- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

Does The Market Misread Byrna Technologies After Recent Share Price Volatility?

Reviewed by Bailey Pemberton

- If you are wondering whether Byrna Technologies at around $18.72 is a hidden bargain or a value trap, you are in the right place to unpack what the market is really pricing in.

- The stock has been choppy lately, slipping about 4.8% over the last week but still up roughly 4.1% over the past month. Longer term it remains down 33.9% year to date and about 24.1% over 1 year, yet still more than doubles investors over 3 years with a 114.2% gain.

- Recent share price moves have been shaped by ongoing interest in less lethal personal security solutions and evolving regulatory conversations around self defense products, as investors reassess Byrna's growth runway. The stock has also reacted to product updates, distribution expansions, and changing sentiment on discretionary consumer spending, all of which feed into how the market values its future cash flows.

- On our framework, Byrna scores a perfect 6 out of 6 on valuation checks, suggesting the market may be underestimating its fundamentals. Next we will break down the different valuation approaches behind that score and hint at an even richer way to think about value by the end of this article.

Find out why Byrna Technologies's -24.1% return over the last year is lagging behind its peers.

Approach 1: Byrna Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it could generate in the future and then discounting those cash flows back into today’s dollars.

For Byrna Technologies, the latest twelve month free cash flow is roughly -$8.2 Million. The model assumes the company moves from current cash burn into positive and growing free cash flow over time. Analyst forecasts and subsequent extrapolations suggest free cash flow could reach about $53.1 Million by 2035, with the path there captured in a two stage Free Cash Flow to Equity framework that gradually tapers growth after the early ramp up years.

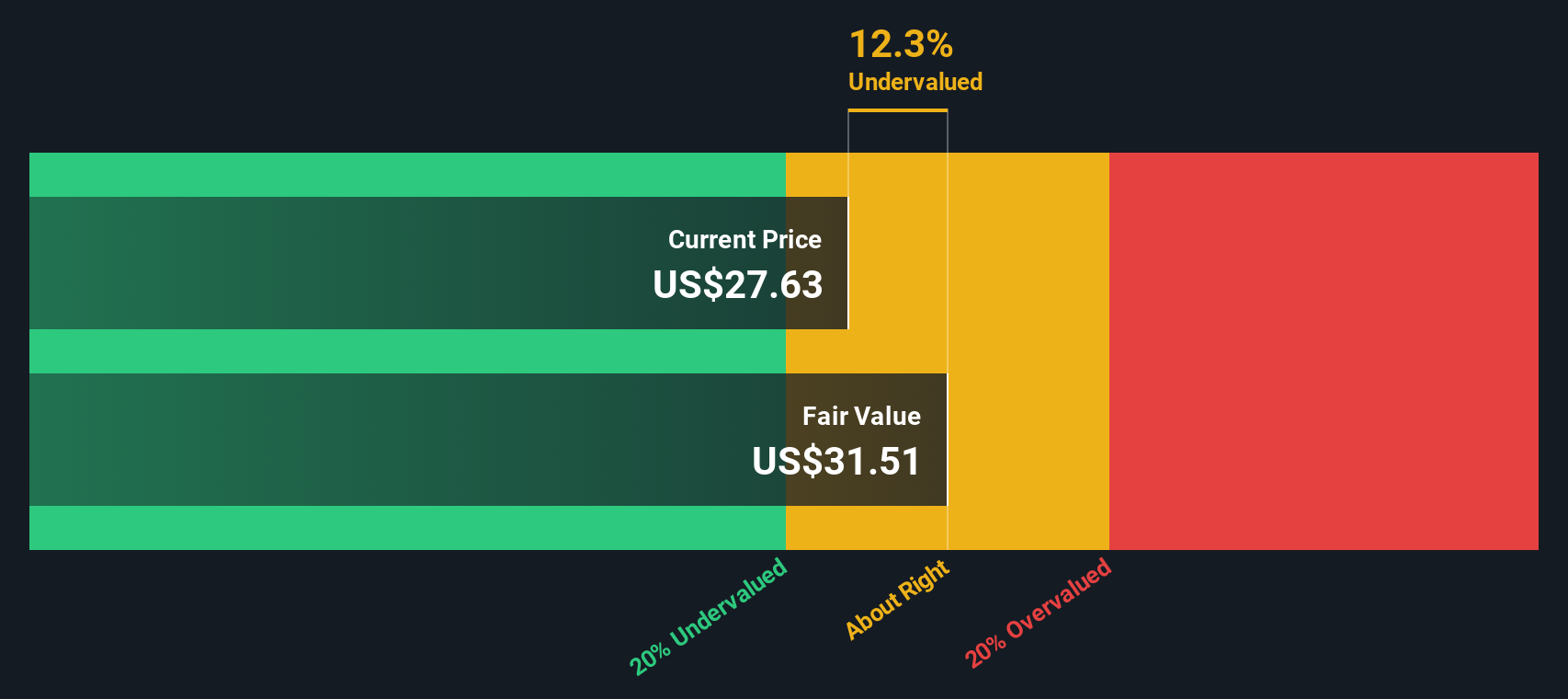

Bringing all those projected cash flows back to today using an appropriate discount rate gives an estimated intrinsic value of about $37.68 per share. Compared with the current share price near $18.72, the DCF implies the stock is roughly 50.3% undervalued. This indicates the market may be heavily discounting Byrna’s longer term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Byrna Technologies is undervalued by 50.3%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Byrna Technologies Price vs Earnings

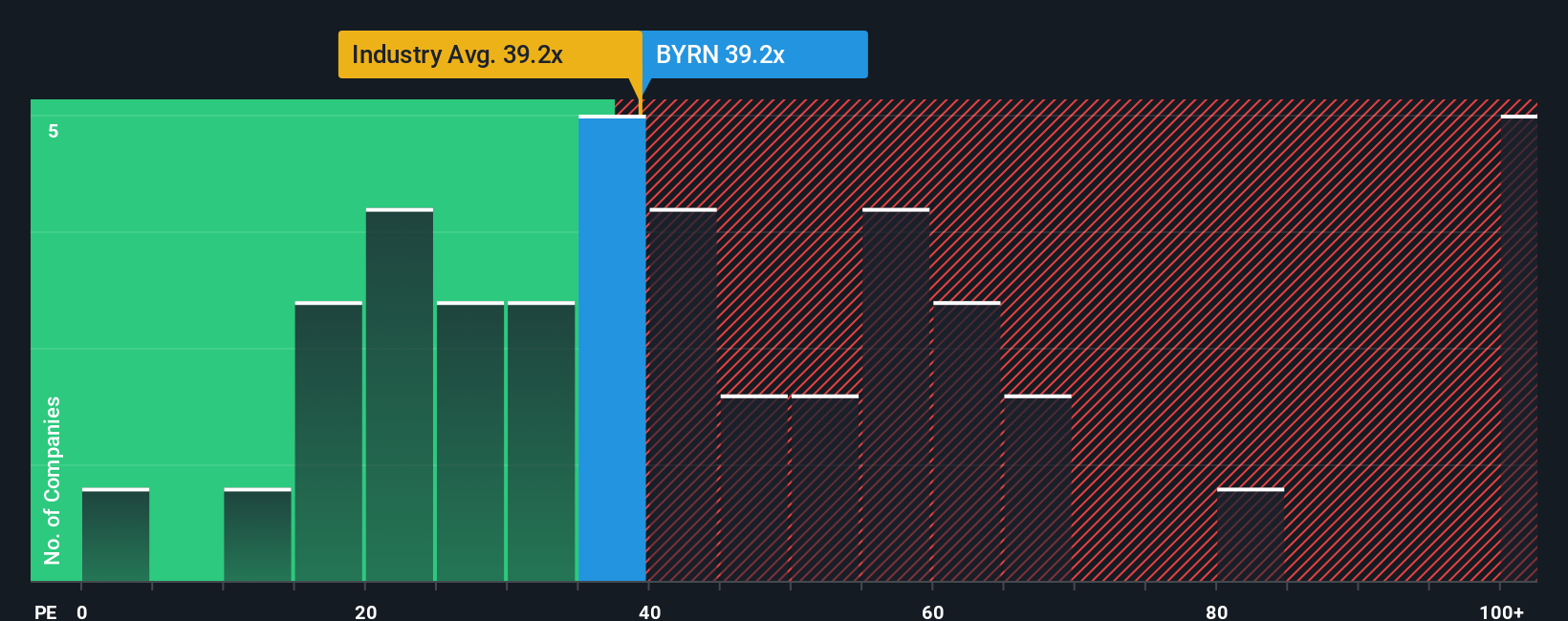

For profitable companies, the price to earnings, or PE, ratio is a useful way to see how much investors are willing to pay today for each dollar of current earnings. What counts as a normal or fair PE depends on how quickly earnings are expected to grow and how risky those earnings are, with higher growth and lower risk typically justifying a higher multiple.

Byrna Technologies currently trades on a PE of about 26.60x, below the Aerospace and Defense industry average of roughly 38.74x and also under the peer group average of around 31.06x. Simply Wall St’s Fair Ratio framework estimates that, given Byrna’s specific mix of earnings growth prospects, margins, risk profile, industry and market cap, a PE closer to 28.31x would be reasonable. This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for the company’s own fundamentals rather than assuming all stocks deserve the same multiple.

Since the Fair Ratio of 28.31x is moderately above the current 26.60x, Byrna’s shares look somewhat cheap on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Byrna Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers behind its future revenue, earnings, margins, and ultimately its fair value.

A Narrative on Simply Wall St is your own investment storyline. You outline what you think will drive Byrna Technologies business, translate that into a financial forecast, and then see the fair value that falls out of those assumptions.

Available on the Community page used by millions of investors, Narratives are easy to set up. They help you compare your Fair Value estimate to the current share price to decide whether you want to buy, hold, or sell, and they automatically update as new information like earnings or news comes in.

For example, one Byrna Technologies Narrative might assume strong execution on Amazon and new product launches and conclude the shares are worth around $46. A more cautious Narrative that focuses on margin pressure and supply chain risks might land closer to $35, giving you a clear, dynamic framework for deciding how the current price stacks up against your own expectations.

Do you think there's more to the story for Byrna Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, develops, manufactures, and sells less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)