Stock Analysis

- United States

- /

- Media

- /

- NYSE:CTV

Top US Growth Companies With High Insider Ownership In May 2024

Reviewed by Simply Wall St

As of May 2024, the U.S. stock market is experiencing fluctuations, with significant movements in both stocks and bonds as investors adjust their expectations for Federal Reserve policy actions. Amid these conditions, growth companies with high insider ownership can be particularly noteworthy; such firms often benefit from leadership that is deeply invested in their success, potentially aligning company performance closely with shareholder interests during uncertain economic times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 26% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 27.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| EHang Holdings (NasdaqGM:EH) | 33% | 98.2% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| ZKH Group (NYSE:ZKH) | 17.7% | 98.2% |

| BBB Foods (NYSE:TBBB) | 23.6% | 77.5% |

| Neonode (NasdaqCM:NEON) | 24.7% | 158% |

Let's explore several standout options from the results in the screener.

AerSale (NasdaqCM:ASLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AerSale Corporation operates globally, offering aftermarket commercial aircraft, engines, and parts, along with maintenance services to various clients including airlines and government contractors; it has a market capitalization of approximately $405.52 million.

Operations: AerSale's revenue is divided into several segments: Tech Ops - MRO Services generating $101.23 million, Tech Ops - Product Sales at $19.33 million, and Asset Management Solutions which includes Engine and Aircraft segments with revenues of $153.68 million and $72.32 million respectively.

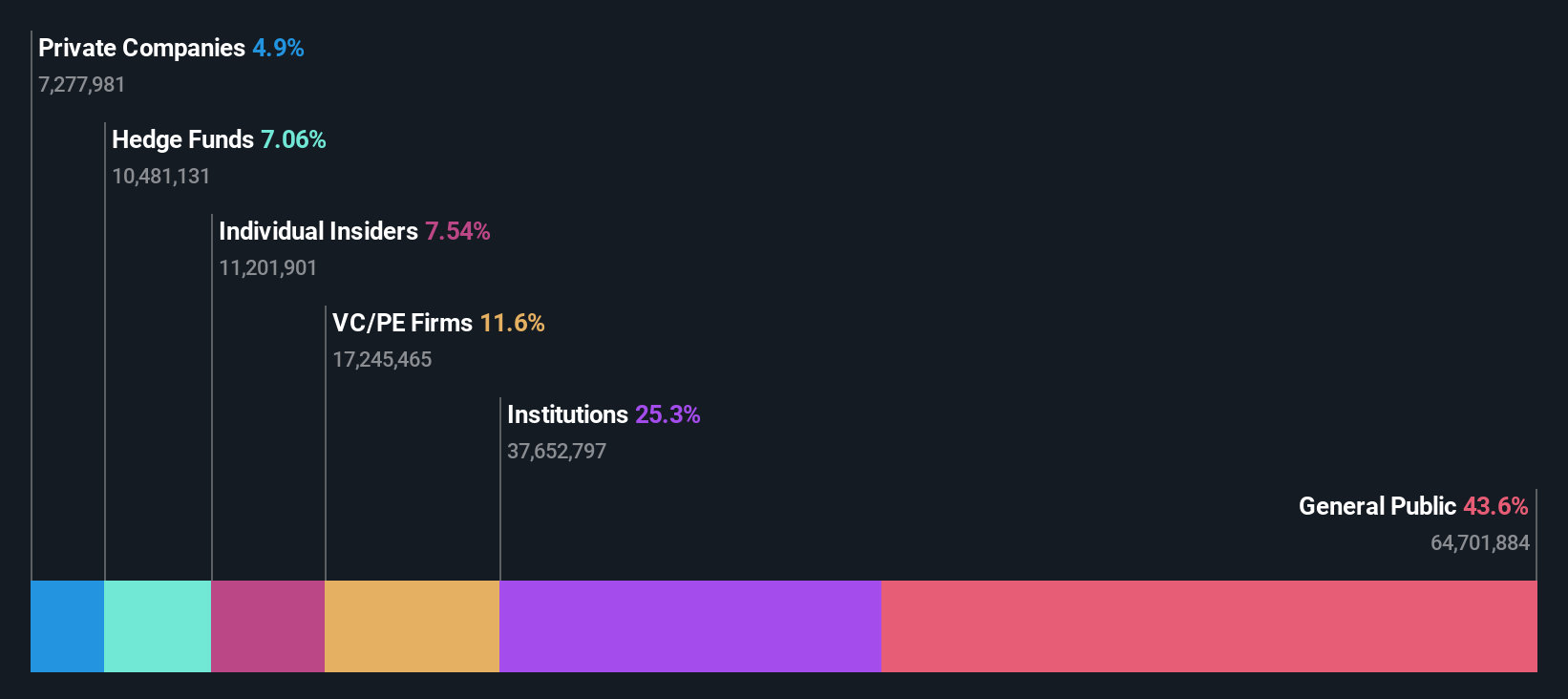

Insider Ownership: 24.1%

Revenue Growth Forecast: 14.8% p.a.

AerSale has demonstrated a robust recovery in its recent quarterly earnings with net income rising to US$6.28 million from nearly negligible levels year-over-year, alongside a significant increase in revenue. Despite facing challenges such as legal disputes and being dropped from the S&P Aerospace & Defense Select Industry Index, insider activities show more buying than selling over the past three months, reflecting confidence by insiders in the company's prospects. However, shareholders have experienced dilution over the past year, and profit margins have declined compared to last year.

- Click here and access our complete growth analysis report to understand the dynamics of AerSale.

- Our expertly prepared valuation report AerSale implies its share price may be lower than expected.

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc., along with its subsidiaries, functions as a digital asset technology company in the United States, with a market capitalization of approximately $679.69 million.

Operations: The company generates revenue primarily through digital currency mining, totaling $100.13 million.

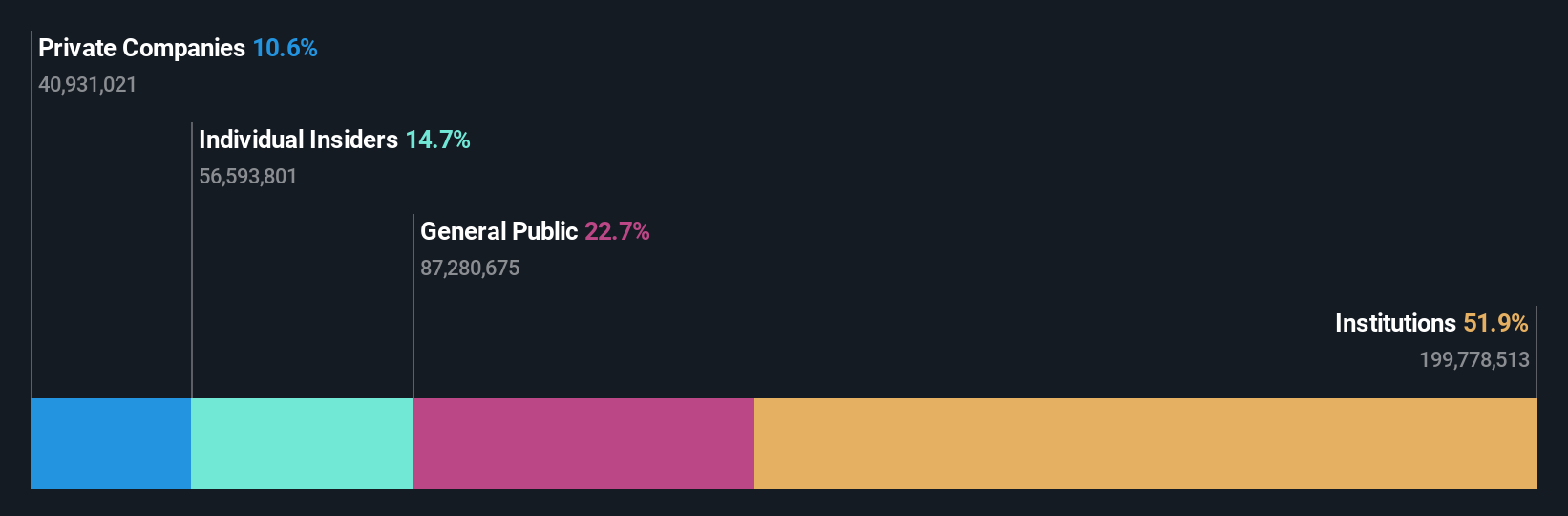

Insider Ownership: 18.8%

Revenue Growth Forecast: 50.5% p.a.

TeraWulf, with high insider ownership, shows potential as a growth company despite recent challenges. In Q1 2024, it reported significant revenue growth to US$42.43 million from US$11.53 million year-over-year and reduced its net loss substantially. The company's commitment to expansion is evident in its plans to achieve 300 MW of infrastructure by end-2024 and 550 MW by 2025. Analysts predict strong future revenue growth and anticipate profitability within three years, although the share price has been highly volatile recently.

- Dive into the specifics of TeraWulf here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of TeraWulf shares in the market.

Innovid (NYSE:CTV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innovid Corp., with a market cap of approximately $303.27 million, operates an independent software platform offering ad serving, measurement, and creative services.

Operations: The company generates revenue primarily through its advertising and creative services segment, totaling $146.14 million.

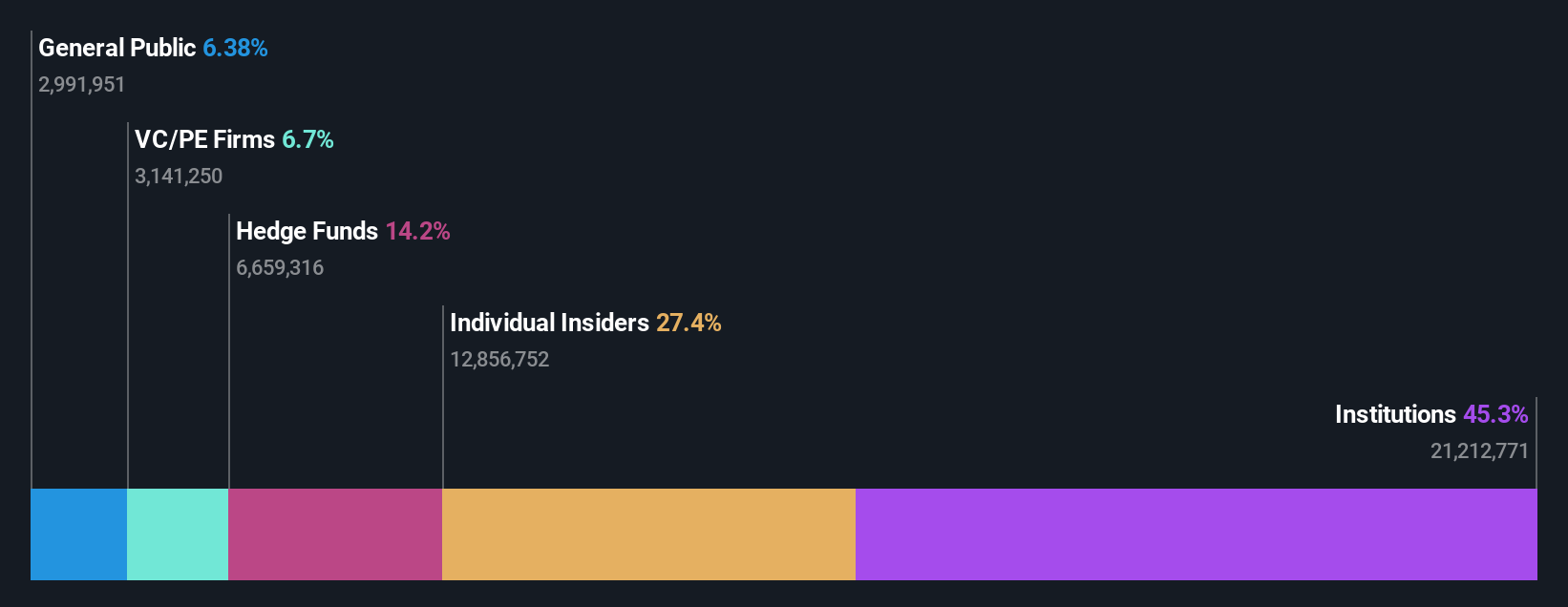

Insider Ownership: 10.5%

Revenue Growth Forecast: 11.5% p.a.

Innovid, characterized by high insider ownership, is poised for growth with a robust revenue forecast increase to US$156 million - US$163 million for 2024, up from earlier projections. The company has recently enhanced its product offerings through the Harmony initiative aimed at optimizing the CTV advertising ecosystem. Despite a volatile share price and a current undervaluation at 68.3% below estimated fair value, Innovid's strategic acquisitions and insider buying activity suggest confidence in its future profitability and market position growth.

- Navigate through the intricacies of Innovid with our comprehensive analyst estimates report here.

- Our valuation report here indicates Innovid may be undervalued.

Key Takeaways

- Gain an insight into the universe of 179 Fast Growing US Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTV

Innovid

Operates an independent software platform that provides ad serving, measurement, and creative services.

Flawless balance sheet and good value.