- United States

- /

- Electrical

- /

- NasdaqCM:FTCI

Revenue Downgrade: Here's What Analysts Forecast For FTC Solar, Inc. (NASDAQ:FTCI)

The latest analyst coverage could presage a bad day for FTC Solar, Inc. (NASDAQ:FTCI), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

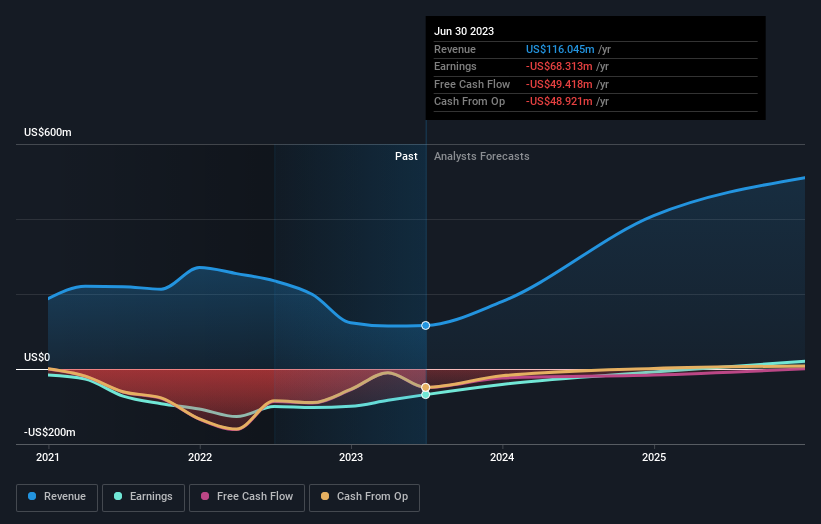

Following the downgrade, the most recent consensus for FTC Solar from its eight analysts is for revenues of US$357m in 2024 which, if met, would be a major 208% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$419m in 2024. It looks like forecasts have become a fair bit less optimistic on FTC Solar, given the measurable cut to revenue estimates.

View our latest analysis for FTC Solar

Notably, the analysts have cut their price target 35% to US$2.73, suggesting concerns around FTC Solar's valuation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing stands out from these estimates, which is that FTC Solar is forecast to grow faster in the future than it has in the past, with revenues expected to display 146% annualised growth until the end of 2024. If achieved, this would be a much better result than the 51% annual decline over the past year. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 8.4% annually. So it looks like FTC Solar is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for FTC Solar next year. Analysts also expect revenues to grow faster than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Overall, given the drastic downgrade to next year's forecasts, we'd be feeling a little more wary of FTC Solar going forwards.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with FTC Solar's financials, such as recent substantial insider selling. For more information, you can click here to discover this and the 3 other flags we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you're looking to trade FTC Solar, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FTCI

FTC Solar

Engages in the provision of solar tracker systems, software, and engineering services in the United States, Asia, Europe, the Middle East, North Africa, South Africa, and Australia.

High growth potential with excellent balance sheet.