- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

Do Fastenal’s (FAST) Contract Wins Reveal a Competitive Edge or Mask Margin Pressures?

Reviewed by Sasha Jovanovic

- Fastenal Company recently reported third quarter earnings, with sales rising to US$2,133.3 million and net income reaching US$335.5 million, while its board affirmed a US$0.22 per share dividend to be paid in November.

- This performance was highlighted by substantial gains in customer contract signings and strong growth in the core fastener product line, despite ongoing pricing and margin pressures.

- We’ll explore how accelerated customer contract growth and segment leadership in fasteners may influence Fastenal’s investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Fastenal Investment Narrative Recap

To be a Fastenal shareholder, you likely believe in the company's focus on expanding managed inventory solutions and deepening customer relationships, especially through its fastener segment leadership. The latest earnings show strong sales and net income growth, but ongoing pricing pressures remain the key short-term risk. The recent update confirming no share repurchases in the last quarter has little impact on these near-term catalysts or risks, pricing actions and trade-related cost headwinds are still front and center.

Among Fastenal’s recent announcements, the Q3 results stand out: sales rose 11.7% year over year, driven by market share gains and double-digit daily sales rate growth in core fasteners. This momentum reinforces Fastenal’s focus on technology-driven supply chain partnerships and broadens the path for enhanced customer retention, both of which are significant for sustaining revenue growth amid industry uncertainty.

In contrast, investors should be aware of margin pressures stemming from tariffs and shifting pricing power, especially as...

Read the full narrative on Fastenal (it's free!)

Fastenal's outlook projects $9.9 billion in revenue and $1.6 billion in earnings by 2028. This requires an annual revenue growth rate of 8.5% and a $0.4 billion earnings increase from the current $1.2 billion in earnings.

Uncover how Fastenal's forecasts yield a $44.35 fair value, a 4% upside to its current price.

Exploring Other Perspectives

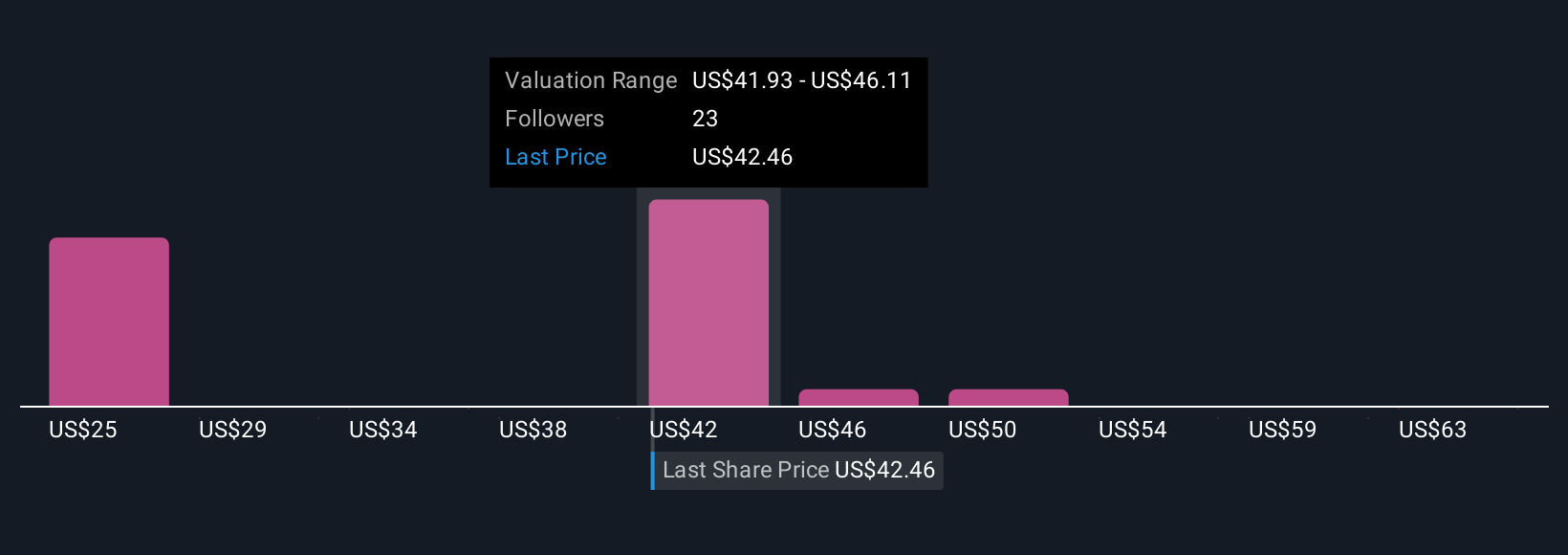

Ten community members on Simply Wall St have set fair value estimates for Fastenal ranging from US$25.31 to US$67. While many see expanding digital and managed inventory initiatives boosting growth, persistent margin pressure remains a focal point for risk and future performance. Check out several viewpoints to get the full picture.

Explore 10 other fair value estimates on Fastenal - why the stock might be worth 41% less than the current price!

Build Your Own Fastenal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fastenal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fastenal's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives