- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

If EPS Growth Is Important To You, Axon Enterprise (NASDAQ:AXON) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Axon Enterprise (NASDAQ:AXON). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Axon Enterprise with the means to add long-term value to shareholders.

See our latest analysis for Axon Enterprise

Axon Enterprise's Improving Profits

Axon Enterprise has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. It's good to see that Axon Enterprise's EPS has grown from US$2.07 to US$2.31 over twelve months. This amounts to a 12% gain; a figure that shareholders will be pleased to see.

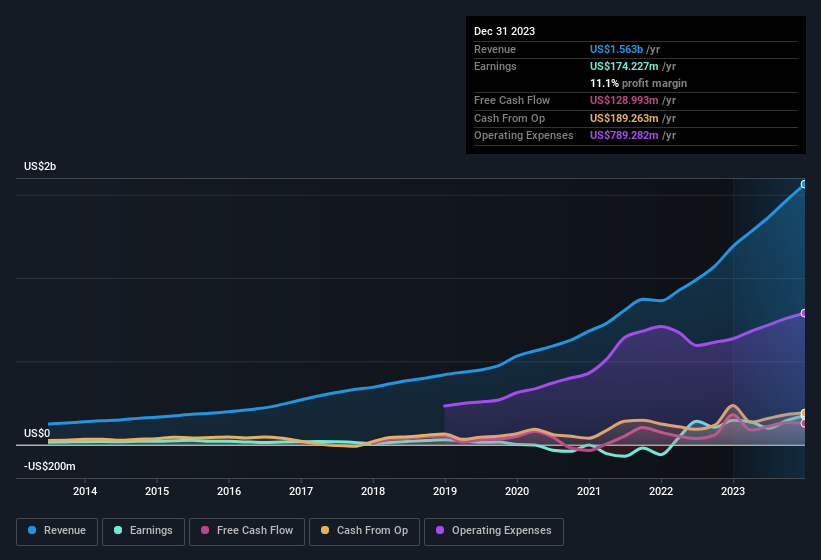

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Axon Enterprise shareholders is that EBIT margins have grown from 7.8% to 10% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Axon Enterprise's future profits.

Are Axon Enterprise Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent US$8.7m buying Axon Enterprise shares, over the last year, without reporting any share sales whatsoever. Knowing this, Axon Enterprise will have have all eyes on them in anticipation for the what could happen in the near future. We also note that it was the Independent Director, Hadi Partovi, who made the biggest single acquisition, paying US$4.8m for shares at about US$191 each.

Along with the insider buying, another encouraging sign for Axon Enterprise is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth US$1.2b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Axon Enterprise's CEO, Rick Smith, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Axon Enterprise, with market caps over US$8.0b, is about US$14m.

Axon Enterprise's CEO only received compensation totalling US$40k in the year to December 2023. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Axon Enterprise To Your Watchlist?

As previously touched on, Axon Enterprise is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. Before you take the next step you should know about the 2 warning signs for Axon Enterprise that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Axon Enterprise isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Axon Enterprise, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives