- United States

- /

- Software

- /

- NYSEAM:EXOD

Unveiling Three Undiscovered Gems in United States Stocks

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has experienced a significant 22% increase over the last year, with earnings expected to grow by 15% annually. In such a dynamic environment, identifying stocks that combine strong fundamentals with growth potential can be key to uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Energy Recovery (NasdaqGS:ERII)

Simply Wall St Value Rating: ★★★★★★

Overview: Energy Recovery, Inc. designs, manufactures, and sells energy efficiency technology solutions across various regions including the Americas, Middle East, Africa, Asia, and Europe with a market capitalization of $885.20 million.

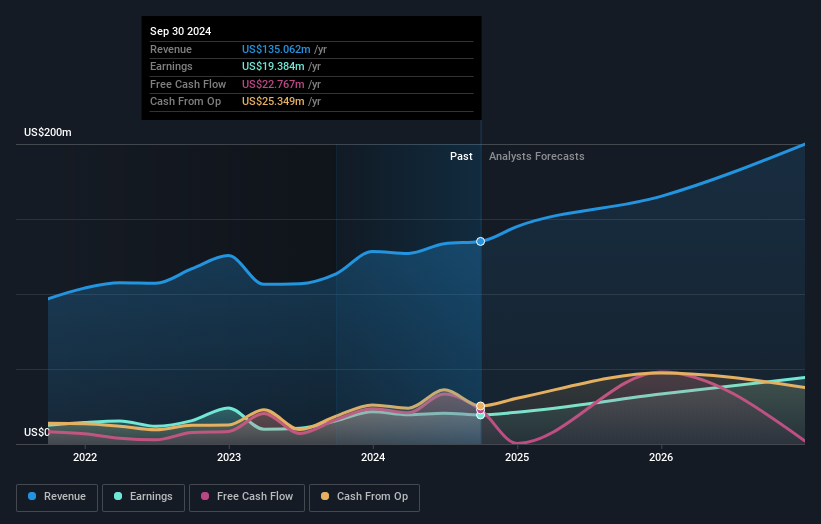

Operations: The company's primary revenue stream is derived from its Water segment, generating $134.45 million, while Emerging Technologies contribute $0.61 million.

Energy Recovery is making strides with its expansion into the wastewater and CO2 sectors, aiming to tap into energy-efficient innovations. The firm's focus on large desalination projects in regions like the Middle East, which contributes over 70% of revenue, highlights both growth potential and geographic risk. With a projected annual earnings growth of 34.68%, Energy Recovery's profitability seems poised for improvement. Recent announcements include a $50 million share repurchase program and revenue guidance suggesting moderate growth due to project delays. Despite these prospects, investors should weigh the risks associated with heavy regional reliance and market volatility.

Associated Capital Group (NYSE:AC)

Simply Wall St Value Rating: ★★★★★★

Overview: Associated Capital Group, Inc. operates in the United States offering investment advisory services and has a market capitalization of approximately $830.86 million.

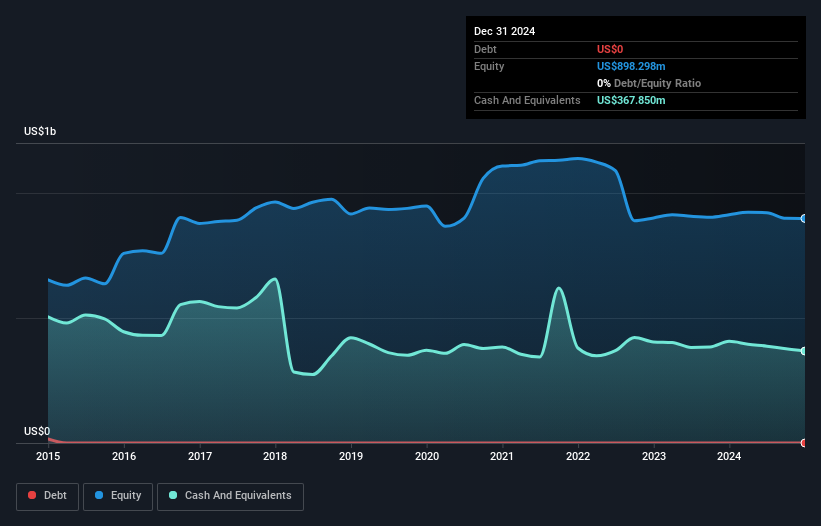

Operations: The company generates revenue primarily through its investment advisory and asset management segment, which reported $13.18 million.

Associated Capital Group, a nimble player in the financial sector, showcases a debt-free balance sheet and an impressive earnings growth of 18.4% over the past year, outpacing the industry average of 17.2%. Its price-to-earnings ratio stands at 18.7x, below the industry norm of 22.1x, suggesting potential value for investors. However, recent results reveal a net income dip to US$4.28 million in Q4 from US$16.34 million last year due to significant one-off gains impacting previous figures by US$42.8 million. Notably, from October to December 2024, it repurchased shares worth US$2.3 million as part of its ongoing buyback program initiated in 2015.

- Dive into the specifics of Associated Capital Group here with our thorough health report.

Gain insights into Associated Capital Group's past trends and performance with our Past report.

Exodus Movement (NYSEAM:EXOD)

Simply Wall St Value Rating: ★★★★★★

Overview: Exodus Movement, Inc. is a financial technology company focusing on the blockchain and digital asset industry in the United States with a market cap of approximately $1.41 billion.

Operations: Exodus Movement generates revenue primarily from its data processing segment, amounting to $89.94 million. The company's market cap stands at approximately $1.41 billion.

Exodus Movement, a nimble player in the crypto space, recently unveiled a new swap experience that enhances user flexibility and reduces fees to as low as 0.5%. This innovation aligns with their strategic move to the NYSE American exchange following delisting from OTC Equity. Their price-to-earnings ratio of 25x is notably below the software industry average of 42.1x, indicating potential value. Despite recent share volatility and being free cash flow negative, Exodus has no debt and projects earnings growth at 25.87% annually, showcasing its ambition in redefining digital asset management for everyday users.

- Click to explore a detailed breakdown of our findings in Exodus Movement's health report.

Examine Exodus Movement's past performance report to understand how it has performed in the past.

Taking Advantage

- Delve into our full catalog of 278 US Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exodus Movement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:EXOD

Exodus Movement

Operates as a financial technology for blockchain and digital asset industry in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives