- United States

- /

- Basic Materials

- /

- NYSE:LOMA

Exploring Three Undiscovered Gems In The United States Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 5.1% and is up 36% over the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying stocks that may not yet be on everyone's radar can offer unique opportunities for investors seeking potential growth beyond well-known names.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Apogee Enterprises (NasdaqGS:APOG)

Simply Wall St Value Rating: ★★★★★★

Overview: Apogee Enterprises, Inc. specializes in providing architectural products and services for building enclosures, as well as glass and acrylic products for preservation and enhanced viewing, operating primarily in the United States, Canada, and Brazil with a market cap of approximately $1.89 billion.

Operations: Apogee Enterprises generates revenue primarily from its Architectural Framing Systems and Architectural Services segments, contributing $553.30 million and $397.99 million, respectively. The Architectural Glass segment adds $363.96 million, while the Large-Scale Optical segment contributes $94.16 million to the total revenue stream.

Apogee Enterprises, a small player in the building industry, shows promise with its recent strategic moves. The company has reduced its debt to equity ratio from 54.2% to 12.2% over five years and maintains a satisfactory net debt to equity of 2%. Its earnings growth of 3.2% over the past year surpassed the industry's average of 3.1%, indicating strong performance relative to peers. With a price-to-earnings ratio at 18.1x, below the US market average, Apogee appears undervalued given its high-quality earnings and robust interest coverage (39.5x EBIT). Recent acquisition efforts aim for diversification but carry integration risks that investors should consider carefully.

Graham (NYSE:GHM)

Simply Wall St Value Rating: ★★★★★★

Overview: Graham Corporation, along with its subsidiaries, specializes in designing and manufacturing fluid, power, heat transfer, and vacuum technologies for industries such as chemical processing, defense, space exploration, petroleum refining, cryogenics, and energy; it has a market cap of $425.52 million.

Operations: Graham Corporation generates revenue through the design and manufacturing of technologies for various industries, with a market cap of $425.52 million. The company's financial performance can be analyzed by examining its cost structure and profit margins, focusing on trends in either gross or net profit margin to gain insights into its profitability dynamics.

Graham Corporation is making strides with a robust 163.9% earnings growth over the past year, outpacing the Machinery industry's 11.5%. The company remains debt-free, providing financial flexibility and reducing risk related to interest payments. Recent developments include a new cryogenic propellant testing facility in Florida, enhancing its capabilities in space and defense sectors. Graham's strategic focus on sustainable energy projects like the net-zero carbon emissions ethylene cracker aligns with current environmental trends and could attract eco-conscious investors. With earnings per share from continuing operations rising to US$0.3 from US$0.04 a year ago, Graham exhibits strong potential amidst evolving market demands.

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Loma Negra Compañía Industrial Argentina Sociedad Anónima, along with its subsidiaries, is engaged in the manufacturing and sale of cement and its derivatives in Argentina, with a market capitalization of $1.21 billion.

Operations: Loma Negra generates revenue primarily from the sale of cement and its derivatives within Argentina. The company has a market capitalization of approximately $1.21 billion.

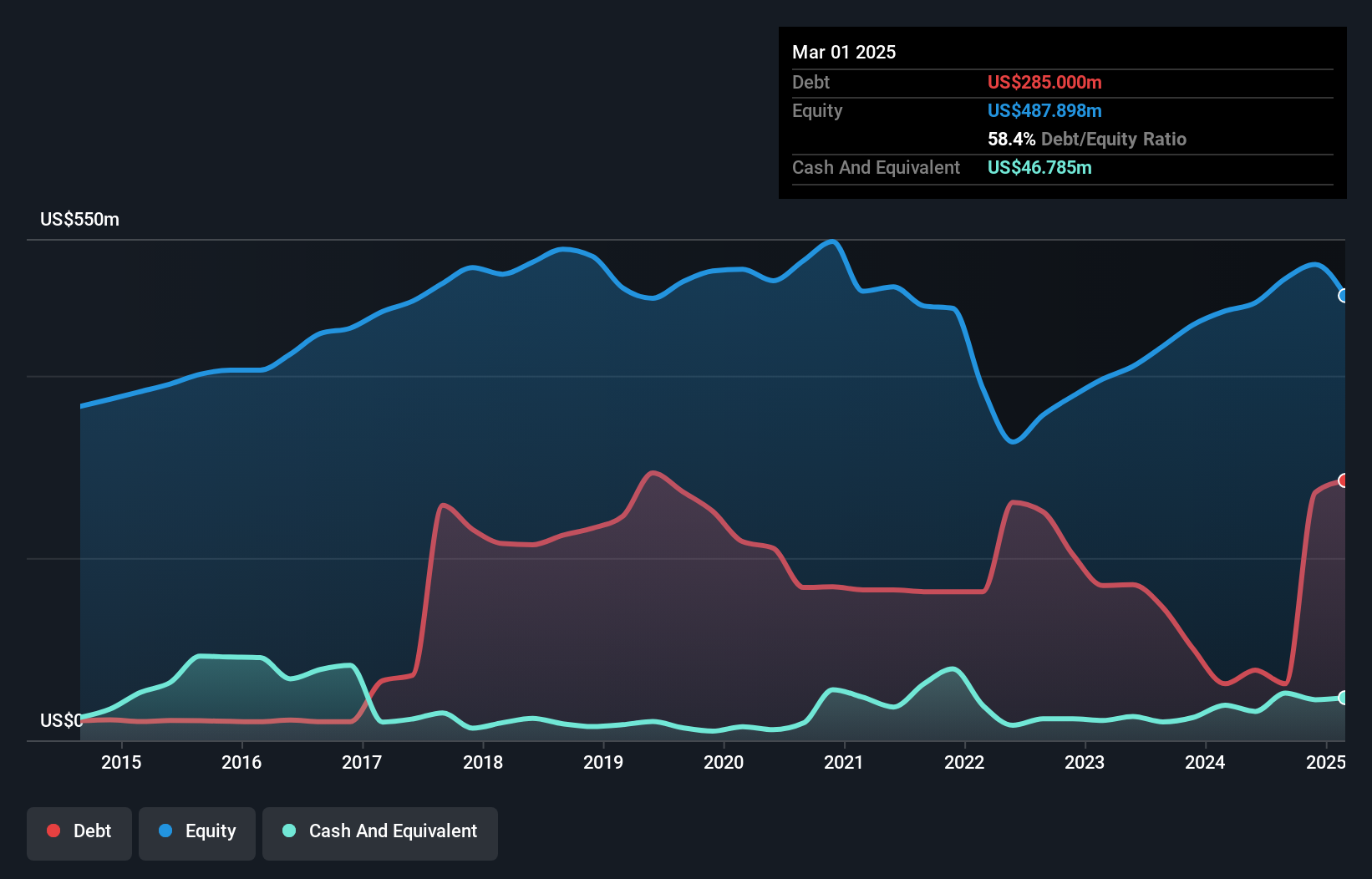

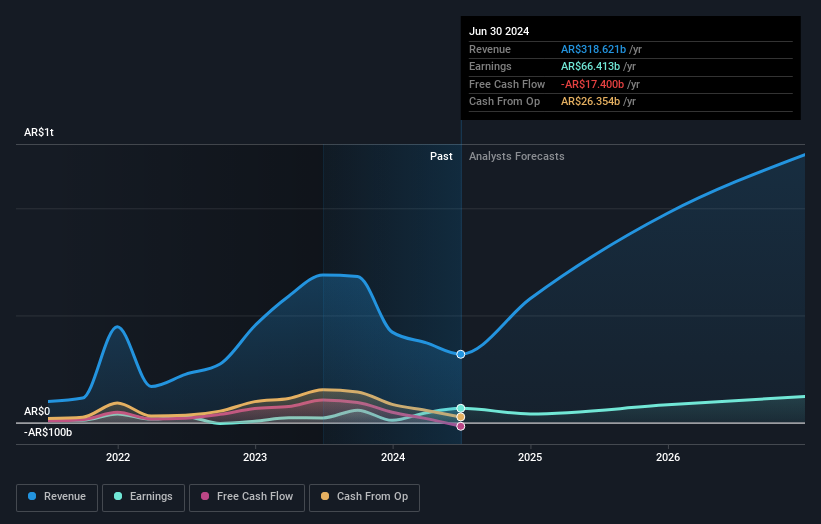

Loma Negra, an Argentine cement producer, showcases a compelling profile with earnings growth of 22.8% over the past year, outpacing the Basic Materials industry average of 10.5%. The price-to-earnings ratio stands at 16.8x, offering better value compared to the US market's average of 19x. Despite a reduction in debt-to-equity from 40.7% to 26% over five years, interest coverage remains tight at 2.6x EBIT, indicating potential challenges in meeting debt obligations comfortably. Recent third-quarter results reflect sales at ARS180 billion and net income at ARS20 billion, slightly lower than last year’s figures but still robust overall performance-wise.

Where To Now?

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 225 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOMA

Loma Negra Compañía Industrial Argentina Sociedad Anónima

Manufactures and sells cement and its derivatives in Argentina.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives