- United States

- /

- Banks

- /

- OTCPK:TCBC

TC Bancshares (TCBC) Q3: Rich 92.9x P/E Tests Confidence in Earnings Rebound

Reviewed by Simply Wall St

TC Bancshares (TCBC) has just posted its Q3 2025 numbers, with revenue at about $4.9 million, basic EPS of $0.08 and quarterly net income of roughly $0.33 million, setting the tone for a cautiously constructive update. The company has seen revenue move from around $4.1 million in Q3 2024 to about $4.9 million in Q3 2025, while basic EPS shifted from roughly $0.06 to $0.08 over the same period, giving investors a clearer read on how recent profitability trends are feeding into the latest quarter. With net income and EPS both firmly positive, the story now turns to how sustainably the bank can defend and build its margins from here.

See our full analysis for TC Bancshares.With the headline numbers on the table, the next step is to see how this earnings print lines up against the dominant narratives around TC Bancshares, highlighting where the data backs the story and where it might start to challenge it.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trailing Revenue And EPS Trend Stabilizes

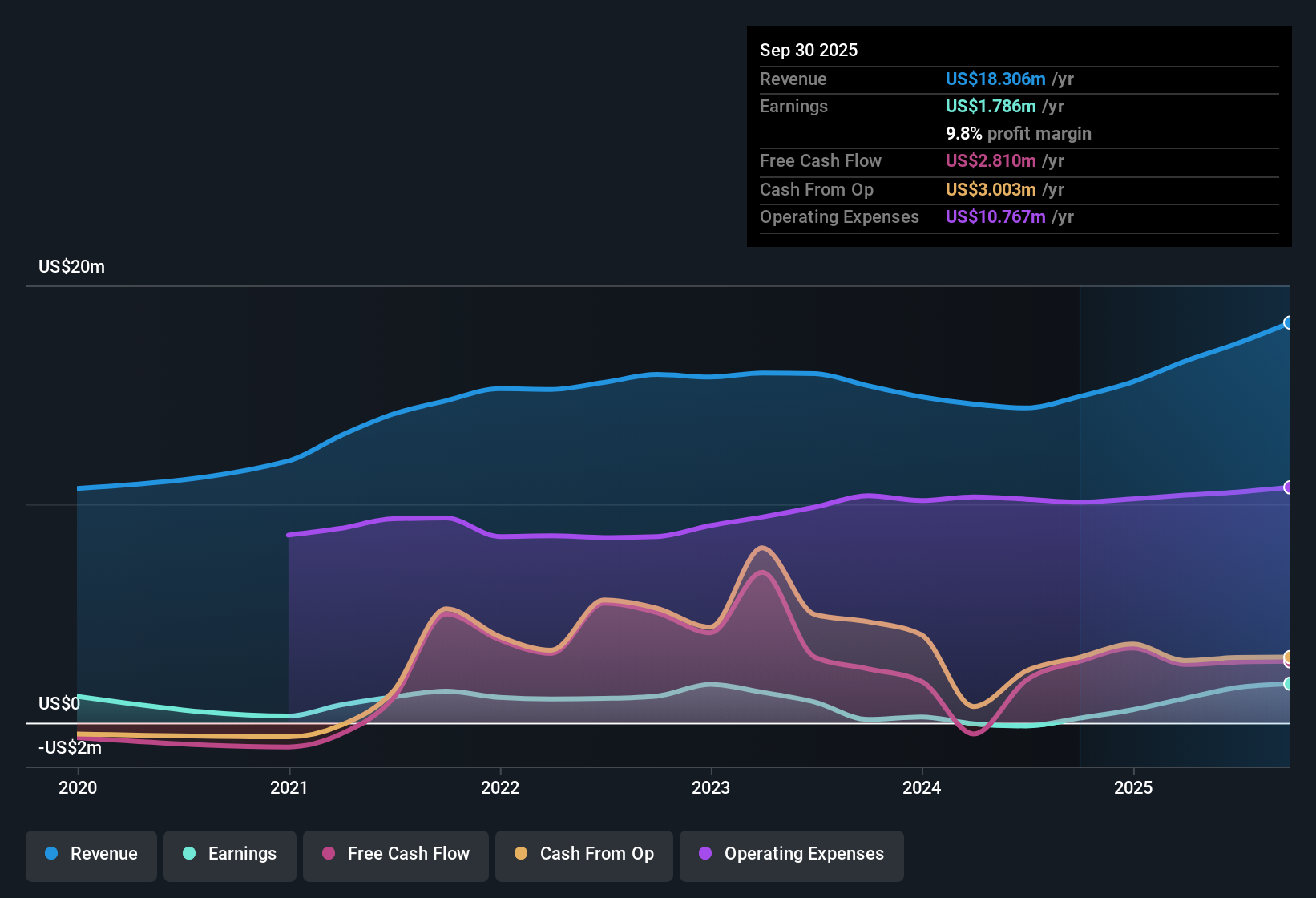

- Over the last 12 months, total revenue rose from about $14.9 million to $18.3 million and trailing basic EPS moved from roughly $0.05 to $0.44, pointing to a much stronger earnings run rate than a year ago.

- What stands out for a more cautious, bearish view is the contrast between that 740.4 percent trailing earnings jump and the longer term 3.3 percent annual earnings decline. This suggests that while the last year looks much better on paper, it sits on top of a multi year record of weaker performance that investors will want to weigh carefully.

- The latest trailing net income of about $1.79 million compares with only around $0.21 million a year earlier, yet the five year history still shows a negative earnings growth rate.

- This mix of a strong recent rebound and a softer multi year track record means bears can point to questions around how durable the new $0.44 trailing EPS level really is.

Profitability Metrics Look Much Healthier

- Trailing net profit margin has climbed to 9.8 percent from 1.4 percent a year ago, and Q3 2025 net income of about $0.33 million is higher than the roughly $0.26 million reported in Q3 2024. Taken together, these figures signal a noticeably stronger margin profile than the bank was running a year back.

- From a more optimistic, bullish angle, this improved margin picture heavily supports the idea that the business model is operating more efficiently than before, even though earlier years looked softer.

- The trailing revenue base expanded from about $14.9 million to $18.3 million while margins improved, indicating that profitability gains did not rely solely on cost cutting from a shrinking top line.

- At the same time, quarterly revenue stepped up from roughly $4.1 million in Q3 2024 to about $4.9 million in Q3 2025. This gives bulls concrete evidence that higher margins are coinciding with higher revenues, not just one off swings in expenses.

Rich 92.9x P/E Versus Bank Peers

- The stock changes hands at a trailing P/E of 92.9 times, far above the US banks industry average of 11.5 times and peer average of 11.2 times. This means the current $21.65 share price embeds a much higher multiple of recent earnings than is typical for the sector.

- From a bearish perspective, this elevated P/E together with substantial shareholder dilution over the past year gives skeptics concrete valuation and capital structure reasons to lean cautious, despite the better trailing year numbers.

- Even with trailing EPS lifting to about $0.44, the implied multiple remains many times higher than sector norms, so the market is paying a premium that is not matched by a similarly strong multi year earnings growth track.

- Critics also highlight that this premium arrives after a period of dilution and a five year earnings decline of 3.3 percent per year, which together challenge the idea that recent profit improvements alone justify such a rich valuation.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TC Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

TC Bancshares’ solid recent rebound sits uncomfortably against its rich valuation multiple and longer term earnings decline, raising doubts about how durable today's profits are.

If you feel that kind of price premium over shaky long term momentum asks too much, use our these 930 undervalued stocks based on cash flows to hunt for companies where strong cash flow prospects are not already fully priced in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TC Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:TCBC

TC Bancshares

Operates as the holding company for TC Federal Bank that provides various banking services to individual and commercial customers in Georgia and Florida, the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026