- United States

- /

- Machinery

- /

- NasdaqGM:HLMN

A Fresh Look at Hillman Solutions (HLMN) Valuation Following Profit Surge and Executive Stock Buys

Reviewed by Simply Wall St

If you’re watching Hillman Solutions (HLMN) after the latest earnings report, you’re probably wondering what the flurry of executive activity and financial gains could mean for its next move. The company recently posted a threefold jump in earnings per share, increasing from just $0.03 to $0.11 over the past year—a level of profitability that’s hard to ignore. In addition, the CFO personally bought nearly $1 million of stock, and the CEO’s pay remains modest compared to peers. For many investors, these actions aren’t just numbers. They are signals of real, down-to-earth confidence from inside the boardroom.

All this has come as the stock’s performance has veered between sharp gains and moderate setbacks. Short-term price dips over the past week and month hint at a market still digesting the news, but a dramatic 45% move higher in the past three months stands out against a more pedestrian long-term record. Over the past year, HLMN has slipped about 4%, yet it is still up 23% when you widen the scope to three years. With momentum building recently, Hillman could be attracting new attention as both earnings growth and insider optimism get noticed by the market.

So after this recent profitability surge and executive vote of confidence, does Hillman Solutions have room left to run, or is the market already pricing in these positive changes?

Most Popular Narrative: 21.1% Undervalued

According to the most widely used analyst narrative, Hillman Solutions is considered notably undervalued compared to its calculated fair value. This view is strongly rooted in robust future expectations around revenue, profit margins, and market positioning.

Hillman's expansion in omni-channel retailing and e-commerce integration, along with improvements in direct-to-store delivery capabilities and proprietary digital inventory management, positions the company to capture a wider addressable market and increase efficiency. These factors are expected to positively impact both revenue and margins.

Want to know what is fueling expectations beyond today's price? Analysts have built their narrative on bold growth projections you won’t want to miss. The reason behind this undervaluation could be projected improvements in sales, profitability, and an aggressive future earnings target. What raw numbers make this company a potential standout in its sector? Unpack the full narrative to discover the surprising figures that push Hillman's fair value far above current levels.

Result: Fair Value of $12.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing margin pressures from heavy reliance on major retail partners and high debt loads could limit profitability. This may challenge the analysts' bullish view.

Find out about the key risks to this Hillman Solutions narrative.Another View: The Market's Price Tag

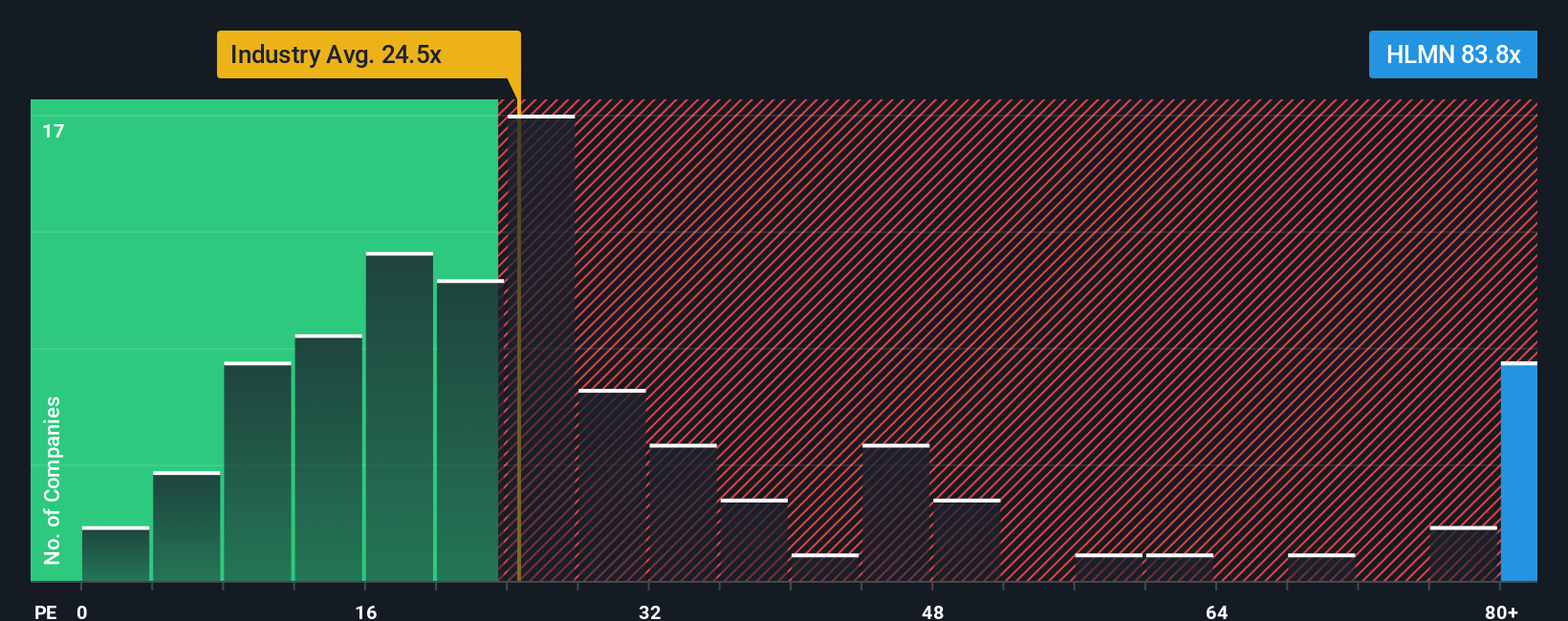

Looking at Hillman Solutions from a different angle, the market's valuation based on earnings is significantly higher than what is typical in its industry. This suggests shares may be priced for perfection. Is the optimism justified, or is there risk being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Hillman Solutions to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Hillman Solutions Narrative

If you believe there’s another side to the story or want to analyze Hillman Solutions on your own terms, you can easily build your own perspective in just a few minutes. Do it your way.

A great starting point for your Hillman Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter investing by using Simply Wall Street’s powerful tools to uncover standout opportunities you might have missed. Here are three paths you shouldn’t overlook:

- Uncover hidden opportunities in the markets when you track undervalued stocks based on cash flows using our undervalued stocks based on cash flows. This approach is perfect for value seekers aiming to spot tomorrow’s winners today.

- Find long-term income potential and reliable payouts as you search for dividend stocks with yields over 3% with our dividend stocks with yields > 3%. This can make it easier to strengthen your portfolio returns.

- Step ahead of the curve by zeroing in on healthcare companies at the forefront of artificial intelligence breakthroughs through our healthcare AI stocks. This is ideal for investors following transformative trends in the medical sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hillman Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HLMN

Hillman Solutions

Provides hardware-related products and related merchandising services in the United States, Canada, Mexico, Latin America, and the Caribbean.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives