- United States

- /

- Electrical

- /

- NasdaqGM:FCEL

FuelCell Energy (FCEL): Assessing Valuation as AI Sector Partnerships Ignite Investor Attention

Reviewed by Kshitija Bhandaru

FuelCell Energy (FCEL) has caught investors’ attention following Bloom Energy’s new partnership with Brookfield on AI infrastructure, which has drawn a spotlight on the entire fuel cell sector. Anticipation is also building ahead of FuelCell’s upcoming virtual investor event.

See our latest analysis for FuelCell Energy.

After a stretch of muted trading, FuelCell Energy’s share price has rocketed up 62.5% over the past month, fueled by sector-wide excitement about AI infrastructure and investor focus ahead of its upcoming virtual event. Despite this recent surge and a 1-year total shareholder return of 5.8%, longer-term returns remain deeply negative. This reflects ongoing uncertainty about the company's path to sustained growth.

If the fuel cell story has you thinking bigger, this could be your chance to discover fast growing stocks with high insider ownership

With shares surging recently, the key question now is whether FuelCell Energy is actually undervalued, or if the market has already priced in the company's future growth prospects. Is there a real buying opportunity here?Most Popular Narrative: 45% Overvalued

Despite FuelCell Energy’s last close of $10.71, the most widely followed narrative sets fair value much lower, flagging a significant disconnect between market price and fundamentals. This has made valuation a focal point for investors tracking the surging fuel cell space.

The partnership with Diversified Energy to deliver up to 360 megawatts to data centers in Virginia, West Virginia, and Kentucky is anticipated to drive significant revenue growth as it positions FuelCell Energy at the forefront of powering AI and high-performance computing sectors.

Curious what bold projections justify that fair value gap? The core narrative relies on ambitious growth plans, margin expansion, and key sector milestones. Which financial assumptions tip the scales? See the full story behind the most debated valuation in clean tech.

Result: Fair Value of $7.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses and reliance on successful new technology commercialization could undermine the optimistic outlook that many investors are counting on.

Find out about the key risks to this FuelCell Energy narrative.

Another View: Value Versus Peers and Industry

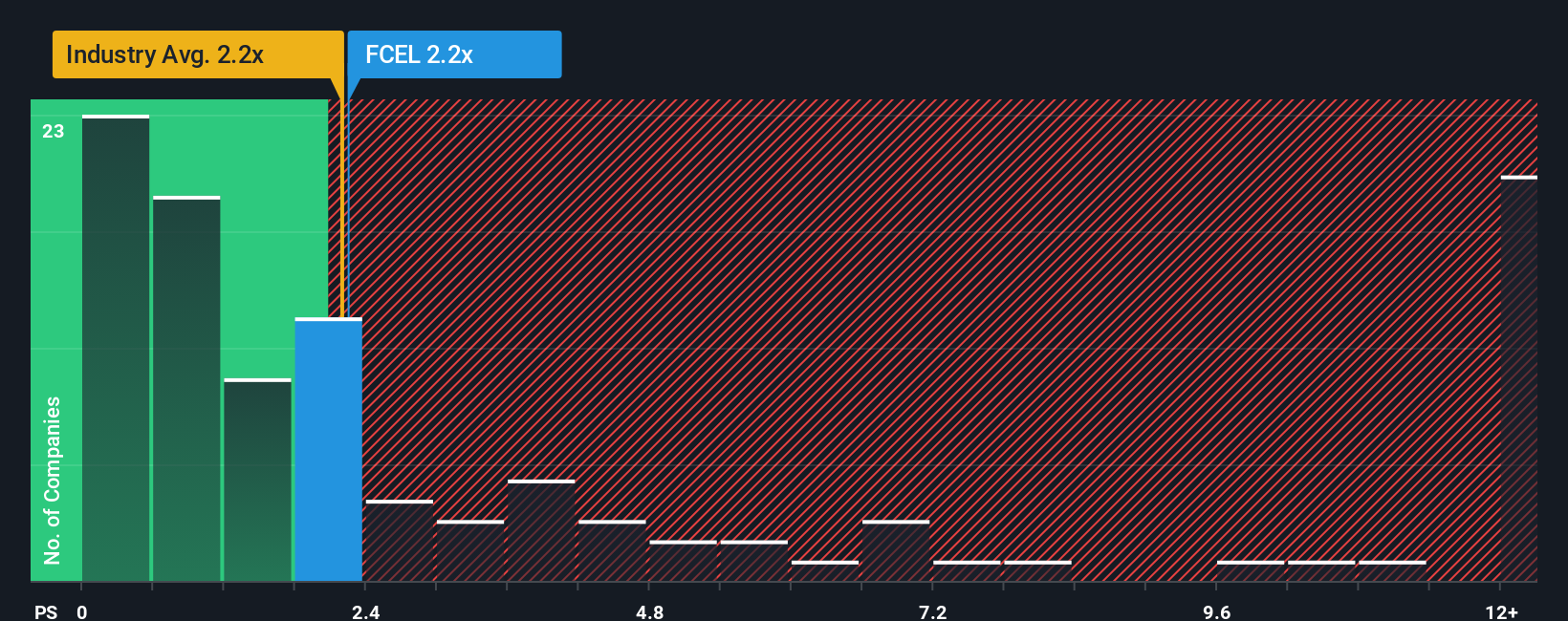

Taking a broader market perspective, FuelCell Energy’s price-to-sales ratio stands at 2.3x, just below the US Electrical industry average of 2.4x and far below the peer group average of 5.9x. Despite this, the fair ratio is estimated to be 0.5x, which suggests that the current valuation could be stretched if market expectations change. Is this a sign that investors are overpaying for future growth, or is the discount versus peers an underappreciated opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FuelCell Energy Narrative

If you think the story could unfold differently or want to dig into the numbers yourself, crafting your own perspective is quick and easy. Just Do it your way.

A great starting point for your FuelCell Energy research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss out on the chance to expand your portfolio. Simply Wall Street’s powerful screeners surface new market opportunities you won’t find anywhere else.

- Scoop up potential bargains by checking out these 875 undervalued stocks based on cash flows based on solid cash flow metrics and strong fundamentals.

- Capitalize on the AI boom by uncovering fresh momentum in these 24 AI penny stocks leading today’s innovation surge.

- Tap into reliable income streams with these 18 dividend stocks with yields > 3% offering attractive yields above 3% for consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FCEL

FuelCell Energy

Manufactures and sells stationary fuel cell and electrolysis platforms that decarbonize power and produce hydrogen.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives