- United States

- /

- Electrical

- /

- NasdaqGM:FCEL

FuelCell Energy, Inc.'s (NASDAQ:FCEL) Shareholders Might Be Looking For Exit

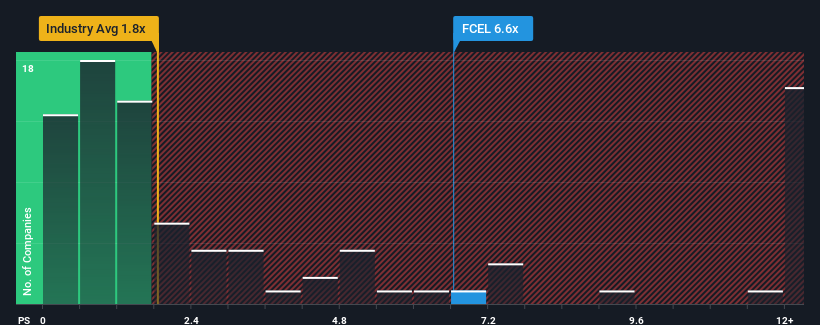

FuelCell Energy, Inc.'s (NASDAQ:FCEL) price-to-sales (or "P/S") ratio of 6.6x may look like a poor investment opportunity when you consider close to half the companies in the Electrical industry in the United States have P/S ratios below 1.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for FuelCell Energy

How Has FuelCell Energy Performed Recently?

With revenue growth that's superior to most other companies of late, FuelCell Energy has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on FuelCell Energy.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like FuelCell Energy's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 57% last year. The strong recent performance means it was also able to grow revenue by 129% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 33% per year as estimated by the ten analysts watching the company. With the industry predicted to deliver 33% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's curious that FuelCell Energy's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From FuelCell Energy's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given FuelCell Energy's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You need to take note of risks, for example - FuelCell Energy has 3 warning signs (and 1 which is concerning) we think you should know about.

If you're unsure about the strength of FuelCell Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FCEL

FuelCell Energy

Manufactures and sells stationary fuel cell and electrolysis platforms that decarbonize power and produce hydrogen.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives