- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

FTAI Aviation (FTAI): Assessing Valuation Following Long-Term Engine Swap Agreement With Finnair

Reviewed by Kshitija Bhandaru

FTAI Aviation (NasdaqGS:FTAI) just signed a multi-year Perpetual Power Agreement with Finnair. The deal gives Finnair the flexibility to swap engines instead of sending them out for major repairs. This aims to boost reliability and control maintenance costs.

See our latest analysis for FTAI Aviation.

FTAI Aviation’s momentum has been hard to ignore lately. The new Finnair agreement follows a standout run, with the share price up 48% over the past 90 days and total shareholder return topping 1,080% over three years. The market’s renewed optimism signals that long-term growth drivers are starting to get more recognition, even as the latest deal further highlights the company’s operational strengths.

If seeing FTAI lock in another industry partnership sparks your curiosity, now is a great time to broaden your search and discover See the full list for free.

With the stock flying high after recent gains, the key question for investors is whether FTAI Aviation’s future growth is already reflected in the price, or if there is still room for upside from here.

Most Popular Narrative: 10.7% Undervalued

With FTAI Aviation's narrative fair value set at $191 and the last close at $170.56, the stock is seen as trading below what analysts believe it could be worth. This prompts a closer look at what is driving optimism from those following the company closely.

The accelerated adoption of FTAI's Maintenance, Repair and Exchange (MRE) programs by both large and small airlines, as a cost-effective and flexible alternative to traditional shop visits, positions the company to capture additional market share as operators increasingly outsource engine management. This will drive both higher utilization rates and improved net margins as volumes scale.

Curious what bold assumptions fuel this eye-catching valuation? The narrative points to compounding gains where profit growth and margin expansion underpin everything, but the keys remain hidden. Uncover the specific projections and see how much conviction sits behind those numbers.

Result: Fair Value of $191 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should watch for risks such as overreliance on legacy engines or setbacks scaling new partnership models, as these could threaten FTAI’s growth story.

Find out about the key risks to this FTAI Aviation narrative.

Another View: High Growth, High Price?

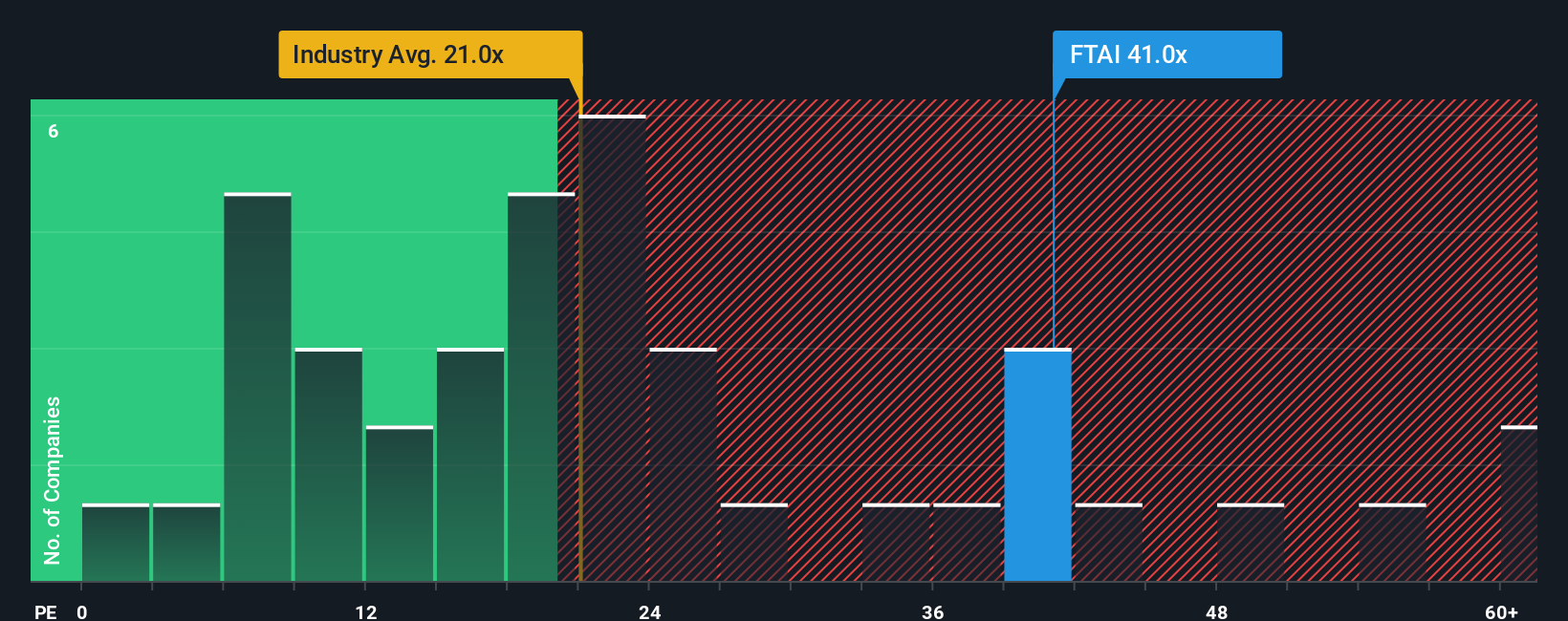

Turning to one key metric, FTAI Aviation is trading at a price-to-earnings ratio of 42x. That is far higher than both its closest peers at 17.9x and the industry average of 21.8x. The fair ratio based on market regression sits at 68.7x. This suggests the stock could have further to run, but also flags valuation risk if expectations change. Is the market ahead of itself, or is this high price justified by its growth potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FTAI Aviation Narrative

If you have a different take or want to dive deeper into the numbers, you can piece together your own narrative in just a few minutes. Do it your way

A great starting point for your FTAI Aviation research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t settle for just one great idea when there are so many possibilities waiting. Start growing your watchlist with a few of the market's most intriguing trends:

- Boost your portfolio’s yield by targeting income with these 18 dividend stocks with yields > 3%. Capture solid returns from companies paying higher dividends than the average stock.

- Fuel growth potential with these 25 AI penny stocks to access companies at the forefront of artificial intelligence and automation booms.

- Tap into tomorrow’s technology with these 26 quantum computing stocks and stay ahead as quantum computing redefines what’s possible for investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives