- United States

- /

- Building

- /

- NasdaqGS:CSTE

Talkspace And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market grapples with significant volatility, highlighted by recent sharp declines in major indices due to tariff tensions, investors are increasingly looking for opportunities that may offer resilience and potential growth. Penny stocks, a term often associated with smaller or newer companies, continue to hold relevance as they can present unique investment opportunities at lower price points. When these stocks are backed by strong financials and sound fundamentals, they may provide an attractive balance of value and growth potential amidst broader market uncertainties.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.23 | $338.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.47 | $1.47B | ✅ 3 ⚠️ 3 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $2.6256 | $7.88M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.16 | $52.61M | ✅ 2 ⚠️ 3 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.46 | $73.57M | ✅ 5 ⚠️ 3 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.50 | $330.99M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.27 | $68.85M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.77 | $5.59M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $213.14M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.6734 | $60.57M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 784 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Talkspace (NasdaqCM:TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company in the United States that connects patients with licensed mental health providers and has a market cap of approximately $442.99 million.

Operations: The company generates revenue from its Pharmacy Services segment, which amounts to $187.59 million.

Market Cap: $442.99M

Talkspace, Inc. has shown significant progress in the penny stock realm by achieving profitability with a net income of US$1.15 million for 2024, compared to a loss the previous year. The company recently launched Talkcast, an AI-powered feature enhancing therapy sessions, which has received positive feedback from users and therapists alike. Furthermore, Talkspace's expansion into Medicare services in Arizona addresses critical mental health needs among seniors. Despite its low return on equity and modest management tenure of 2.5 years on average, the absence of debt positions it favorably for future growth opportunities and strategic acquisitions.

- Get an in-depth perspective on Talkspace's performance by reading our balance sheet health report here.

- Gain insights into Talkspace's outlook and expected performance with our report on the company's earnings estimates.

Connect Biopharma Holdings (NasdaqGM:CNTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Connect Biopharma Holdings Limited is a clinical-stage biopharmaceutical company focused on developing therapies for T cell-driven inflammatory diseases, with a market cap of $34.81 million.

Operations: Connect Biopharma Holdings Limited has not reported any revenue segments.

Market Cap: $34.81M

Connect Biopharma Holdings Limited, a clinical-stage biopharmaceutical company, is navigating the penny stock landscape with promising developments. The company recently announced positive Phase 2 trial results for rademikibart in asthma treatment, highlighting its potential as a novel biologic therapy with significant improvements in lung function and asthma control. Despite being unprofitable, Connect reduced its net loss to US$15.63 million from US$62.11 million the previous year and reported revenue of US$26.03 million for 2024. With no debt and sufficient cash runway projected into 2027, it remains positioned to advance its pipeline further into Phase 3 trials.

- Click to explore a detailed breakdown of our findings in Connect Biopharma Holdings' financial health report.

- Explore Connect Biopharma Holdings' analyst forecasts in our growth report.

Caesarstone (NasdaqGS:CSTE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Caesarstone Ltd. designs, develops, manufactures, and sells engineered stone and porcelain products globally under various brands, with a market cap of $88.46 million.

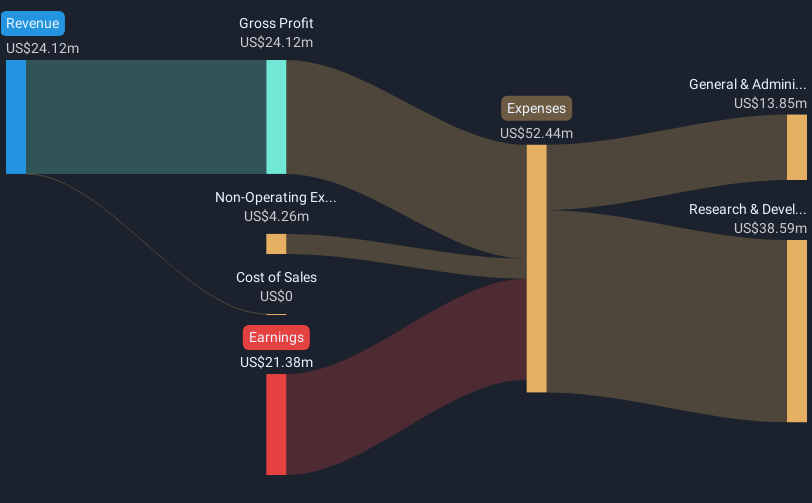

Operations: The company generates revenue of $443.22 million from its Building Products segment.

Market Cap: $88.46M

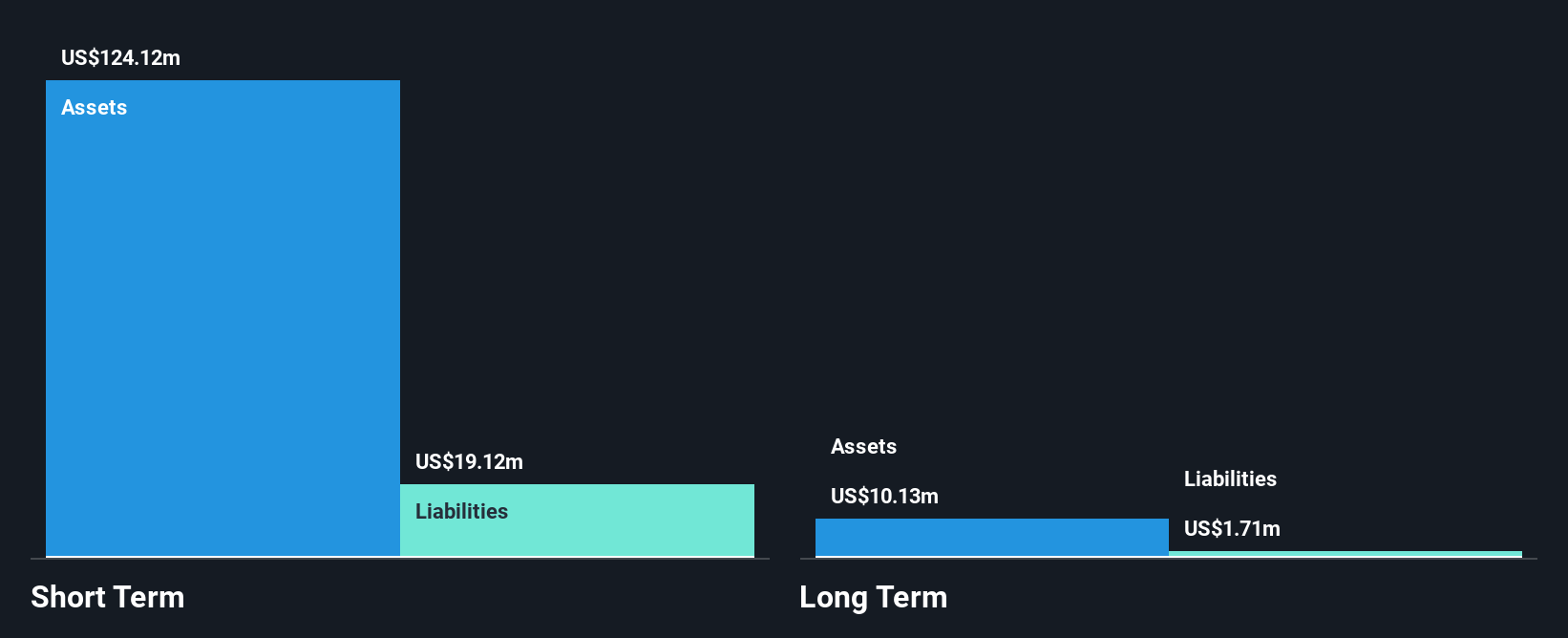

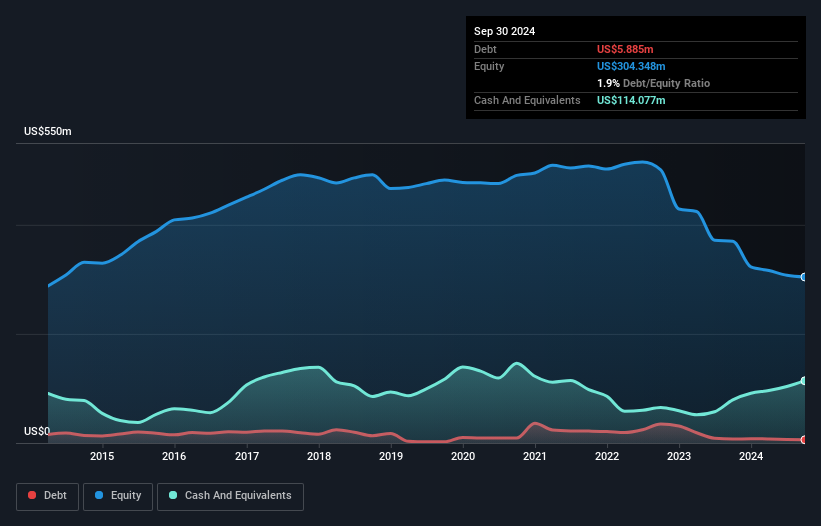

Caesarstone Ltd. presents a mixed picture in the penny stock arena, with its market cap at US$88.46 million and revenue of US$443.22 million from its Building Products segment. Despite being unprofitable, the company has reduced its net loss to US$24.34 million for Q4 2024 compared to a year ago, showing some progress in financial management. Its short-term assets of US$348.5 million exceed both short- and long-term liabilities, indicating solid liquidity positions despite earnings challenges. The management team is experienced with an average tenure of 2.4 years, contributing to strategic stability amid industry volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Caesarstone.

- Understand Caesarstone's earnings outlook by examining our growth report.

Where To Now?

- Click through to start exploring the rest of the 781 US Penny Stocks now.

- Interested In Other Possibilities? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSTE

Caesarstone

Designs, develops, manufactures, and sells engineered stone and porcelain products under Caesarstone and other brands in the United States, Canada, Latin America, Australia, Asia, Europe, the Middle East and Africa, and Israel.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives