- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

Earnings Guidance Narrowed As AeroVironment (NasdaqGS:AVAV) Sees 13% Price Drop

Reviewed by Simply Wall St

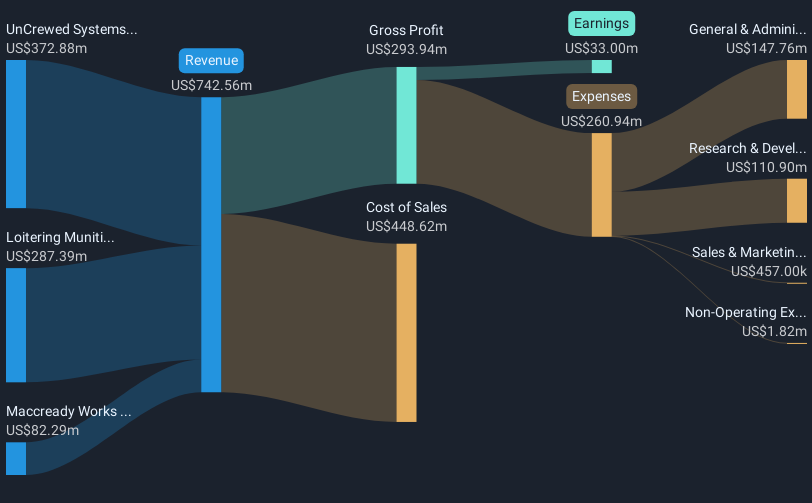

AeroVironment (NasdaqGS:AVAV) experienced a 13% drop in share price over the past week, coinciding with several impactful developments. The company's announcement of a narrowed earnings guidance due to underwhelming Q3 results revealed a revenue decrease to $168 million, down from $187 million the previous year, alongside a net loss of $1.75 million. This performance contrasts with the broader market decline, as the Nasdaq witnessed a 4% slide amid heightened concerns over macroeconomic uncertainties and tariffs introduced by the Trump administration. The weaker-than-expected earnings report likely contributed to investor apprehension, aligning with the broader sell-off in technology and defense sectors. Meanwhile, the introduction of the JUMP 20-X, an advanced uncrewed aircraft system, although innovative, may not have offset negative sentiment influenced by the earnings results. As the market navigates volatility, AeroVironment’s performance underscores challenges in meeting investor expectations within the current economic landscape.

Unlock comprehensive insights into our analysis of AeroVironment stock here.

Over the last five years, AeroVironment's total shareholder return, including share price and dividends, was 141.82%. This growth reflects various company developments and market factors. Despite recent challenges, such as the underwhelming Q3 results in March 2025—a revenue decline to US$167.64 million and a net loss of US$1.75 million—the five-year period was marked by significant achievements. For instance, the company secured major contracts with the U.S. Army, including a third delivery order worth US$288 million in February 2025, bolstering its defense sector presence.

Furthermore, AeroVironment's focus on product innovation has been pivotal. The recent launch of the JUMP® 20-X, a cutting-edge uncrewed aircraft system, underlines its commitment to technological advancement. During this period, AeroVironment also engaged in strategic acquisitions, such as the agreement with BlueHalo LLC in December 2024, enhancing its market position. However, despite these strides, the company's one-year performance was impacted, as it underperformed the US Aerospace & Defense industry, which returned 19.8% compared to the broader market.

- Discover whether AeroVironment is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Uncover the uncertainties that could impact AeroVironment's future growth—read our risk evaluation here.

- Already own AeroVironment? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AeroVironment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives