Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Capstone Turbine Corporation (NASDAQ:CPST) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Capstone Turbine

What Is Capstone Turbine's Net Debt?

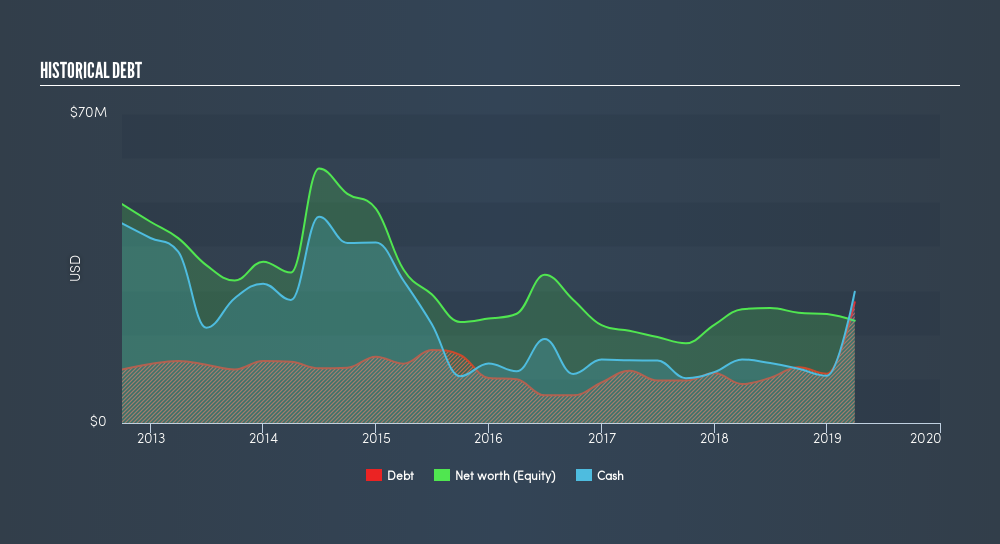

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Capstone Turbine had US$27.3m of debt, an increase on US$8.85m, over one year. But it also has US$29.7m in cash to offset that, meaning it has US$2.39m net cash.

How Strong Is Capstone Turbine's Balance Sheet?

The latest balance sheet data shows that Capstone Turbine had liabilities of US$28.1m due within a year, and liabilities of US$28.7m falling due after that. Offsetting this, it had US$29.7m in cash and US$16.2m in receivables that were due within 12 months. So its liabilities total US$10.9m more than the combination of its cash and short-term receivables.

Capstone Turbine has a market capitalization of US$50.8m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Despite its noteworthy liabilities, Capstone Turbine boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Capstone Turbine's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Capstone Turbine saw its revenue hold pretty steady. While that hardly impresses, its not too bad either.

So How Risky Is Capstone Turbine?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Capstone Turbine lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$21m and booked a US$17m accounting loss. But at least it has US$30m on the balance sheet to spend on growth, near-term. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. For riskier companies like Capstone Turbine I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:CGEH

Capstone Green Energy Holdings

Provides customized microgrid solutions, on-site resilient energy-as-a-service (EaaS) solutions, and on-site energy technology systems.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)