- United States

- /

- Machinery

- /

- NasdaqGS:CMCO

Columbus McKinnon Corporation's (NASDAQ:CMCO) Earnings Haven't Escaped The Attention Of Investors

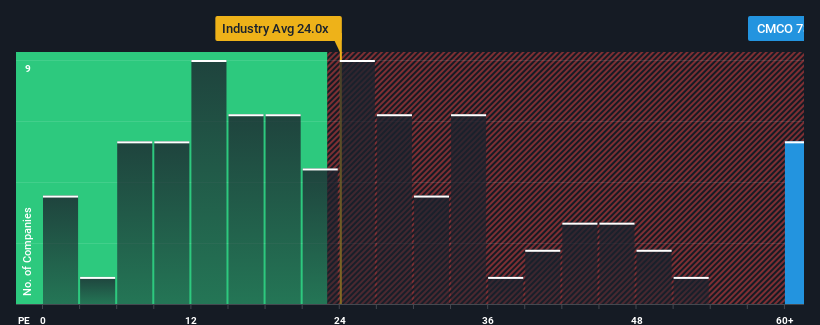

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 19x, you may consider Columbus McKinnon Corporation (NASDAQ:CMCO) as a stock to avoid entirely with its 73.5x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Columbus McKinnon hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Columbus McKinnon

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Columbus McKinnon's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 71%. As a result, earnings from three years ago have also fallen 44% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 242% as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 15%, which is noticeably less attractive.

In light of this, it's understandable that Columbus McKinnon's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Columbus McKinnon's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Columbus McKinnon's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Columbus McKinnon (1 is a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on Columbus McKinnon, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Columbus McKinnon, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CMCO

Columbus McKinnon

Designs, manufactures, and markets motion solutions for moving, lifting, positioning, and securing materials worldwide.

Established dividend payer slight.

Similar Companies

Market Insights

Community Narratives