- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

Why Investors Shouldn't Be Surprised By FTAI Aviation Ltd.'s (NASDAQ:FTAI) 53% Share Price Surge

FTAI Aviation Ltd. (NASDAQ:FTAI) shareholders are no doubt pleased to see that the share price has bounced 53% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 151% in the last year.

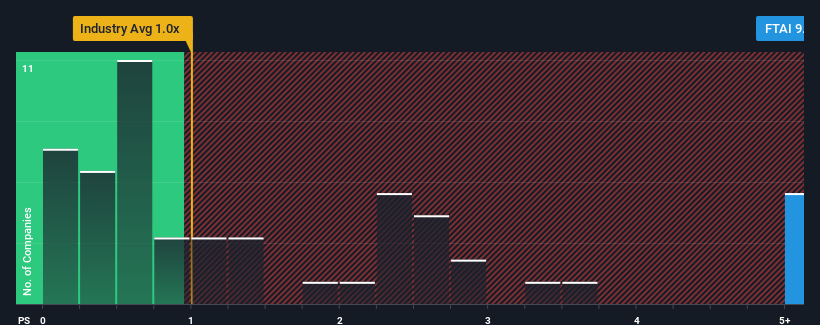

Following the firm bounce in price, given around half the companies in the United States' Trade Distributors industry have price-to-sales ratios (or "P/S") below 1x, you may consider FTAI Aviation as a stock to avoid entirely with its 9.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for FTAI Aviation

How Has FTAI Aviation Performed Recently?

FTAI Aviation certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think FTAI Aviation's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like FTAI Aviation's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 22% each year during the coming three years according to the eleven analysts following the company. With the industry only predicted to deliver 5.9% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why FTAI Aviation's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in FTAI Aviation have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that FTAI Aviation maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Trade Distributors industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for FTAI Aviation that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives