- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:VLGE.A

Discover 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.7%, yet it has shown resilience with a 12% rise over the past year and an expected annual earnings growth of 14% in the coming years. In this dynamic environment, identifying stocks that are poised for growth but remain underappreciated can offer unique opportunities for investors seeking to capitalize on emerging trends and potential value.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

AerSale (NasdaqCM:ASLE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: AerSale Corporation specializes in supplying aftermarket commercial aircraft, engines, and parts to a diverse range of clients including airlines and government contractors, with a market cap of approximately $438.80 million.

Operations: AerSale generates revenue primarily from two segments: Tech Ops, contributing $129.60 million, and Asset Management Solutions, contributing $215.50 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

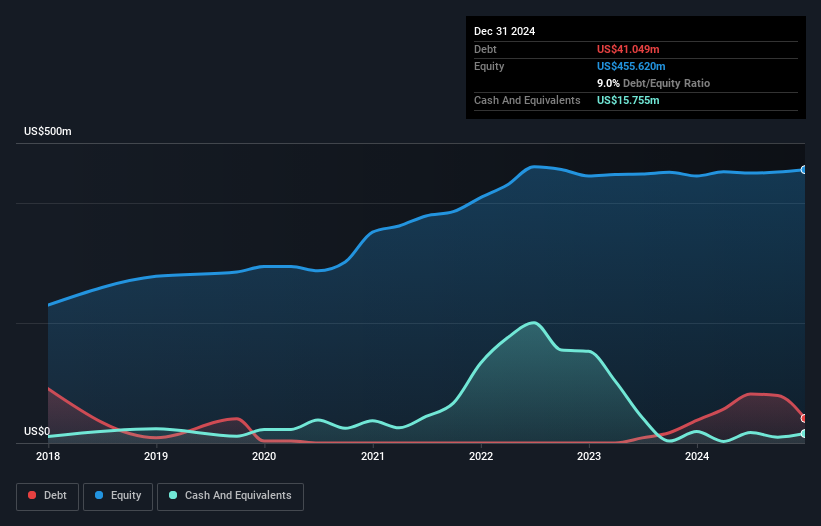

AerSale, a player in the aerospace sector, recently reported a net income of US$5.85 million for 2024, bouncing back from a loss of US$5.56 million the previous year. Their revenue saw an uptick to US$345.07 million from US$334.5 million year-over-year, reflecting growing momentum in their operations. Despite having high-quality earnings and becoming profitable this past year, challenges remain with interest payments not well covered by EBIT at 1.7x coverage and increased debt to equity ratio now at 9%. The company’s focus on innovative products like AerAware could drive future growth if market acceptance is achieved despite current hurdles such as feedstock issues and competition pressures impacting cash flow stability.

Village Super Market (NasdaqGS:VLGE.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Village Super Market, Inc. operates a chain of supermarkets in the United States and has a market capitalization of approximately $486.64 million.

Operations: Village Super Market generates revenue primarily through the retail sale of food and nonfood products, amounting to $2.28 billion.

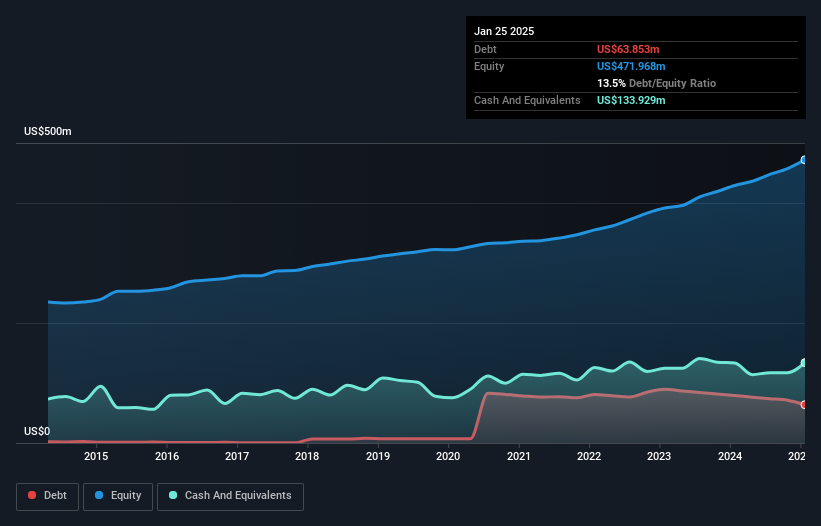

Village Super Market is carving a niche in the retail sector, with earnings growth of 3.6% over the past year, outpacing its industry peers. Its debt-to-equity ratio has risen from 2.2 to 13.5 over five years, yet it holds more cash than total debt, ensuring financial stability. The company reported second-quarter sales of US$599.65 million and net income of US$16.9 million, showing improvement from last year’s figures of US$575.58 million and US$14.48 million respectively. Trading at about 8% below fair value estimates suggests potential for investors seeking undervalued opportunities in this space.

- Get an in-depth perspective on Village Super Market's performance by reading our health report here.

NL Industries (NYSE:NL)

Simply Wall St Value Rating: ★★★★★★

Overview: NL Industries, Inc., through its subsidiary CompX International Inc., operates in the component products industry across Europe, North America, the Asia Pacific, and internationally with a market cap of approximately $357.08 million.

Operations: CompX International Inc., a subsidiary of NL Industries, generates revenue primarily from its component products segment, amounting to $145.90 million. The company focuses on optimizing its cost structure to enhance profitability.

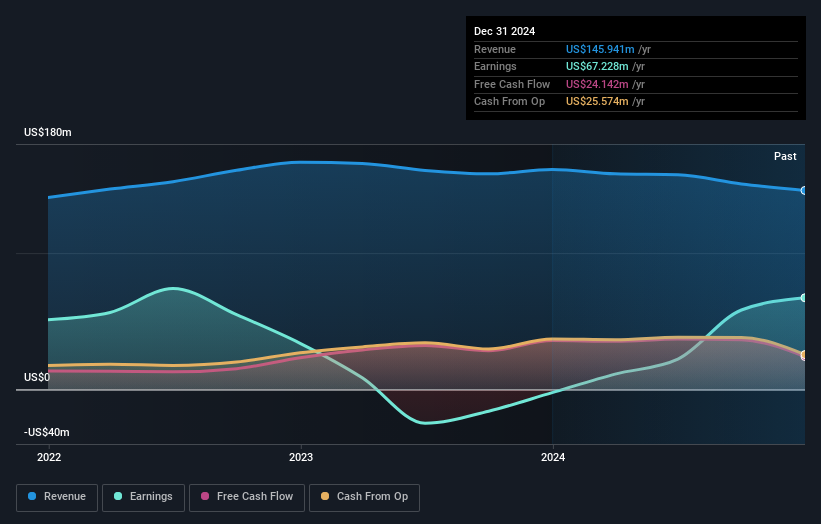

NL Industries is making waves with its recent profitability, reporting a net income of US$67.23 million for 2024, compared to a net loss of US$2.31 million the previous year. Trading at 34.9% below estimated fair value, it presents an intriguing opportunity for investors seeking value in smaller companies. Despite legal challenges requiring a settlement payment of US$56.1 million related to environmental claims, NL remains financially robust with more cash than total debt and positive free cash flow reaching US$36.97 million by mid-2024. Its debt-to-equity ratio has improved from 0.2 to 0.1 over five years, indicating prudent financial management amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of NL Industries.

Assess NL Industries' past performance with our detailed historical performance reports.

Where To Now?

- Navigate through the entire inventory of 285 US Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLGE.A

Village Super Market

Engages in the operation of a chain of supermarkets in the United States.

Adequate balance sheet average dividend payer.