- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:FLY

Firefly Aerospace (FLY) Faces Scrutiny After Alpha Rocket Test Failure: What Does It Mean for Reliability?

Reviewed by Sasha Jovanovic

- Firefly Aerospace experienced a major setback in September when the first stage of its Alpha Flight 7 rocket exploded during a pre-flight test, prompting investigations into reliability and legal compliance amid a competitive commercial launch sector.

- This incident came just as Firefly reported increased net losses and heightened scrutiny from law firms following its initial public offering earlier this year.

- We'll examine how the recent Alpha rocket test failure and reliability questions weigh on Firefly Aerospace's evolving investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Firefly Aerospace's Investment Narrative?

For anyone considering Firefly Aerospace, the central belief is that the company will secure a meaningful foothold in the commercial space sector, converting prestigious NASA contracts and innovative lunar achievements into consistent revenue. However, the recent Alpha Flight 7 explosion reframes the company’s immediate risk profile, previously centered on achieving projected revenue and delivering on a large contract backlog, short-term attention now shifts to reliability concerns. This setback, marked by a 23.93% price decline in a week and fresh legal investigations, introduces new uncertainty to near-term catalysts like upcoming launches and milestone payments. While Firefly’s ambitious growth projections and contract wins remain significant, the material impact of this failure cannot be overlooked; it has the potential to delay customer contracts or even affect Firefly’s competitive positioning in a crowded launch market. Investors should watch closely as management details next steps and addresses these technical and reputational challenges.

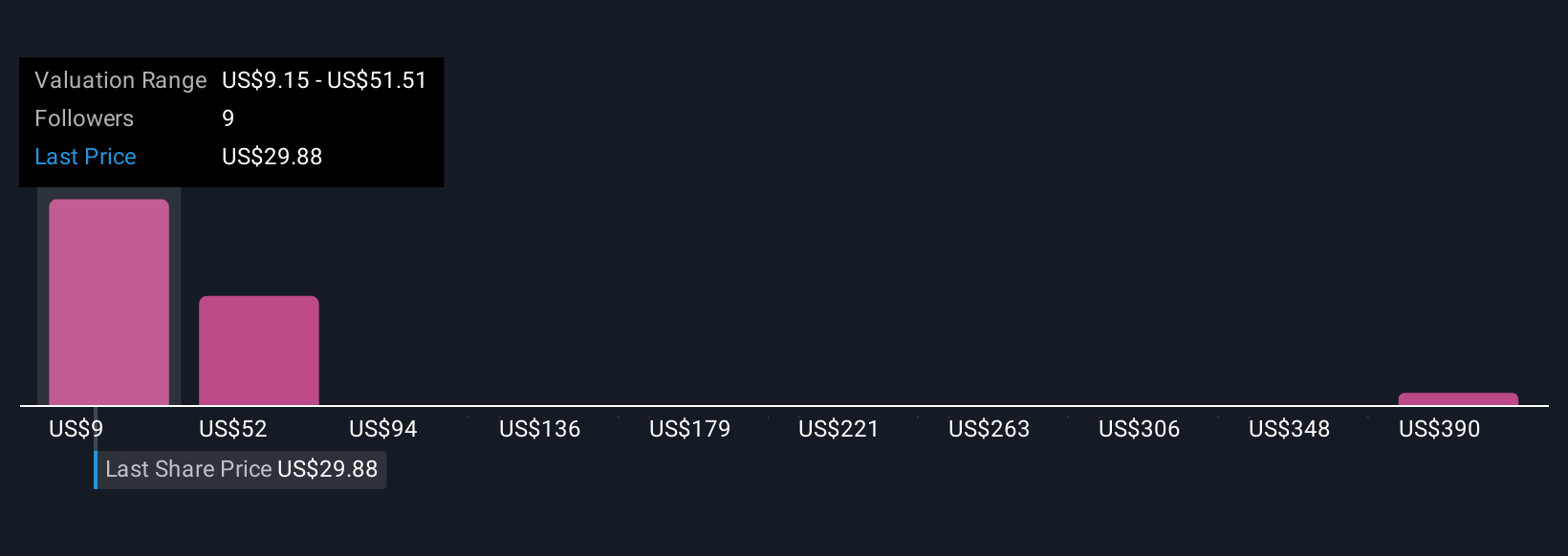

But, regulatory concerns and financial volatility have become even more important to monitor. Despite retreating, Firefly Aerospace's shares might still be trading 26% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 6 other fair value estimates on Firefly Aerospace - why the stock might be worth over 2x more than the current price!

Build Your Own Firefly Aerospace Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Firefly Aerospace research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Firefly Aerospace research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Firefly Aerospace's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FLY

Firefly Aerospace

Operates as a space and defense technology company and provides mission solutions for national security, government, and commercial customers.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives