track record.