- United States

- /

- Electrical

- /

- NasdaqGM:FCEL

Can FuelCell Energy's (FCEL) Rising Revenue Offset Its Mounting Losses?

Reviewed by Simply Wall St

- FuelCell Energy, Inc. recently reported third quarter 2025 financial results, showing revenue of US$46.74 million, an increase from US$23.7 million a year ago, but the net loss also widened to US$91.66 million from US$32.66 million.

- While the company nearly doubled its revenue over the prior year, its losses grew very large, raising ongoing questions about its path to profitability.

- We'll now examine how the sharp increase in revenue but widening losses may impact FuelCell Energy's investment outlook and future risks.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

FuelCell Energy Investment Narrative Recap

For someone to be a shareholder in FuelCell Energy right now, they likely have to believe in the company’s vision to become a leading clean energy provider despite ongoing losses. The latest quarterly results, revealing surging revenue but a much wider net loss, do not materially change the most important short term catalyst: securing revenue from key partnerships and contracts. However, the continued rise in losses amplifies the company’s biggest risk, its ability to achieve sustainable profitability.

One announcement relevant to this discussion is FuelCell Energy’s recent supply agreement with CGN-Yulchon Generation in South Korea. This highlights the company's ongoing expansion in Asia, which is directly tied to its efforts to drive revenue growth through international partnerships, an essential element for catalyzing progress in the next year.

But while these international growth efforts appear promising, investors should be aware that continuing high losses...

Read the full narrative on FuelCell Energy (it's free!)

FuelCell Energy's narrative projects $310.5 million revenue and $31.6 million earnings by 2028. This requires 33.9% yearly revenue growth and a $175.3 million increase in earnings from -$143.7 million.

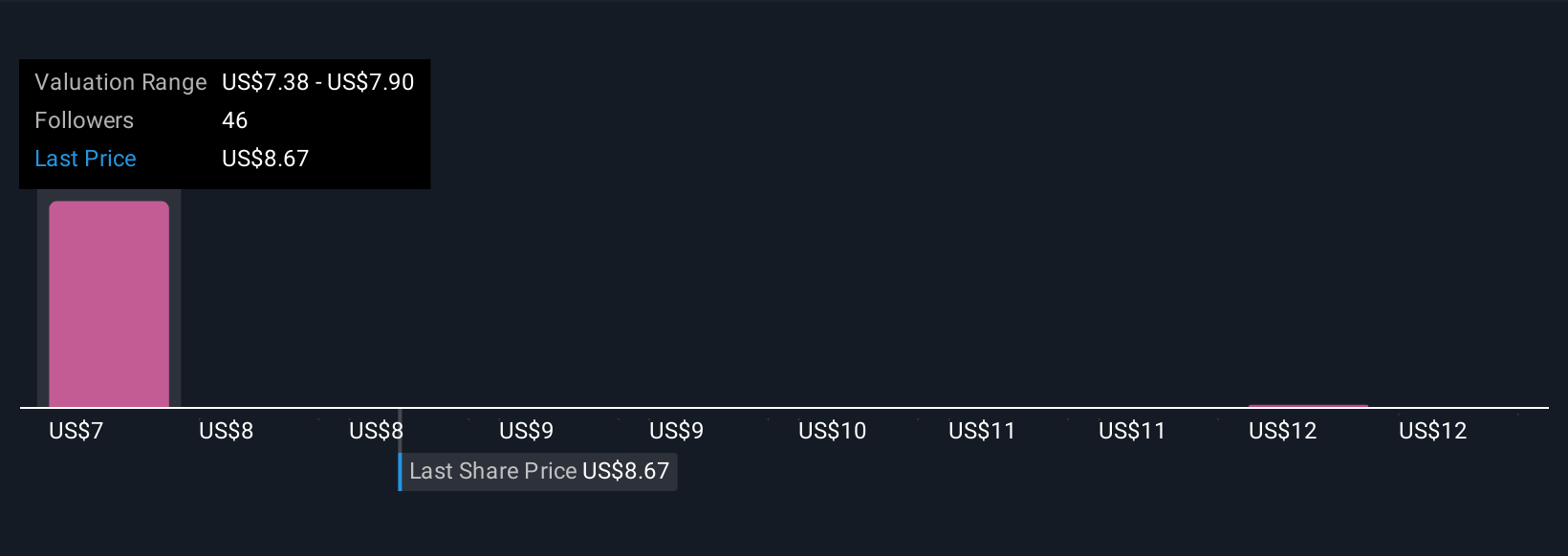

Uncover how FuelCell Energy's forecasts yield a $7.38 fair value, a 23% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community fall between US$7.38 and US$12.58 per share. Many community participants have focused on revenue expansion as a key catalyst, yet persistently rising losses could weigh on any future improvements, so be sure to compare several opinions.

Explore 4 other fair value estimates on FuelCell Energy - why the stock might be worth 23% less than the current price!

Build Your Own FuelCell Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FuelCell Energy research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free FuelCell Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FuelCell Energy's overall financial health at a glance.

No Opportunity In FuelCell Energy?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FCEL

FuelCell Energy

Manufactures and sells stationary fuel cell and electrolysis platforms that decarbonize power and produce hydrogen.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives