- United States

- /

- Electrical

- /

- NasdaqCM:DFLI

Will Nevada’s Lithium Hub Funding Push Dragonfly Energy (DFLI) Closer to Supply Chain Leadership?

Reviewed by Sasha Jovanovic

- Dragonfly Energy Holdings announced it was selected by Nevada Tech Hub for approximately US$300,000 in funding to support lithium battery manufacturing capacity and workforce development, with the contract currently being finalized.

- This recognition positions Dragonfly Energy at the center of Nevada's efforts to expand its "Lithium Loop" supply chain and grow high-value clean energy jobs in the region.

- We'll explore how this award and Nevada collaboration may deepen Dragonfly Energy's integration into the regional lithium battery ecosystem.

Find companies with promising cash flow potential yet trading below their fair value.

Dragonfly Energy Holdings Investment Narrative Recap

To believe in Dragonfly Energy Holdings as a shareholder, the big picture centers on its ability to capture growth from surging demand for advanced lithium battery solutions in the clean energy and transportation sectors, while navigating ongoing losses and market volatility. The recent US$300,000 Nevada Tech Hub award enhances Dragonfly's local manufacturing and workforce development but does not materially shift the company's most pressing short-term catalyst, expanding OEM partnerships, or mitigate the biggest risk of exposure to cyclical demand in RV and trucking markets. A recent announcement with Airstream Inc. stands out, as it positions Dragonfly’s batteries across more RV models and expands integration with OEM partners. This directly relates to the key revenue growth catalyst of recurring OEM orders and offers more visibility into market adoption of Dragonfly’s solutions, which remains crucial for reaching scale as the company works toward profitability. Yet, in contrast, investors should remain alert to risks from economic slowdowns that could quickly pressure demand and lead to...

Read the full narrative on Dragonfly Energy Holdings (it's free!)

Dragonfly Energy Holdings' outlook anticipates $142.6 million in revenue and $14.5 million in earnings by 2028. This scenario implies a 37.8% annual revenue growth rate and an increase in earnings of $45 million from the current earnings of -$30.5 million.

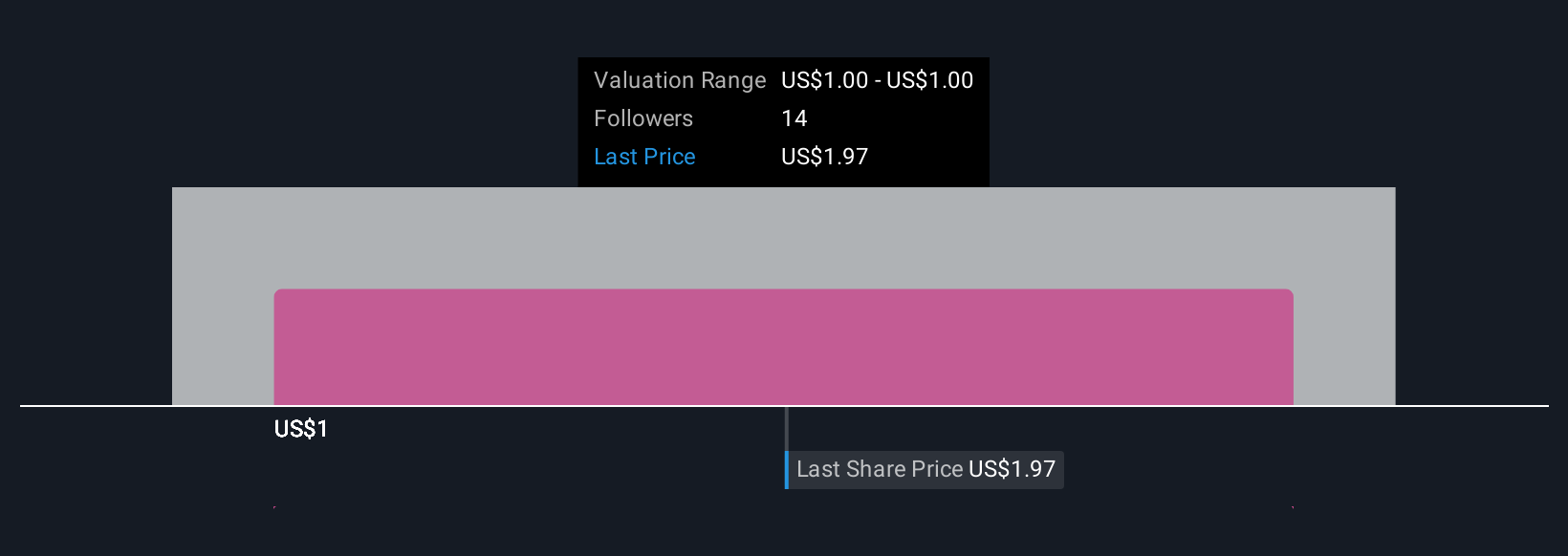

Uncover how Dragonfly Energy Holdings' forecasts yield a $1.00 fair value, a 47% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community's single fair value estimate of US$1 highlights a unanimous view before the recent funding news. With market participants focused on expansion into OEM channels, your perspectives may differ, explore what others are seeing.

Explore another fair value estimate on Dragonfly Energy Holdings - why the stock might be worth as much as $1.00!

Build Your Own Dragonfly Energy Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dragonfly Energy Holdings research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Dragonfly Energy Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dragonfly Energy Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DFLI

Dragonfly Energy Holdings

Engages in the manufacturing and sale of deep cycle lithium-ion batteries for recreational vehicles, marine vessels, solar and off-grid residence industries, and industrial and energy storage markets.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives