- United States

- /

- Industrials

- /

- NasdaqGS:HON

Honeywell International (NasdaqGS:HON) Expands Refrigerant Solutions With Arkema For Global Market

Reviewed by Simply Wall St

Honeywell International (NasdaqGS:HON) recently experienced a significant share price increase of 14% over the past month. This upswing coincided with the announcement of a commercial partnership with Arkema to introduce new lower-GWP refrigerants, reflecting a proactive approach to environmental regulations. Additionally, despite reporting slightly down net income, Honeywell's raised FY 2025 earnings guidance and continued commitment to shareholder returns via dividends and share buybacks may have further bolstered investor confidence. Market conditions, characterized by an overall rally and strong earnings reports, likely supported these developments and contributed to the company's upward trajectory.

We've identified 1 warning sign for Honeywell International that you should be aware of.

Honeywell International's recent share price increase coincides with initiatives that might influence the firm's long-term trajectory, such as its partnership with Arkema for environmentally friendly refrigerants. Over the past five years, the total shareholder return was 78.82%, including share price appreciation and dividends. This strong historical performance provides context for investors assessing Honeywell's growth amidst volatile market conditions.

Against the backdrop of sector challenges due to tariff pressures and global economic uncertainties, Honeywell's share price is currently near the consensus analyst price target of US$237.60, trading at a slight discount. Over the past year, the company's performance didn't quite match the US Industrials industry, which returned 17.7% during the period.

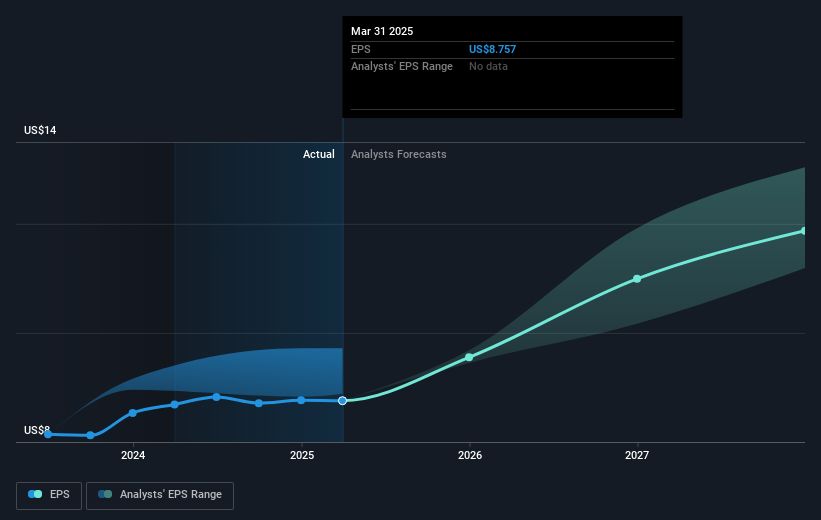

The ongoing efforts to split into three separate companies and engage in acquisitions could lead to revenue and earnings fluctuations. The market views these strategies as potential catalysts for renewed growth, but they also carry risks of initial costs impacting margins. Honeywell forecasts earnings of US$7.10 billion by 2028, with expected share repurchases potentially supporting earnings per share. However, the market's expectations seem higher than analyst predictions, suggesting potential price adjustments in the future. Investors should weigh these factors when considering Honeywell's current and future value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honeywell International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HON

Honeywell International

Engages in the aerospace technologies, industrial automation, building automation, and energy and sustainable solutions businesses in the United States, Europe, and internationally.

Established dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives