- United States

- /

- Electrical

- /

- NasdaqGM:ARRY

Array Technologies (ARRY): Valuation Spotlight After Intertek Validation of 2kV Solar Trackers

If you have been watching Array Technologies (ARRY) lately, the latest news might give you pause before making a move. Intertek’s validation that Array’s DuraTrack and OmniTrack systems fully meet the technical, safety, and performance benchmarks for next-generation 2kV solar projects is more than a formality. This could change how developers approach system design. Array is now able to serve emerging high-voltage projects right out of the box, offering efficiency gains and cost reductions that matter in today’s solar landscape.

This announcement follows a period of growing momentum. Over the past year, Array Technologies’ stock is up by nearly 49% and has surged over 63% in the past month, fueled by both its product innovations and clear signals from the industry about where solar is heading. Although the company presented at the ROTH Solar & Storage Symposium recently, it is these forward-looking product moves that are catching investors’ attention, especially after a tough multi-year stretch marked by a three-year return well below its one-year rebound.

After this dramatic swing back, can Array’s new validation unlock further upside for shareholders, or is the market already pricing in the company’s forward potential?

Most Popular Narrative: 3.5% Undervalued

The current narrative points to Array Technologies as modestly undervalued, with analysts suggesting there is still room for upside in the stock price based on future earnings and revenue growth.

Enhanced product mix and technology innovation, with over 35% of the order book for recently launched, higher-value products targeting challenging terrains and emerging extreme weather concerns. This increases pricing power and supports margin expansion, thus improving gross margins and earnings.

How does a solar technology company justify a future price tag that is still above today's market? The narrative's secret sauce involves a blend of new product breakthroughs, ambitious margin forecasts, and a future earnings multiple that is not just for big tech. Want to know what makes analysts confident about this fair value call and how much growth is really baked in? Find out which bold numbers push this target well past current levels.

Result: Fair Value of $9.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory changes or an unexpected drop in utility-scale solar demand could quickly challenge the company’s growth outlook and valuation case.

Find out about the key risks to this Array Technologies narrative.Another View: What Does Our DCF Model Say?

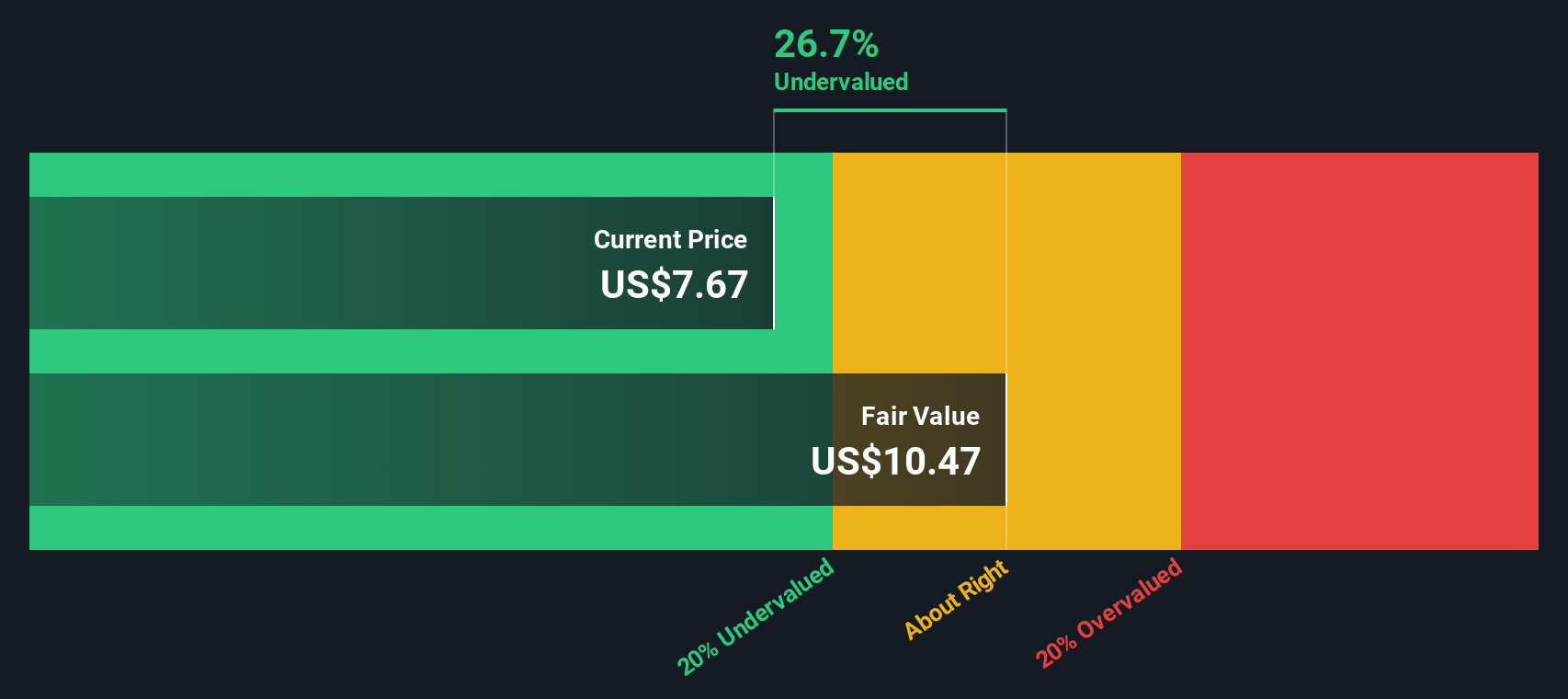

While analysts see potential in Array Technologies using future growth estimates, our DCF model also points to the stock trading below its calculated fair value. However, could a different set of assumptions tip the scales?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Array Technologies Narrative

If you see the numbers differently or want to dig into the data on your own terms, building your own valuation takes just a few minutes. Do it your way.

A great starting point for your Array Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Supercharge your portfolio by tapping into our exclusive ideas and spot trends before the crowd catches on.

- Uncover companies with attractive cash flow potential by starting with undervalued stocks based on cash flows, a tool built to spotlight undervalued gems you might otherwise miss.

- Seize the momentum in emerging industries by checking out AI penny stocks, which features top innovators driving the artificial intelligence revolution.

- Lock in reliable income even when markets are volatile by using our tool showcasing dividend stocks with yields > 3% to find solid yield performers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:ARRY

Array Technologies

Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.