- United States

- /

- Banks

- /

- OTCPK:WCCB

West Coast Community Bancorp (WCCB) Margin Decline Challenges Bullish Narrative on Operational Strength

Reviewed by Simply Wall St

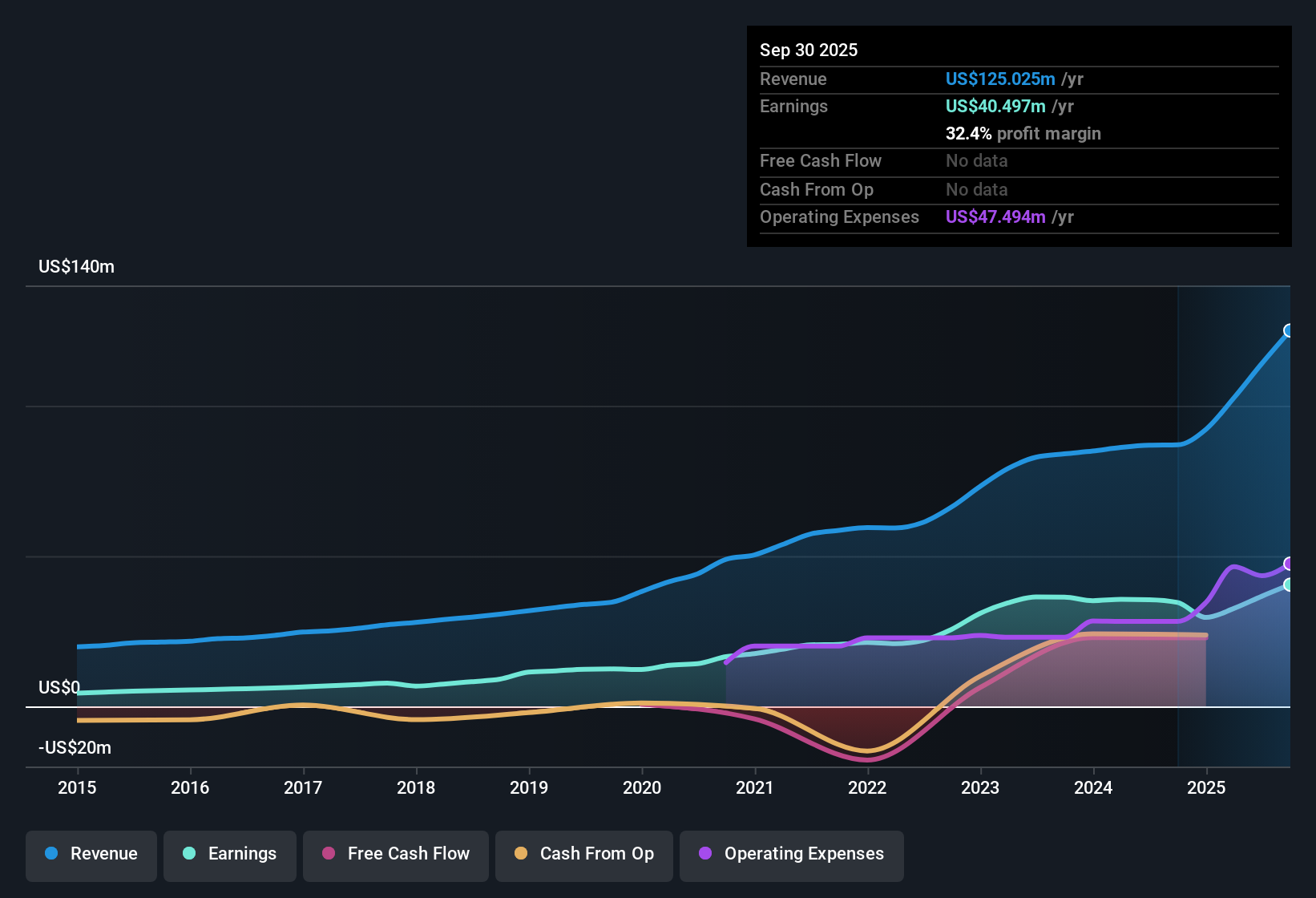

West Coast Community Bancorp (WCCB) posted a net profit margin of 32.1% for the latest period, down from 40.9% a year earlier. Earnings grew 3.2% year-over-year, falling short of the company’s five-year average growth rate of 15.9% per year, signaling a slowdown. Despite this moderation, WCCB has a notable record of high-quality earnings and substantial profit growth, which continues to underscore operational strength in today’s market.

See our full analysis for West Coast Community Bancorp.Now, let’s see how these results measure up against the widely followed narratives. This is where market stories meet the numbers, and perceptions may get reshaped.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Pulls Back, Still Stays Strong

- Net profit margin narrowed to 32.1% from 40.9% last year, remaining well above typical regional bank levels even after the drop.

- Bulls spotlight WCCB’s ability to keep its profit margin relatively high despite sector pressure on lending and funding costs.

- Conservative lending standards and stable deposit growth, as highlighted in recent news, offer some insulation and support for the bullish case even as margins compress.

- The moderate dip in margins has not derailed WCCB’s multi-year record of substantial profit growth, which bullish investors view as continued operational strength.

P/E Ratio Runs Hot Versus Peers

- WCCB’s price-to-earnings ratio stands at 11.6x, higher than the industry average of 11.3x and its peer group at 10.4x. This suggests investors are paying a premium for perceived stability.

- Critics highlight that, while profitability has been solid, this valuation premium exposes the stock to downside if sector-wide pressures worsen.

- Bears warn that continued sector risks, such as volatile interest rates and slowing loan growth, may make it harder for earnings to support the higher multiple relative to other banks.

- WCCB’s advantage in credit quality and risk management could lose its edge if macro conditions drag down all regional banks, potentially flattening its valuation gap.

Share Price Lags DCF Fair Value

- With shares recently trading at $40.45 compared to a DCF fair value estimate of $88.53, the stock sits at a 54% discount according to discounted cash flow analysis.

- Surprisingly, despite modest earnings growth and a premium P/E, the sizable gap to fair value points to potential upside if WCCB can maintain stability where peers waver.

- Current rewards flagged include profit growth, attractive dividend characteristics, and value support, which back the idea that disciplined management could help close the price-to-fair value spread.

- Operational resilience evidenced in past years remains a critical factor for investors weighing whether this discount can be realized.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on West Coast Community Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

WCCB’s premium valuation and slowing profit growth suggest potential challenges if sector headwinds persist or if its operational edge narrows further.

If you want to focus on companies that look undervalued on key metrics and trade with a wider margin of safety, start your search with these 871 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if West Coast Community Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:WCCB

West Coast Community Bancorp

Operates as the bank holding company for Santa Cruz County Bank that provides a range of commercial and personal banking services to residents and businesses in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)