- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:ASLE

Investors Give AerSale Corporation (NASDAQ:ASLE) Shares A 29% Hiding

Unfortunately for some shareholders, the AerSale Corporation (NASDAQ:ASLE) share price has dived 29% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

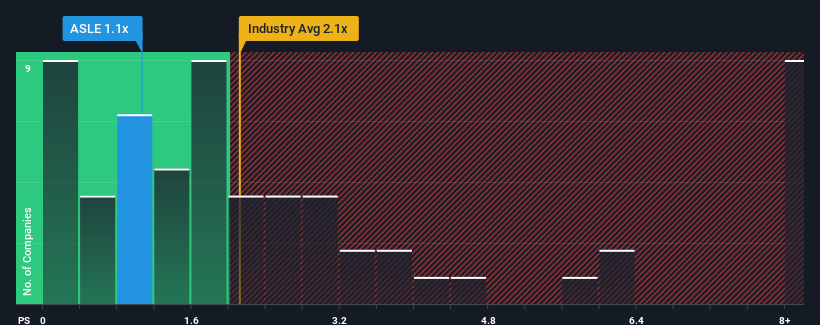

Since its price has dipped substantially, it would be understandable if you think AerSale is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.1x, considering almost half the companies in the United States' Aerospace & Defense industry have P/S ratios above 2.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for AerSale

How AerSale Has Been Performing

AerSale could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AerSale.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as AerSale's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. Even so, admirably revenue has lifted 60% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 9.9% growth forecast for the broader industry.

With this in consideration, we find it intriguing that AerSale's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The southerly movements of AerSale's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at AerSale's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for AerSale with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ASLE

AerSale

Provides aftermarket commercial aircraft, engines, and its parts to passenger and cargo airlines, leasing companies, original equipment manufacturers, government and defense contractors, and maintenance, repair, and overhaul service providers worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives