- United States

- /

- Electrical

- /

- NasdaqCM:CBAT

Undervalued Opportunities: 3 Penny Stocks With Market Caps As Low As $10M

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed signals from economic data and ongoing trade discussions, investors are increasingly looking for alternative opportunities beyond the major indices. Penny stocks, often representing smaller or newer companies, continue to attract attention due to their affordability and potential for growth. Despite being a term that might seem outdated, penny stocks remain relevant as they can offer hidden value when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Safe Bulkers (NYSE:SB) | $3.80 | $388.56M | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $118.07M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8994 | $6.03M | ★★★★★☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.41 | $74.31M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.46 | $48.84M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.78 | $145.05M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.21 | $20.22M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.849 | $73.49M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.43 | $480.59M | ★★★★☆☆ |

Click here to see the full list of 753 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

ARB IOT Group (NasdaqCM:ARBB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ARB IOT Group Limited, operating through its subsidiaries, offers Internet of Things (IoT) system solutions and integration services in Malaysia, with a market cap of $13.14 million.

Operations: The company generates MYR 58.19 million in revenue from its Internet of Things (IoT) system solutions and integration services in Malaysia.

Market Cap: $13.14M

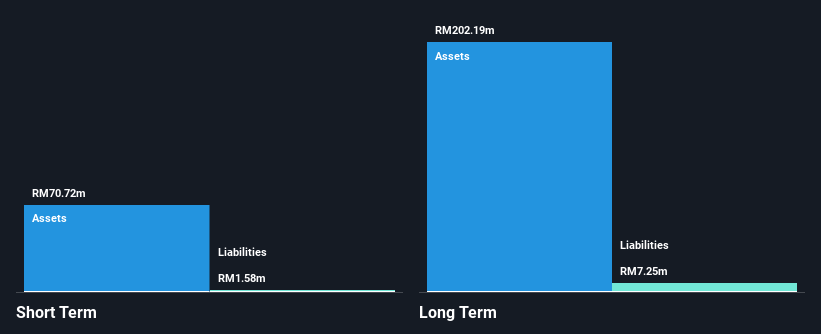

ARB IOT Group Limited, with a market cap of US$13.14 million, has recently secured significant agreements that could enhance its position in the AI and IoT sectors. The company signed a US$45 million deal to supply AI servers to Gajah Kapitalan Sdn Bhd and is involved in establishing an AI data center experimental lab in collaboration with Malaysian institutions. Despite being unprofitable with increasing losses over five years, ARB IOT is debt-free and has sufficient short-term assets to cover liabilities. Its share price remains volatile, trading significantly below estimated fair value amid strategic growth initiatives.

- Unlock comprehensive insights into our analysis of ARB IOT Group stock in this financial health report.

- Review our historical performance report to gain insights into ARB IOT Group's track record.

CBL International (NasdaqCM:BANL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CBL International Limited is a marine fuel logistics company offering vessel refueling solutions across Malaysia, Hong Kong, China, South Korea, Singapore, and internationally with a market cap of $28.87 million.

Operations: The company generates revenue primarily from its sales and distribution of marine fuel, amounting to $521.17 million.

Market Cap: $28.87M

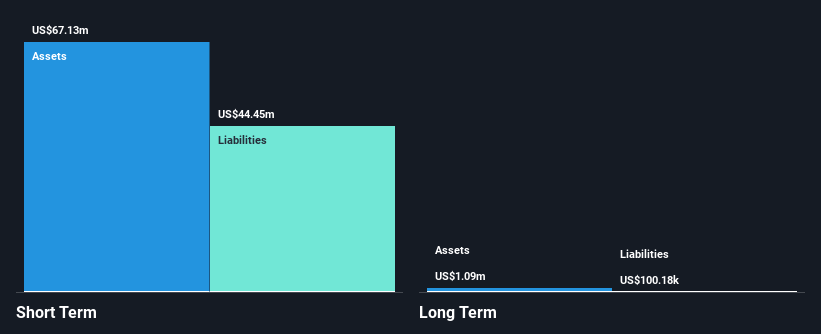

CBL International Limited, with a market cap of US$28.87 million, focuses on marine fuel logistics and generated US$521.17 million in revenue. Despite being unprofitable with increasing losses over five years at 55.3% annually, the company is debt-free and has sufficient short-term assets (US$67.1 million) to cover liabilities (US$44.4 million). Recent activities include a follow-on equity offering of US$2.60 million and a US$50 million shelf registration filing for various securities, indicating potential capital-raising efforts amid executive changes as the CEO temporarily assumes CFO responsibilities following the previous CFO's transition to another role within the company.

- Click here and access our complete financial health analysis report to understand the dynamics of CBL International.

- Examine CBL International's past performance report to understand how it has performed in prior years.

CBAK Energy Technology (NasdaqCM:CBAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CBAK Energy Technology, Inc. engages in the manufacture, commercialization, and distribution of lithium-ion high power rechargeable batteries across Mainland China, the United States, Europe, and internationally with a market cap of $73.49 million.

Operations: The company's revenue is primarily derived from its operations in the lithium-ion battery sector, with $150.73 million generated by CBAT and $56.70 million by Hitrans.

Market Cap: $73.49M

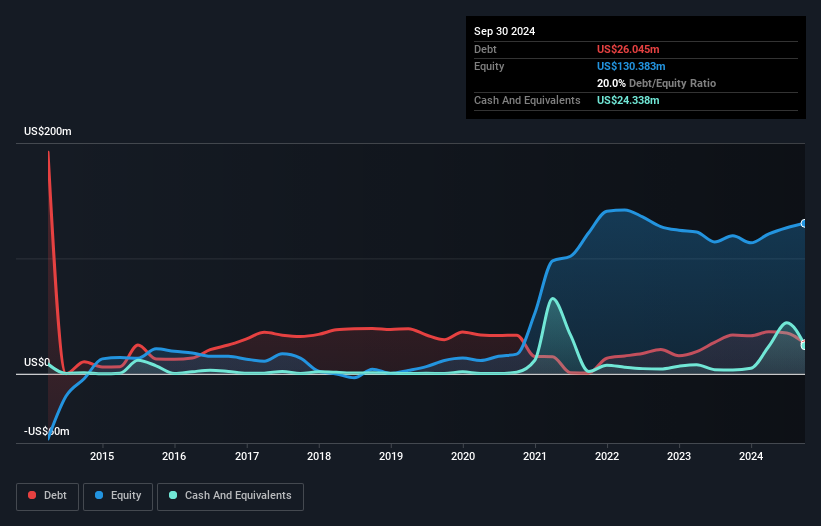

CBAK Energy Technology, with a market cap of US$73.49 million, has recently become profitable, marking a significant shift in its financial trajectory. Despite facing delisting risks from Nasdaq due to non-compliance with the minimum bid price requirement, it maintains stable weekly volatility and satisfactory debt levels. The company's net debt to equity ratio is low at 1.3%, and its interest payments are well covered by EBIT. However, short-term liabilities exceed short-term assets by US$23.7 million, posing liquidity challenges. Earnings growth is forecasted at 26.39% annually, although past results were impacted by a large one-off loss of US$9.4 million.

- Get an in-depth perspective on CBAK Energy Technology's performance by reading our balance sheet health report here.

- Explore CBAK Energy Technology's analyst forecasts in our growth report.

Make It Happen

- Access the full spectrum of 753 US Penny Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CBAK Energy Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CBAT

CBAK Energy Technology

CBAK Energy Technology, Inc., together with its subsidiaries, manufacture, commercialization, and distribution of standard and customized lithium and sodium batteries in Mainland China, Europe, and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives