- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:ASLE

3 Undiscovered Gems in the US Market with Promising Potential

Reviewed by Simply Wall St

Amid ongoing market volatility driven by tariff concerns and fluctuating economic indicators, the U.S. stock market has seen a mix of gains and losses across major indices like the Dow Jones Industrial Average and the S&P 500. In this environment, identifying stocks with strong fundamentals and resilience to external pressures can be key to uncovering potential opportunities in lesser-known companies that may offer promising growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

AerSale (NasdaqCM:ASLE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: AerSale Corporation specializes in supplying aftermarket commercial aircraft, engines, and parts to a diverse clientele including airlines, leasing companies, OEMs, government and defense contractors, and MRO service providers globally, with a market cap of approximately $361.76 million.

Operations: AerSale generates revenue primarily through its Asset Management Solutions, with engine sales contributing $173.72 million and aircraft sales adding $41.75 million. The Tech Ops segment, comprising MRO Services and Product Sales, brings in an additional $107.97 million and $21.63 million respectively.

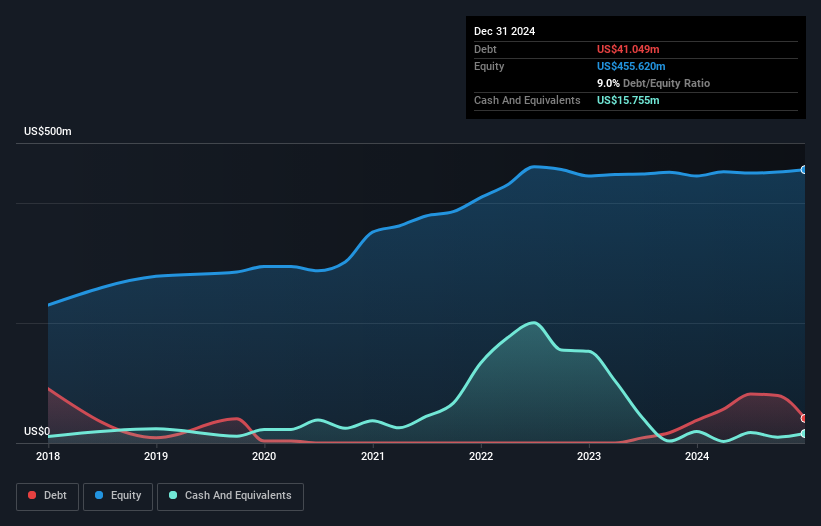

AerSale, a notable player in the aviation sector, has shown promising growth with net income reaching US$5.85 million for 2024 compared to a net loss of US$5.56 million the previous year. The company is enhancing its lease pool and MRO facilities, aiming for improved margins by early 2025. AerSale's recent share repurchase program up to 6.43 million shares at no more than US$7 per share indicates confidence in its valuation strategy. Despite challenges like feedstock availability and competition, analysts project a revenue growth rate of 15% annually over three years, suggesting potential upside from current market conditions.

Carter Bankshares (NasdaqGS:CARE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Carter Bankshares, Inc. is the bank holding company for Carter Bank & Trust, offering a range of retail and commercial banking products and insurance services across the United States, with a market cap of $337.48 million.

Operations: Carter Bankshares generates revenue primarily from its banking segment, amounting to $140.87 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Carter Bankshares, with assets totaling US$4.7 billion and equity of US$384.3 million, is navigating challenges with a high level of bad loans at 7.2% and a low allowance for these loans at 29%. The bank's total deposits stand at US$4.2 billion against loans of US$3.5 billion, indicating robust customer trust despite the risk factors. Recent executive changes include the retirement announcement of director E. Warren Matthews and the passing of EVP Richard Owen, who significantly contributed to the bank's growth by expanding its mortgage portfolio to nearly $650 million since 2017, reflecting his strategic impact on operations.

Capital City Bank Group (NasdaqGS:CCBG)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital City Bank Group, Inc. is a financial holding company for Capital City Bank, offering a variety of banking services to individual and corporate clients, with a market cap of $577.29 million.

Operations: Capital City Bank Group generates revenue primarily through its commercial banking segment, which reported $230.88 million.

With total assets of US$4.3 billion and equity at US$495.3 million, Capital City Bank Group stands strong in the financial landscape. Deposits reach US$3.7 billion, while loans amount to US$2.6 billion, supported by a robust net interest margin of 4.1%. The bank's allowance for bad loans is well-managed at 0.2% of total loans, reflecting prudent risk management practices and low-risk funding sources comprising 96% customer deposits. Trading significantly below its fair value estimate, CCBG offers an intriguing valuation prospect with earnings growth outpacing industry averages over the past year by a notable margin.

Seize The Opportunity

- Dive into all 284 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASLE

AerSale

Provides aftermarket commercial aircraft, engines, and its parts to passenger and cargo airlines, leasing companies, original equipment manufacturers, government and defense contractors, and maintenance, repair, and overhaul service providers worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives