- United States

- /

- Tech Hardware

- /

- OTCPK:DROR

3 US Penny Stocks With Market Caps Under $50M To Watch

Reviewed by Simply Wall St

As the U.S. stock market shows signs of rebounding, with futures pointing to a higher open for major indices like the S&P 500 and Nasdaq, investors are keenly observing economic indicators that could influence future trends. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area of investment despite their somewhat outdated moniker. These stocks can offer surprising value and potential growth when backed by strong financials, making them appealing options for those looking beyond the usual large-cap names.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.78651 | $5.71M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.20 | $547.49M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.60 | $2.07B | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.7889 | $3.24M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.61 | $51.81M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.70 | $113.74M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.56M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

Click here to see the full list of 763 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Greenland Technologies Holding (NasdaqCM:GTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Greenland Technologies Holding Corporation designs, develops, manufactures, and sells components and products for material handling industries worldwide with a market cap of $31.40 million.

Operations: The company generates revenue of $90.36 million from the manufacturing and selling of various transmission boxes.

Market Cap: $31.4M

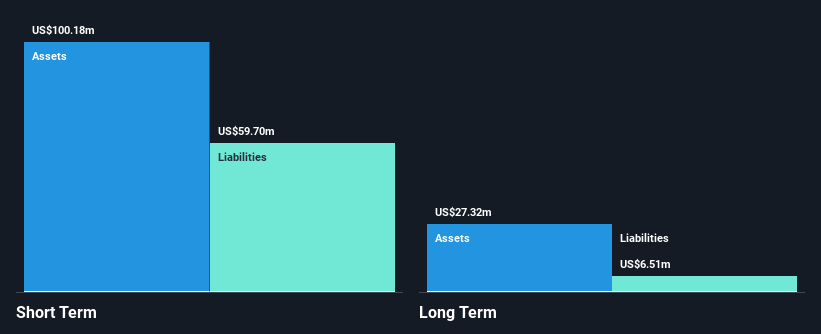

Greenland Technologies Holding Corporation, with a market cap of US$31.40 million, reported second-quarter sales of US$23.02 million and net income of US$4.65 million, showing improved profitability compared to the previous year. Despite its unprofitability over the past five years and negative return on equity, the company benefits from strong short-term asset coverage over liabilities and a significant reduction in debt-to-equity ratio from 61.5% to 0.2%. Its seasoned management team supports stability amidst high share price volatility and shareholder dilution concerns, while earnings are forecasted to grow significantly at 111.54% annually according to analyst estimates.

- Unlock comprehensive insights into our analysis of Greenland Technologies Holding stock in this financial health report.

- Understand Greenland Technologies Holding's earnings outlook by examining our growth report.

IZEA Worldwide (NasdaqCM:IZEA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IZEA Worldwide, Inc. provides software and professional services to connect brands with content creators across North America, the Asia Pacific, and internationally, with a market cap of $45.73 million.

Operations: The company generates revenue through two main segments: SaaS Services, contributing $0.67 million, and Managed Services, which accounts for $32.17 million.

Market Cap: $45.73M

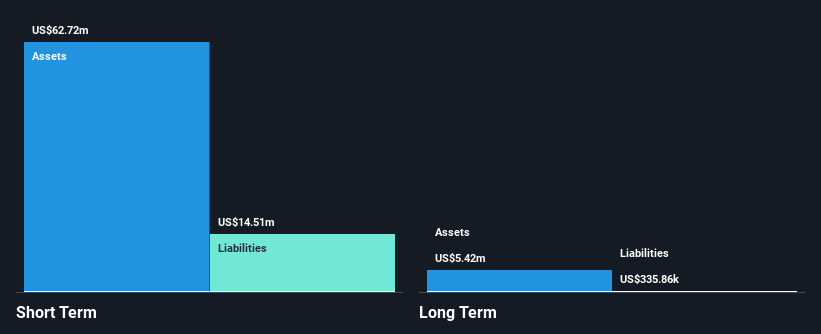

IZEA Worldwide, Inc. faces challenges as an unprofitable entity with a negative return on equity of -14.76%, yet it shows potential in its strategic initiatives and financial stability. The company has more cash than debt, with short-term assets of US$62.3 million covering both short and long-term liabilities comfortably. Recent leadership changes, including the appointment of Patrick Venetucci as CEO and Kerry Griffin as Chief Talent Officer, signal a focus on growth and innovation. Additionally, the introduction of IZZY AI aims to enhance efficiency in influencer marketing campaigns while a share repurchase program reflects confidence in future prospects.

- Click here and access our complete financial health analysis report to understand the dynamics of IZEA Worldwide.

- Examine IZEA Worldwide's earnings growth report to understand how analysts expect it to perform.

Dror Ortho-Design (OTCPK:DROR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dror Ortho-Design, Inc. focuses on the research and development of an orthodontic alignment platform and has a market capitalization of $4.21 million.

Operations: Dror Ortho-Design, Inc. does not report any specific revenue segments.

Market Cap: $4.21M

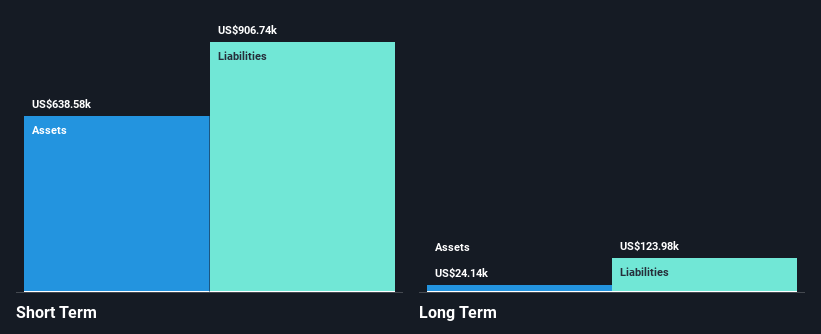

Dror Ortho-Design, Inc., with a market cap of US$4.21 million, is pre-revenue and faces financial challenges as it remains unprofitable with increasing losses over the past five years. The company's cash runway is less than a year if current cash flow trends persist, though it benefits from being debt-free. Despite high volatility and negative return on equity (-339.61%), Dror's short-term assets (US$1.9 million) exceed its liabilities, providing some financial buffer. Recent participation in investor conferences indicates efforts to engage potential investors amid ongoing operational hurdles highlighted by rising net losses reported in recent earnings announcements.

- Navigate through the intricacies of Dror Ortho-Design with our comprehensive balance sheet health report here.

- Understand Dror Ortho-Design's track record by examining our performance history report.

Turning Ideas Into Actions

- Gain an insight into the universe of 763 US Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dror Ortho-Design, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DROR

Dror Ortho-Design

Engages in the research and development of an orthodontic alignment platform.

Medium-low with worrying balance sheet.