- United States

- /

- Banks

- /

- OTCPK:UBOH

United Bancshares (UBOH) Earnings Growth Rebound Challenges Bearish Profitability Narrative

Reviewed by Simply Wall St

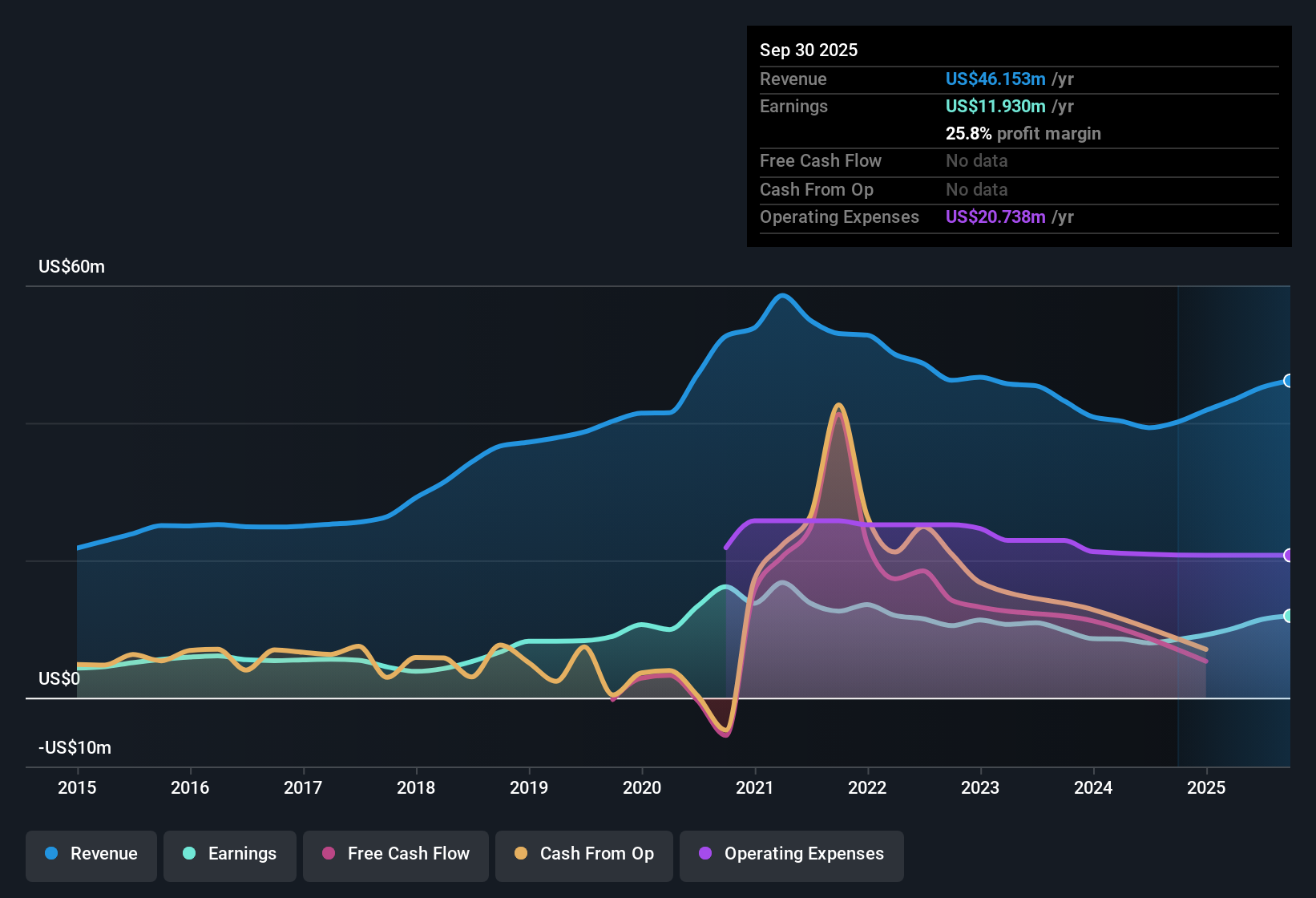

United Bancshares (UBOH) posted a notable turnaround in its latest results, with earnings growing 40.8% over the past year, a dramatic improvement compared to its five-year average decline of 10.3% per year. Net profit margins climbed to 25.8%, up from 21.1% a year ago, showing a stronger operational performance. The combination of currently high-quality earnings and a Price-To-Earnings ratio of 8.7x, well below industry and peer averages, sets a value-oriented backdrop for investors. However, questions remain about the sustainability of these gains and whether profit growth can continue.

See our full analysis for United Bancshares.The next section will pit these numbers against the market narratives that often guide investor sentiment, highlighting where the latest results reinforce or challenge the consensus story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Point to Quality Performance

- Net profit margins rose to 25.8%, up from 21.1% in the prior year, signaling that United Bancshares is retaining a significant portion of revenue as profit compared to historical levels.

- Strong profitability heavily supports the argument that recent results show more than just a temporary spike.

- With profit margins sharply improving, the narrative that UBOH earnings are now considered “higher quality” finds material support in the numbers.

- Given that margins have lagged for years, the current jump aligns with claims that operating efficiency and core profitability are rebounding, not just a result of one-off gains.

DCF Fair Value Underscores Discount

- The current share price of $35.01 sits well below the DCF fair value estimate of $66.30, showing a 47% discount and positioning United Bancshares as potentially undervalued by this metric.

- Valuation discount brings the focus to what bullish investors see as a long runway for price recovery.

- Bulls point to the Price-To-Earnings ratio of 8.7x, which is meaningfully below both the US Banks industry (11.2x) and peer average (13.2x), as an additional sign the market has not priced in the recent improvement in profit margins.

- The combination of a significant gap to estimated fair value and lower relative valuation supports the bullish narrative that there is untapped upside if earnings trends persist.

Dividend Reliability in Question

- Risks are flagged over whether United Bancshares’ dividend is sustainable despite its recent profit boost, with ongoing uncertainty around future revenue and earnings growth.

- Critics highlight the tension between recent profitability and long-term earnings reliability.

- Even as short-term figures improve, the persistent five-year average earnings decline of 10.3% per year acts as a warning that recent success may not ensure ongoing cash flow for dividends.

- The current uplift in margins and profits has not erased questions about the company’s ability to deliver stable dividends if earnings were to revert to past trends.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on United Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite the recent rebound in profit margins, United Bancshares continues to face concerns about the reliability of its long-term earnings growth and dividend sustainability.

If you want portfolios with steadier performance, discover companies delivering consistent results and fewer surprises by starting with stable growth stocks screener (2099 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:UBOH

United Bancshares

Operates as the bank holding company for The Union Bank Company that provides various commercial and consumer banking services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives